AUDJPY, Daily

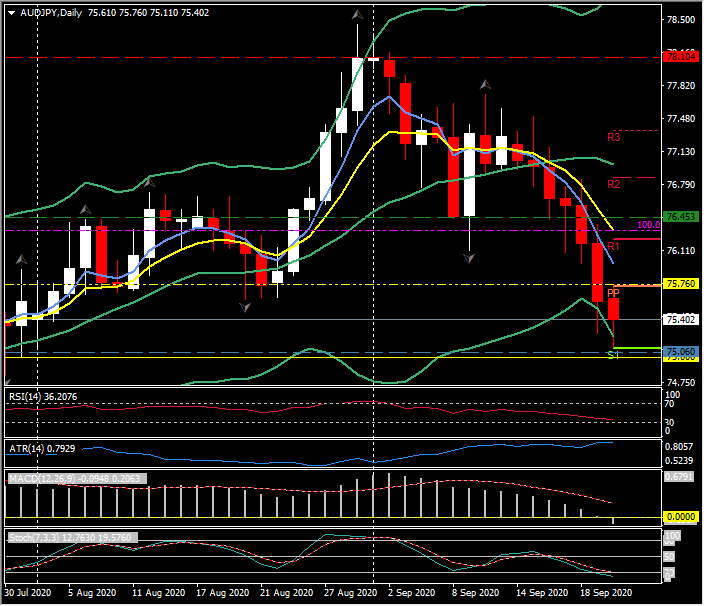

The Dollar and Yen have remained firm and pushed ahead of Monday’s highs. The Australian Dollar has been the major mover of note out of the main currencies we track, falling to new lows after RBA deputy governor Debelle said that the central bank is watching the currency “carefully” and that forex intervention is a policy option, as is negative interest rates (while stressing that this doesn’t mean it’s on the table). AUDUSD hit a low at 0.7177 to post a new four-week low, while AUDJPY posted a fresh seven-week low at 75.10. Elsewhere, EURUSD moved lower to post a new seven-week low at 1.1724. Cable also remained heavy, pushing to 1.2710, before recovering the 1.2800 handle following Governor Bailey’s defence of the need to use negative interest rates. The governor said that “we have looked very hard” at ways of adding further monetary stimulus, including negative interest rates. Bailey, who was speaking at the British Chambers of Commerce, subsequently said that last week’s note in the minutes from the MPC meeting, that members had been briefed on negative interest rate preparations, “did not imply” that the BoE would adopt negative rates. This seemed to inspire the snap back in the Pound. USDJPY settled in the mid 104.00s after rebounding out of yesterday’s six-month low at 104.00, and what appears to be BOJ intervention. EURJPY also traded above yesterday’s low, though ebbed back under 123.00 after peaking at a rebound high at 123.35. GBPJPY broke below 133.00 briefly, but rallied to hold 134.00, following the Governor’s comments.

A risk-off theme has continued in global markets, although price changes in assets and currencies have moderated somewhat today relative to yesterday. This backdrop is supportive for the Dollar and Yen, though some market narratives are pointing to a rise in some inflation-adjusted (aka real) JGB yields as being yen positive. Japanese markets reopened from a long weekend. The Nikkei 225 managed a modest gain, but this was the exception as most Asian markets continued to drop, and some quite sharply (South Korea’s KOPSI, for instance, racking up a loss of over 2.5%). S&P 500 minis have also declined in its overnight session, although only moderately. Most commodity prices have managed to steady, however, and the pace of declines in global stocks has, overall, lessened. Nonetheless, the prevailing bias across markets is one of caution. Many European countries are implementing restrictions in the face of a surging coronavirus case-demic (still no significant correspondence in public health issues, i.e. hospitalisations, mortality), which has clobbered stocks in the airline and hospitality sectors. The US Congress remains deadlocked over the size and shape of a new fiscal support bill, while uncertainty about the upcoming US election (6 calendar weeks but only 31 trading days away) is also causing market participants to tread cautiously.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.