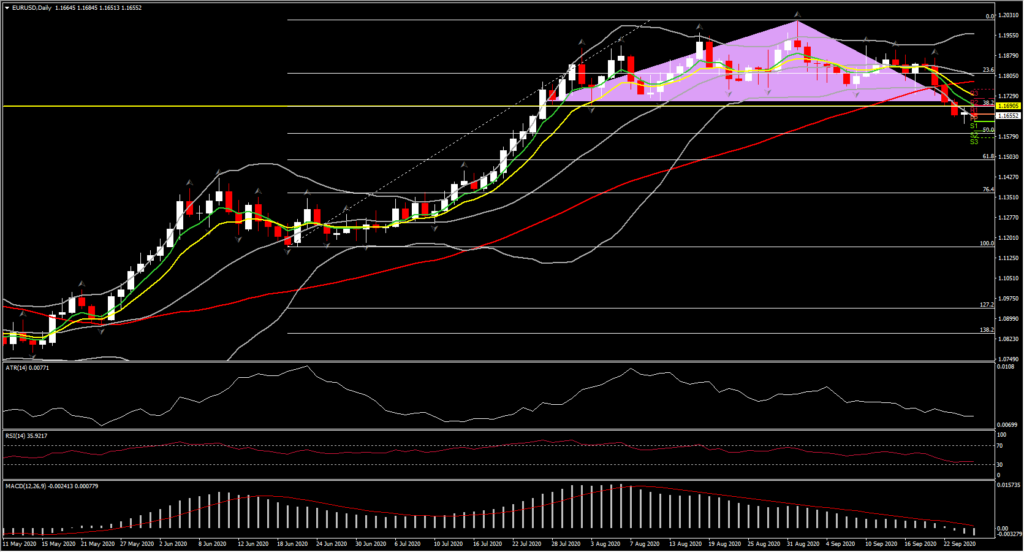

The USD settled off its Thursday highs in narrow ranges trading into the London interbank open. EURUSD saw a less than 15-pip range around 1.1665-75, holding above the two-month low that was seen yesterday at 1.1626. Cable saw a similar price action. USDJPY edged out a 10-day high at 105.56, superseding yesterday’s peak by a couple of pips, before ebbing back moderately. Yen crosses were steady.

AUDJPY plied a narrow range after dropping every day last week and every day this week through to yesterday. The cross, widely seen as a barometer of global investor risk appetite, settled around 74.50, up from the three-month low that was seen yesterday at 73.96. AUDUSD also managed to settle after falling precipitously in recent sessions. Global stock markets remain whippy, mostly gaining in Asia today after Wall Street managed a positive close, which helped lift the dollar bloc currencies out of their lows, but sentiment is uncertain.

USDCAD has corrected to the mid 1.3300s after pegging a seven-week high at 1.3419 yesterday. The US Dollar has softened against most currencies, while oil prices have lifted moderately, paring losses seen over the last week. Directional risks remain to the upside.

Focus is on Capitol Hill in the US and progress towards a new fiscal support package. Democrats are working on a $2.2 tln package that could be voted on in the House of Reps next week, with the party saying they are ready to negotiate with the White House.

New restrictions across Europe amid a surge in positive Covid tests has also been inspiring caution at a global level, while uncertainties into the November US elections (which will have major implications on the course of US fiscal policy, among other policy biases), and continued lack of a new fiscal support package in the US have been generating a more cautious overall mindset among market participants. But so far there has been a marked discordance between positive tests and hospital admissions and deaths.

The Belgium government on Wednesday announced it will no longer use PCR testing (the dominant form of Covid testing) to gauge the prevalence of Covid, and will be focusing on hospitalisations instead, while also bucking the trend in Europe by announcing a reduction in restrictions. False positives are a known problem in PCR testing, especially when testing programs are ramped higher. If hospital admissions and deaths remain markedly disproportionate to new cases, other nations may start to throttle back on restrictions, which would be a bullish scenario for global markets and the Euro.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.