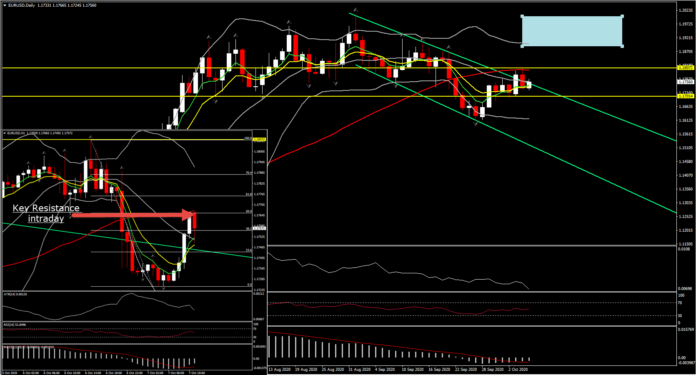

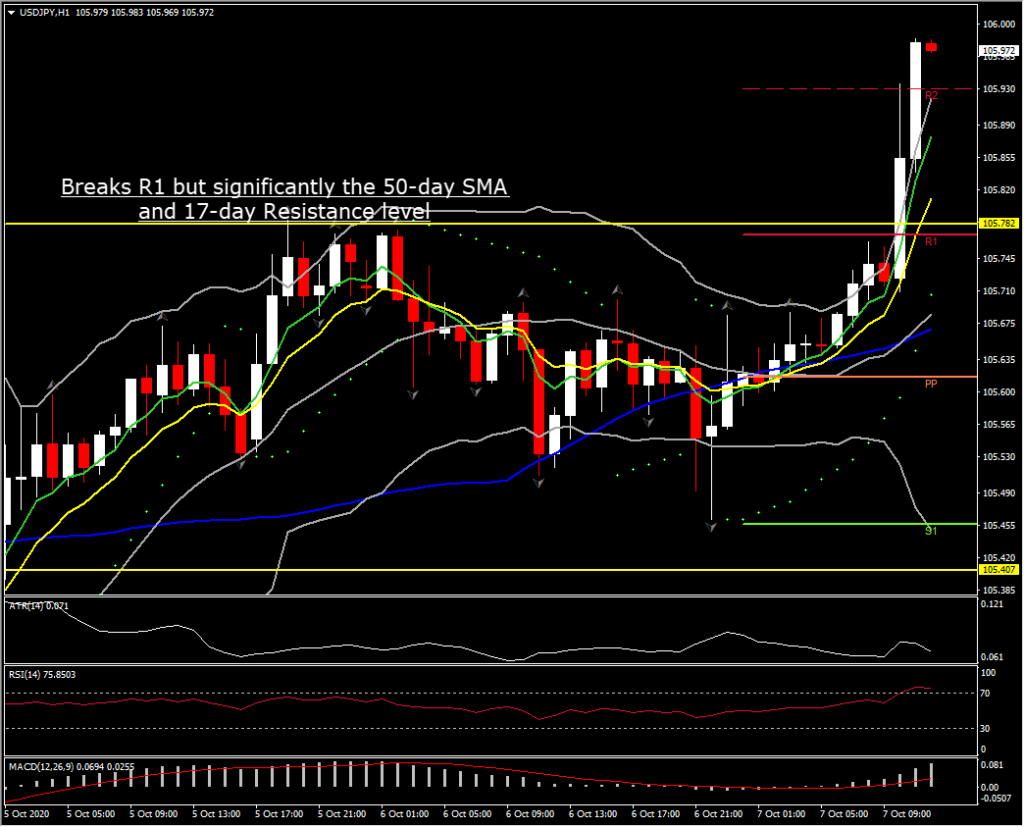

USDJPY, H1

The USD has come off the boil after rallying during the New York afternoon when President Trump abruptly called off talks with the Democrats on further fiscal aid until after the election. This catalysed a bout of risk-off positioning, which featured USD and JPY buying in currency markets.

Trump subsequently tweeted that he is ready to approve support for airlines (totalling $25 bln), wage protection ($135 bln) and a $1,200 stimulus check, which helped revive spirits in markets to a degree, which saw the USD lose upside traction and the JPY soften. The USDIndex edged out a high at 93.95, which is its best level since last Friday, while EURUSD concurrently whittled out a 2-day low at 1.1725 before lifting back above 1.1766.

