USDCHF, Daily

Delivering a very clear dovish message, Lagarde pointed out what the ECB will do in the short, medium and long term. In the short term, she’s hinting at more QE as soon as December. In the medium term, Lagarde points to an explicit focus on core inflation. Finally, over the long term, she is hinting at a symmetrical inflation target with a kind of soft Average Inflation Targeting (AIT).

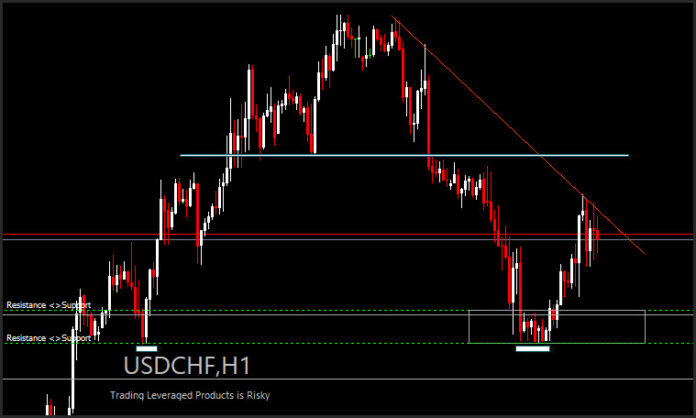

Due to the negative correlation, if EURUSD goes down it is likely that USDCHF will go up. So it’s important to look at the USDCHF exchange rate. USDCHF bounced off 0.9000 levels when the US Dollar Index rebounded from a low of 0.9170 in early September. The recent decline in the USDCHF pair occurred in the context of the overall USD weakness.

But it looks like there will be resistance; by falling to the level of 0.9200, USDCHF met the support in the confluence area. On the one hand, the previous horizontal resistance turned into support. On the other hand, the market also fulfills dynamic support at the same level provided by the channel’s rising median line. 0.9200 is key for now as we head into the final quarter of 2020.

But it looks like there will be resistance; by falling to the level of 0.9200, USDCHF met the support in the confluence area. On the one hand, the previous horizontal resistance turned into support. On the other hand, the market also fulfills dynamic support at the same level provided by the channel’s rising median line. 0.9200 is key for now as we head into the final quarter of 2020.

Click here to access the Economic Calendar

Adi Phangestu

Market Analyst – HFIndonesia

Disclaimer: This material is provided as general marketing communications for informational purposes only and is not provided for independent investment research. This communication does not contain investment advice or recommendation or solicitation for the purpose of buying or selling any financial instrument. All information presented comes from a trusted, reputable source. Any information that contains an indication of past performance is not a guarantee or reliable indicator of future performance. Users should be aware, that any investment in Leveraged Products is subject to a certain degree of uncertainty and that any investment of this type involves a high level of risk for which the sole responsibility and responsibility is borne by the user. We are not responsible for any losses arising from any investment made based on the information provided in this communication. Reproduction or further distribution of this communication is prohibited without our prior written permission.

Risk Warning : Trading Leveraged Products such as Forex and Derivatives may not be suitable for all investors as they carry a high level of risk to your capital. Before trading, please ensure that you fully understand the risk involved, taking into account your investment objectives and level of experience and seek independent advice and input if necessary.