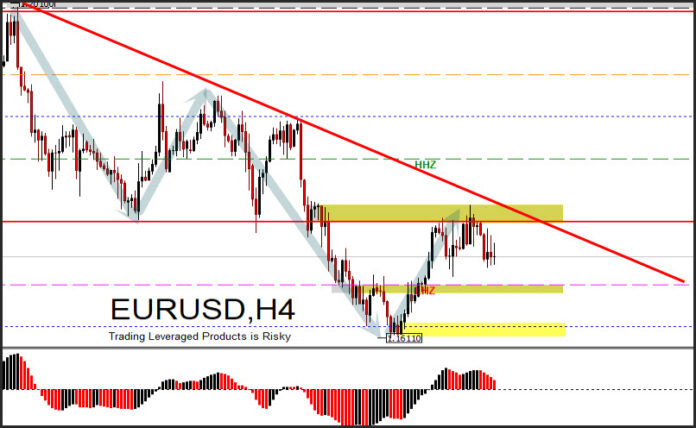

EURUSD intraday bias will likely remain neutral at the beginning of the week. A break of the resistance at 1.1769 will give an indication that the correction has been completed, and the intraday bias will return to the upside to retest 1.2010 if this break of resistance holds. On the downside, a break of the 1.1611 support could extend the decline from the short term peak at 1.2010 to 1.1494.

The movement of D1 is still under the neckline which was previously broken on September 22. Last week’s price was still stuck at the 26-day EMA, whereas at 4 hours, price resistance rose to the neckline, which is also the 200 EMA and the 61.8% retracement level which were drawn from the nearest peak 1.1870 and the new low 1.1611. Last week’s gains are still a corrective move of the downside structure, as long as 1.1769 holds as short-term resistance. A break of the minor support 1.1684 will bring a test of 1.1611.

In higher timeframes, the rise from 1.0635 looks like the head of an unnatural inverse head and shoulder pattern, it also corresponds to the San Sen from the Sakata method introduced by Munehisa Homma in the 18th century. The rally’s further advance will test the quarterly level of 1.2250 with a continuation of peak resistance at 1.2500-55. However, it seems that it will take some considerable time to get there, considering that the current price structure tends to be corrective to test the support level 1.1494 or 1.1370. However, it should be noted that the price has managed to break out of the major descending trendline and is still above the 2019 opening price and below the 2018 opening price. The range between these annual openings will be a room for movement.

In higher timeframes, the rise from 1.0635 looks like the head of an unnatural inverse head and shoulder pattern, it also corresponds to the San Sen from the Sakata method introduced by Munehisa Homma in the 18th century. The rally’s further advance will test the quarterly level of 1.2250 with a continuation of peak resistance at 1.2500-55. However, it seems that it will take some considerable time to get there, considering that the current price structure tends to be corrective to test the support level 1.1494 or 1.1370. However, it should be noted that the price has managed to break out of the major descending trendline and is still above the 2019 opening price and below the 2018 opening price. The range between these annual openings will be a room for movement.

Click here to access the Economic Calendar

Adi Phangestu

Market Analyst – HFIndonesia

Disclaimer: This material is provided as general marketing communications for informational purposes only and is not provided as independent investment research. This communication does not contain investment advice or recommendations or solicitations for the purchase or sale of any financial instrument. All information presented comes from a trusted, reputable source. Any information that contains an indication of past performance is not a guarantee or reliable indicator of future performance. Users should be aware, that any investment in Leveraged Products is subject to a certain degree of uncertainty and that any investment of this type involves a high level of risk for which the sole responsibility and responsibility is borne by the user. We are not responsible for any losses arising from any investment made based on the information provided in this communication. Reproduction or further distribution of this communication is prohibited without our prior written permission.

Risk Warning : Trading Leveraged Products such as Forex and Derivatives may not be suitable for all investors as they carry a high level of risk to your capital. Before trading, please ensure that you fully understand the risk involved, taking into account your investment objectives and level of experience and seek independent advice and input if necessary.