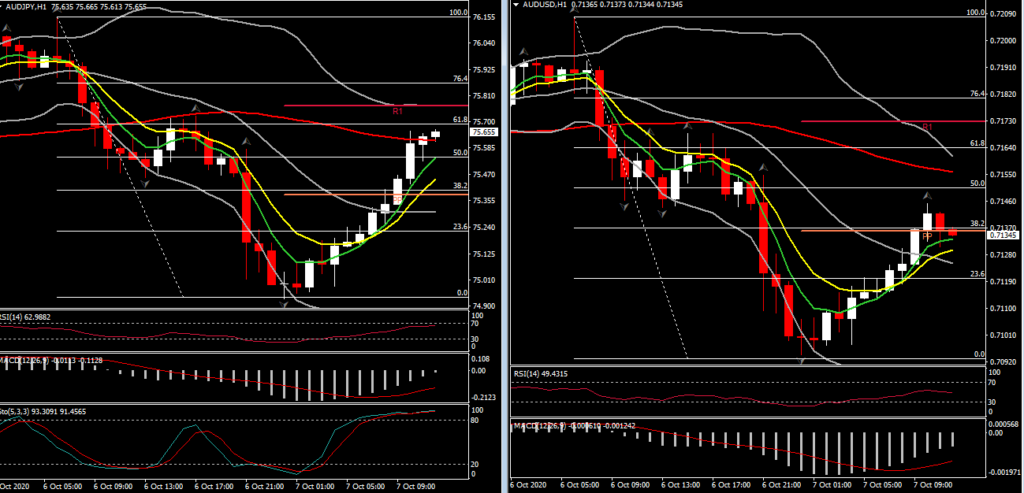

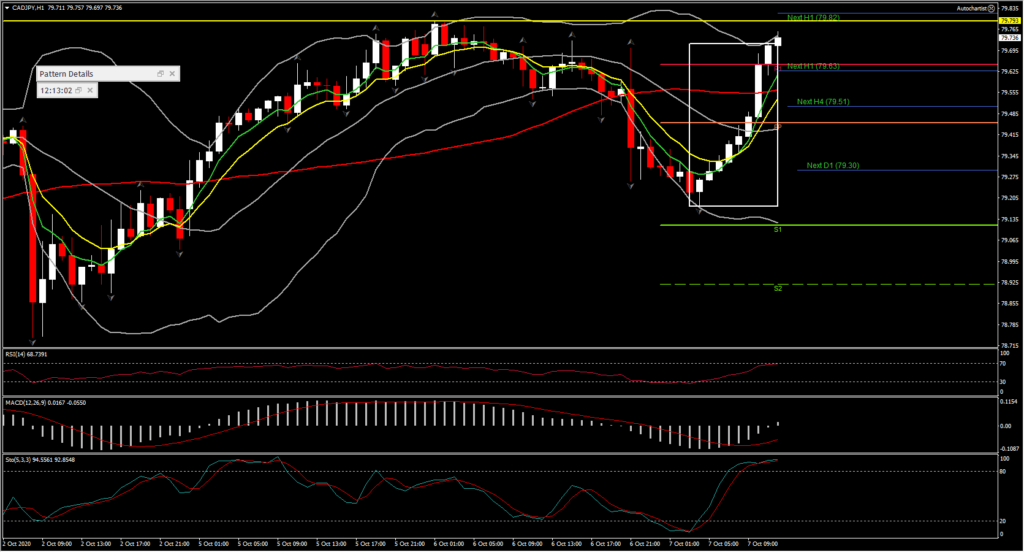

USDJPY recouped from yesterday’s dip to a 105.47 low and has spike to 106 high in European session. There was a neutral overall outlook in the past 2 weeks, however, if the pair sustains recent rally the picture could turn into a positive one, even though this would mean the stimulus news has not benefited the risk negative Yen. Hence the sustainability of 106 Support would be key for the medium term outlook of USDJPY. Momentum indicators are posting a decreasing negative bias. Most Yen crosses declined yesterday, though the risk-sensitive AUDJPY managed to recover some lost ground today, after dropping quite sharply.

