Soft agricultural commodities such as coffee, sugar and cocoa have been broadly strengthening over the past few weeks, stabilizing after a period of sharp volatility at the height of the pandemic crisis.

Coffee futures for December delivery trading on New York’s Intercontinental Exchange (ICE) are up nearly 15% so far this quarter, after starting sharp gains in mid-July to hit a four-month high in early August. Coffee prices spiked in late March as countries began stockpiling goods amid the nationwide pandemic lockdown.

A futures contract is an agreement to buy or sell an asset, for example “coffee” at a certain price at a certain point in the future. It shows what people expect from future coffee prices.

Coffee futures prices until the end of November contract are traded today approaching the resistance zone at 122.00. The highest price, formed in March, was at 130.05.

Coffee futures prices until the end of November contract are traded today approaching the resistance zone at 122.00. The highest price, formed in March, was at 130.05.

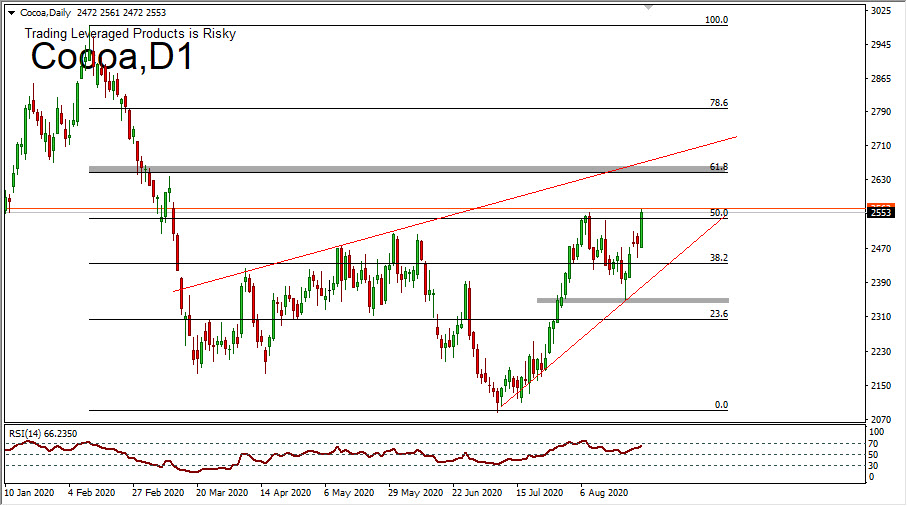

Technically, Sugar has reached the 61.8% retracement level near the price of 13.08 and currently it is still consolidating between the 50%-61.8% level. Prices of sugar futures for October delivery in general have been steadily rising since their trough in late April and are currently trading around 12.75 cents per pound, after rising more than 21% since the end of March, despite the lowest point of 9.02 cents per pound at the end of April. Meanwhile, the price of December cocoa futures has continued to increase since early July until it peaked at $2,554 per metric ton in early August, up 10% so far this quarter. The technical bias still shows that the price retesting new contract prices, with a limit of 61.8% in the range of 2,643.

The US Dollar is weak at the moment and as most commodities are priced in US Dollars, the limited decline in demand and investors’ willingness to look at commodities when returns dry up elsewhere have all contributed to the recent price momentum.

During the Covid-19 pandemic, governments and central banks have injected unprecedented amounts of liquidity in a bid to mitigate long-term economic damage, renewing fears that inflation could surge. With alternative assets offering lower returns and greater complications during the pandemic, investors may be looking for commodities to diversify their portfolios.

The gradual recovery in soft commodity prices will be sustainable, as long as it continues to be supported by the strong demand seen so far.

Click here to access the Economic Calendar

Ady Phangestu

Market Analyst – hfindonesia

Disclaimer:This material is provided as general marketing communications for informational purposes only and is not provided for independent investment research. This communication does not contain investment advice or recommendations or solicitations for the purchase or sale of any financial instrument. All information presented comes from a trusted, reputable source. Any information that contains an indication of past performance is not a guarantee or reliable indicator of future performance. Users should be aware, that any investment in Leveraged Products is subject to a certain degree of uncertainty and that any investment of this type involves a high level of risk for which the sole responsibility and responsibility is borne by the user. We are not responsible for any losses arising from any investment made based on the information provided in this communication. Reproduction or further distribution of this communication is prohibited without our prior written permission.