GBPUSD, H4

The final UK August composite PMI was revised lower, to a headline of 59.1. This is quite a sharp revision from the 60.3 preliminary estimate. Nonetheless, the 59.1 reading still marked an acceleration in activity from July’s 57.0 headline, and marked the quickest pace of expansion in the private sector since August 2014. The reopening process of the economy and a sharp recovery in consumer spending were highlighted by the surveys as driving the expansion in activity. The services PMI was revised down to 58.8 from the 60.1 preliminary estimate, though still marked the highest level since April 2015, while the final UK August manufacturing PMI, released earlier in the week, had been revised a tick lower, to 55.2 versus 55.3 in the preliminary figure. Both the manufacturing and service sectors showed reasons for concern, however, despite the strong headline data. Both sectors saw an acceleration in job shedding in August, corresponding with a downsizing in the government’s pandemic-era wage support scheme. At the same time, both sectors showed signs of excess capacity as work backlogs were depleted. Optimism for the 12 months ahead remained upbeat, on the premise that the road to economic normalcy remains open, though concerns were expressed by respondents about the strength of recovery as government support measures taper off. The risk is that activity will flag as lockdown-caused work backlogs are completed, and when the government wage support program expires in October, which will likely spark job losses (there is a chance that the scheme will be extended). The government’s ‘Eat Out to Help Out’ scheme (with the government, courtesy of the bond market/taxpayer, meeting up to half the bill for consumers at restaurants and pubs) expired on September 1. The service sector will be particularly exposed to a cut in the wage support scheme next month, with the aviation, high street retail and hospitality sectors most at risk.

The Pound has seen mixed trading in the wake of the final August PMI data out of the UK. Market participants were seemingly not too perturbed by the downward revisions in the UK’s headline services and composite PMI readings, nor the acceleration in job shedding in both the manufacturing and service sectors in August. Cable is showing a 0.4% decline on the day, which reflects the impact of an earlier advance in the dollar. The pair’s six-day low at 1.3277 has remained unchallenged in the wake of the PMI data. EURGBP is presently about 20 pips up on the three-month low that was seen earlier, at 0.8866. The common currency has been underperforming as markets focus on a possible framework change at the ECB aimed at increasing inflation, which comes in light of the unexpected negative reading in August Eurozone CPI data (of -0.2% y/y). Downside risks for the pound seem greater than upside risks. Job losses are continuing in the UK, with vulnerable areas of the labour market being impacted by the partial unwinding of the government’s wage support scheme last month. The scheme is due to fully expire next month. The rebound in consumer lending, after four months of contraction, has been a particular positive in the circumstances, as it suggests demand conditions are improving, which may help the private sector weather the withdrawal of the furlough scheme. The pound faces other downside risks, including possible tax hikes and the risk of a bare-bones deal or no-deal outcome in the Brexit endgame.

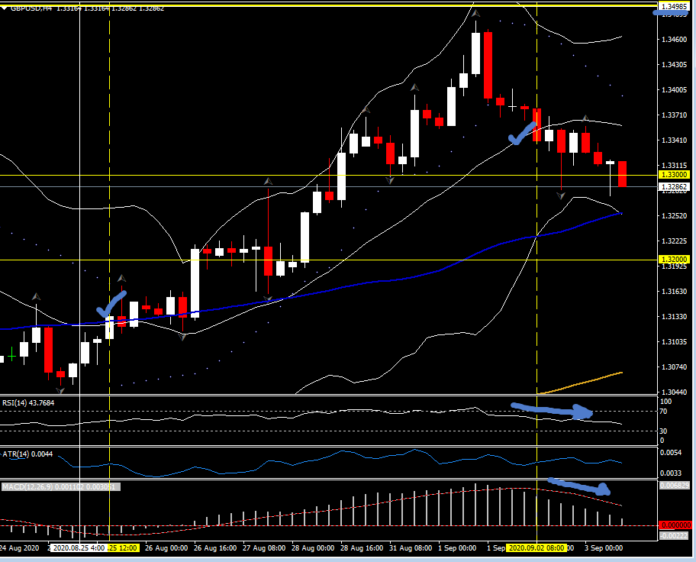

Cable (H4) rejected 1.3500 with the engulfing candle on Monday, breaching the 20-period moving average yesterday (September 2) with the conclusion of the 08:00 candle. A 2 x ATR move would take the pair to 1.3250 and a 3 x ATR move to 1.3206. A LL5 stop would have initially been placed at the turn in the market at 1.3465 and currently sit at 1.3350.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.