AUDUSD rebounded to a high at 0.7146 after printing an eight-day low at 0.7096 yesterday, which had been the product of a 1%-plus decline that was seen after the RBA laid the groundwork for a rate cut at its next meeting in early November. The Pound lifted after underperforming yesterday.

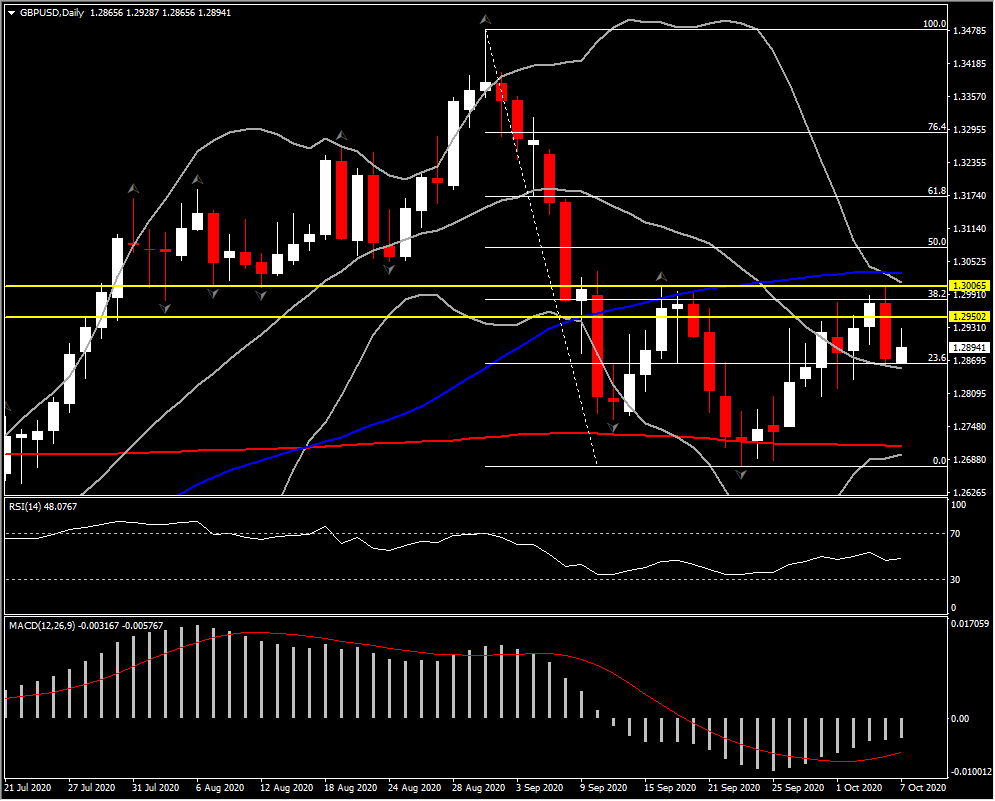

Cable posted a high at 1.2928, up from yesterday’s 1.2867 low but remaining well off yesterday’s highs just above 1.3000. Even in the scenario that the EU and UK strike a trade deal, Pound faces downside risks as this would still result in a deterioration in the UK’s trading position. Key Resistance area holds at 1.3000 level. A Bloomberg article yesterday highlighted the steady stream of financial services resources that are being moved out of the UK to the Eurozone, and the fact that even with a trade deal in place, London will likely continue to lose business to the continent as the “equivalence” regime on rules would leave firms with long-term uncertainty.

USDCAD dipped back under 1.3300 after earlier posting a one-week high at 1.3341. President Trump’s postponement of negotiations on a new fiscal support package caused a bout of risk aversion in global markets, which both supported the US Dollar while weighing on the Canadian Dollar via a weakening in oil prices. A subsequent improvement in risk appetite saw USDCAD ebb back, while in general Canadian crosses rally. On Canada’s domestic front, rising positive Covid-19 tests are becoming a problem as they are leading to economically disruptive restrictions. Canada’s September employment report is up on Friday, where we anticipate a 100.0k headline gain after the 245.8k rise in August, with unemployment seen ebbing to 10.0% from 10.2%.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.