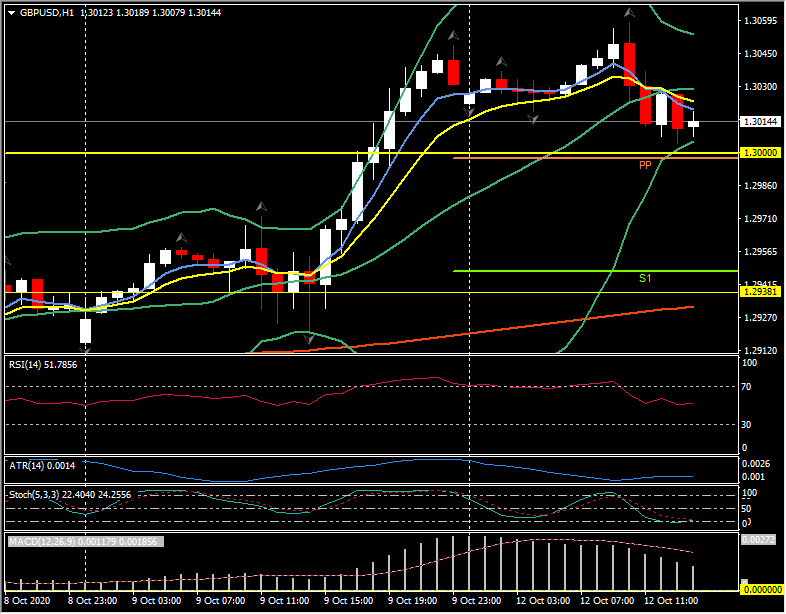

GBPUSD, H1

The Dollar has been holding mostly steady and narrow ranges, though the Yuan stirred things up by falling nearly 0.5% at its lows. This yuan weakness came after the PBoC removed a bank reserve requirement on yuan forward contracts, which signalled that policymakers may have been concerned about the currency’s recent gains. The Yuan is up over 7% on the Dollar from May, having been underpinned by favourable growth and interest rate differentials. The currency had also popped high last week after polls showed a widening poll advantage for Joe Biden, who most consider would adopt a constructive engagement with China, at least compared to Trump. The softer currency underpinned a 2.5%-plus rally in China’s bellwether CSI 300 index. China, and South East Asia, are also looking in much better shape than North America and Europe with regard to the Covid situation. The MSCI Asia-Pacific stock index rallied by over 1% in posting a two-and-a-half-year high. US equity index futures are, in some contrast, showing modest gains.

