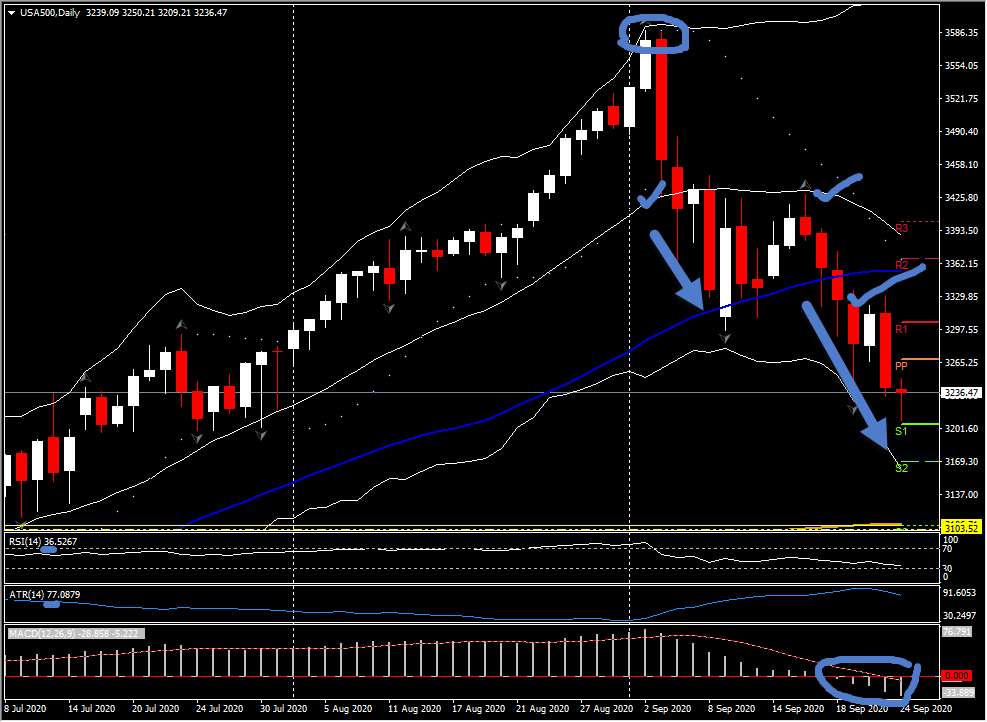

USA500, H1 & Daily

A 4,000 initial claims rise to 870,000 in the third week of September followed a -27,000 drop to 866,000 in the BLS survey week, leaving a disappointing rise as we now log the fourth week with the new additive seasonal factors. We saw a -167,000 continuing claims drop to a modestly higher than expected 12.58 million in the BLS survey week, after a downward bump that left a -797,000 decline to 12.747 million in the first week of September. The insured jobless rate fell to 8.6% from 8.7%, versus a 17.1% peak in the second week of May and a 1.2% cycle-low for nearly two years ending in mid-March.

Initial claims are averaging 875,000 thus far in September, versus higher prior averages of 992,000 in August and 1.34 million in July. The 866,000 BLS survey week reading undershot prior BLS survey week readings of 1.104 million in August and 1.422 million in July. We saw a 4.442 million peak in April and a 203,000 prior cycle-low in April of 2019. We now have a continuing claims drop of -1.912 million between the August and September BLS survey weeks, though this measure is clouded by the seasonal adjustment switch that left one procedure for the August figure and another for September. We saw prior declines of -2.459 million in August, -2.28 million in July, and -1.61 million in June. September nonfarm payroll consensus remains around 900,000, though today’s data adds some risk to the forecasts and could be amended into next week.

The US Equity markets, which have seen Futures under pressure all day following yesterday’s significant declines (Nasdaq closed down by over 3% and the S&P 500 lost over 2.3%) are weaker again, with the USA500 trading at 3230 in early trades, 30 points above the key 3200 support level, but still 130 points above the vital 200-day moving average at 3,100.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.