Today (October 20) is the date scheduled for the media giant Netflix to report its third-quarter results. Obviously, Netflix has been one of the companies that benefited from stay-at-home orders following the outbreak of the COVID-19 pandemic around the globe. Q3 has seen live sports return and also more competitors in the streaming space, but most analysts remain bullish on the market leader.

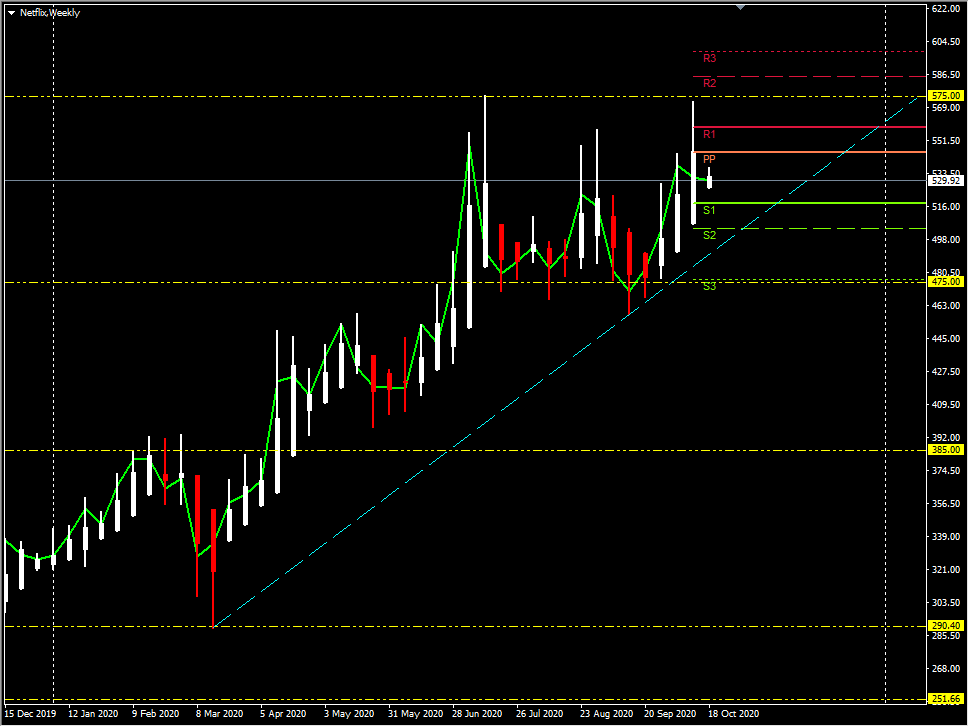

In Q2 2020, the company reported an increase of 10.9 million global subscribers compared to expectations of 8.26 million, and Revenue also beat expectations last time at $6.15 billion vs. $6.08 billion. However, the key Earnings per share (EPS) came in at $1.59 vs. $1.81 expected, while the appointment of Ted Sarandos as co-CEO alongside CEO Reed Hastings, and a weaker outlook for Q3, all colluded to see the share price drop over 9% following the announcement. On July 13, Netflix’s stock price soared and reached a new high of $575.23 before sharply retreating and finding support through $475.00 for the rest of the quarter. The shares closed the week at $530.79 on Friday – $45.00 shy of the all-time high, but up 40% for the year to date and 75% from the mid-March low under $290.00.

The July Netflix forecast said it would add 2.5 million new paid streaming customers globally between July and September, based on the expectation that its strong first-half performance – in which it added almost 26 million subscribers – likely pulled forward some demand from the second half of the year. However, as the pandemic has evolved and the quarter progressed, many analysts polled by Refinitiv have this number at 3.4 million, significantly over the company’s own estimates in July.

According to the Zacks Consensus Estimate , Netflix forecasts Q3 earnings to be $2.09 per share, implying over 40% of year-over-year growth, but the Zacks consensus estimate was pegged higher at $2.12 per share. The Zacks consensus estimate for September quarter revenues was pegged at $6.38 billion, over 20% higher than a year earlier with a profit of $968.6 million.

Analysts remain bullish on the sector as a whole and the market leader in particular. Morgan Stanley were the latest to up their stock price forecast on Netflix to $630 from $600, assigning an “Overweight” rating foreseeing short and long-term benefits to Netflix growth and earnings power due to the changes brought on by the COVID-19 pandemic. Goldman Sachs ($670), Canaccord Genuity ($630) and Pivotal Research ($650) all have BUY ratings on the stock with only The Benchmark Company ($420) with a SELL rating and Raymond James (Market Perform) the dissenting voices.

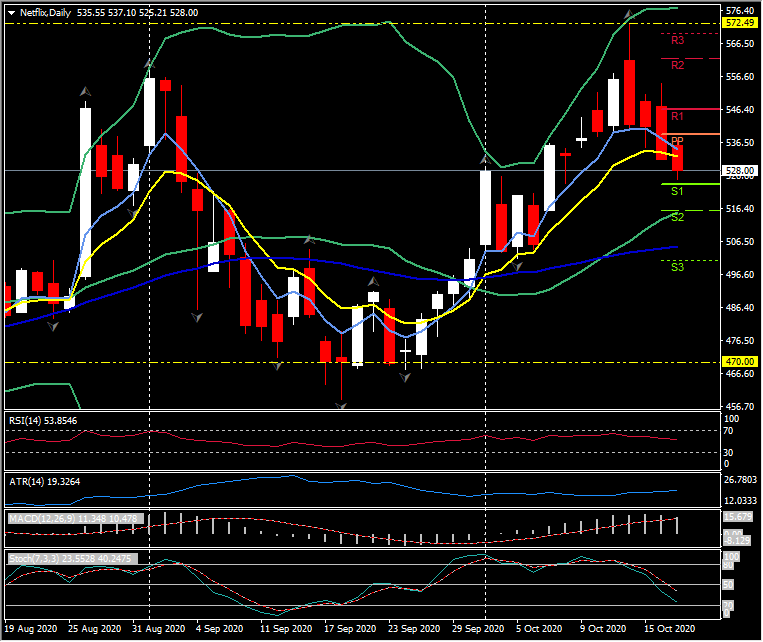

Technically, the weekly chart remains bid following three consecutive positive weeks from the key support at $475. To the upside there is resistance at $545 (Pivot Point & 23.6 fib. Level), $560 (R1) and the all-time high from July at $575.23. Support resides at $515, $505, $475 and the September low at $460. The daily chart has had 4 days lower into Earnings day from last week’s high at $572.50, immediate support is the 20-day moving average at $515, the 50-day moving average at $505 and the September $460 low. The 200-day moving average resides at $445.

Netflix will report after the New York cash market closes October 20, with all eyes on those key subscriber numbers.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.