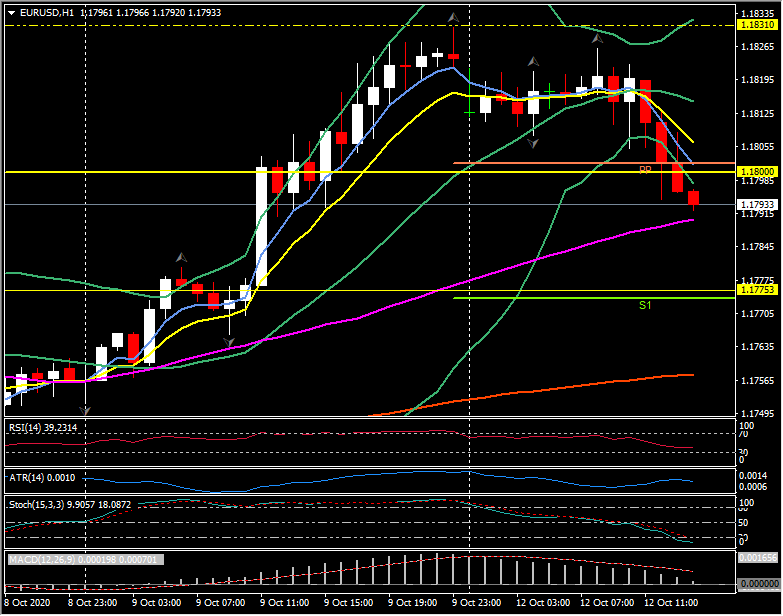

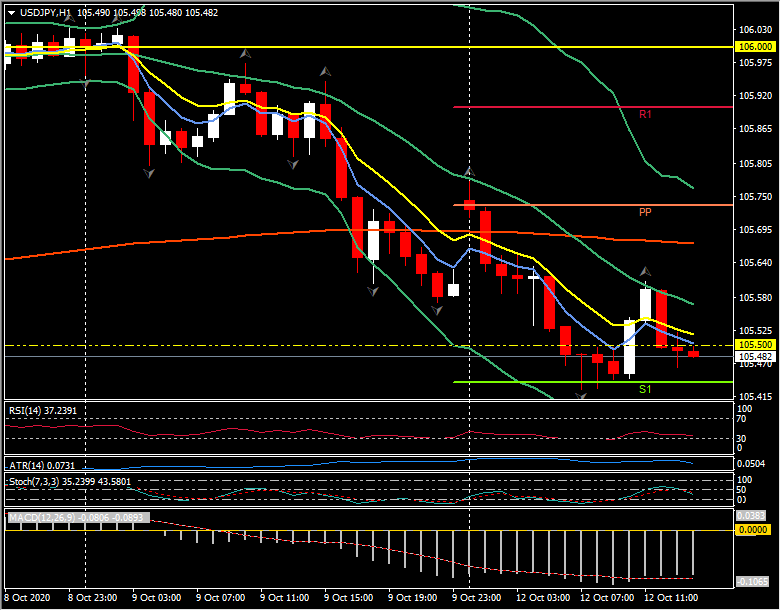

In the forex realm, EURUSD maintained a narrow range 1.1800-1.1795, below Friday’s three-week peak at 1.1831. ECB chief economist Lane said that the surge in Covid cases in Europe, and the resulting restrictions, puts a question mark over the economic rebound. USDJPY nudged moderately lower and posted a one-week low at 105.43. EURJPY and other yen crosses have also seen downside drift, although most have remained above their respective Friday lows. In Japan, August core machinery orders beat expectations in rising 0.2% m/m, while September PPI came in at -0.8% y/y, below the median forecast for -0.5% y/y. The Australian Dollar recouped declines that were seen as China’s currency dropped (China accounting for over a third of Australian exports).

Sterling has been steady so far after posting modest gains last week against peer currencies. Future relationship negotiations between the EU and UK continue this week, into the EU summit on Thursday and Friday. A French minister said that talks may continue through to early November. Boris Johnson told Germany’s Merkel that “significant gaps” remain to be bridged, while the European Council President said that the UK needed to take “significant steps” to secure a deal. EU trade diplomat Barnier said on Friday that the UK needs to make a few more concessions before the final intense phase of negotiations can proceed. Despite the public hard talk and brinkmanship, and some confusing headlines, there have been reports from behind the scenes of motion toward finding a compromise on key issues from both UK and EU sources. The fact that negotiations have intensified over the last week also shows that both sides are eager for a deal. We expect a limited free trade agreement, though cannot absolutely rule out a no-deal scenario. Fishing rights and level playing field rules (in particular state aid rules) are the principal obstacles. France is the main objector to UK demands on fishing, but is under pressure from other EU nations to make concessions. A recent BBC article reported that EU diplomats are hoping that “guiding principles” in place of strict adherence to level playing field rules, alongside measures to resolve future disputes, may be the route to compromise on that front. The FT reported today that the EU will insist on tough enforcement powers, which is something the powerful hard-Brexit faction in Johnson’s party won’t like the sound of.

Any news of a deal would likely boost Sterling over the near term, but even with a deal, and even with the UK’s progress in signing continuity agreements with non-EU trading partners, the UK will see its terms of trade position deteriorate. It has also become increasingly clear that London’s European dominance in financial services will be eroded, deal or not. Surging new Covid cases in the UK and increasing odds for the BoE to go negative on interest rates could ultimately lead to a pound-bearish recipe.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.