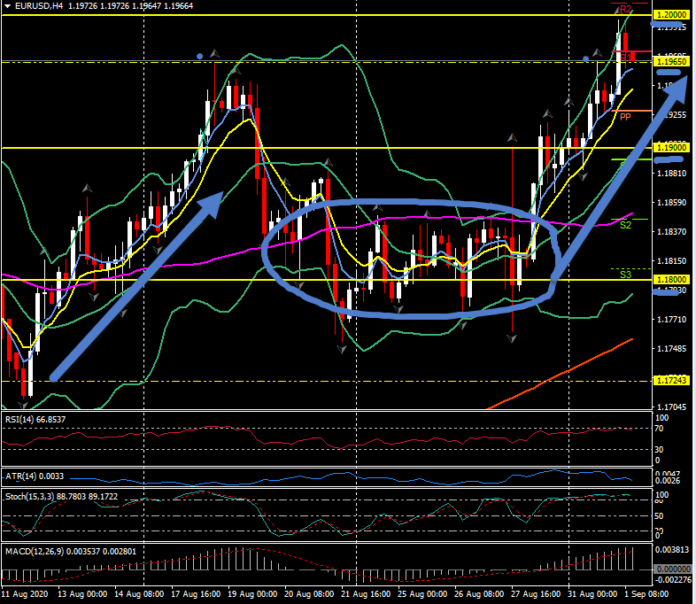

EURUSD, H4

Rally, re-trace, consolidate, rally to new highs. 1.2000 last touched May 2018, some 120 weeks ago.

Eurozone manufacturing PMI confirmed at 51.7, unchanged from the preliminary release and marginally lower than the 51.8 final reading for July. A slight slowdown in the pace of expansion then, likely caused by the renewed flare up of new virus infections, which has already led to a tightening of restrictions and regional lockdown, although so far that has impacted mainly services providers. National data was mixed, with the German reading revised down and the French revised up, although the fact that the German number is still at a 22-month high and the Italian reading at a 26-month high at now 53.1 is encouraging. Markit reported marked gains in output and new orders, with confidence reaching the highest level in over two years. Still, the survey also revealed that job losses continued at a strong rate through August, which highlights the challenges for the labour market going forward, despite the widening and strengthening of job retention schemes across most Eurozone countries.

Earlier the German labour market data was better than expected, with the seasonally adjusted jobless total falling back -9,000 in August, after dropping -17,000 in the previous month. Employment data, which lags and is only available for July, showed the first improvement since Covid-19 hit – with sa numbers rising 53,000. The official jobless rate was once again steady at 6.4%. All in all a positive report, with no sign yet that the tightening of lockdown restrictions has led to new job cuts. The impact was likely counterbalanced by the government’s decision to extend subsidies for companies that keep on staff at shortened hours, which can run for up to 24 months now and will only run out at the end of 2021. That should help to support consumption during the remainder of the year and thus support domestic demand in the recovery phase. Longer term the question is of course to what extent this only delays the demise of companies that are set to fail on their own and how the government will steer investment to create new sustainable jobs in the “new normal”.

With the US 2020 Presidential Election nine weeks to the day away, EURUSD is once again in focus. The first Trump term top at 1.2550 for the pair, during January 2018, a year into the administration, from the lows of the post-2016 polling day under 1.0400, appeared a distant memory as the USD rallied for close to two and half years. The decline from the January 2018 highs is well and truly over, with the breach of the 200- week moving average and 1.1500 mark during July. With the pair into its sixteenth consecutive week of gains, 1.2000 looms.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.