On 21st October, the US electric vehicle giant, Tesla, Inc. (NASDAQ: TSLA) is expected to report earnings for the fiscal Quarter ending September 2020, after the market close.

Two weeks ago, the company reported record deliveries of 139,300 vehicles for Q3 2020 which outperformed analysts’ estimates of 137,000 vehicles. The number of vehicles delivered over the third quarter is about 1.5 times higher than those delivered in the previous quarter (90,650). Tesla’s previous best performance was in Q4 2019 with 112,000 vehicles delivered. CEO Elon Musk stated at the annual stockholder meeting in September that vehicle deliveries would likely achieve 30%-40% (Y-o-Y) gains, which implies deliveries of 477,750 to 514,500 vehicles in 2020. Considering the accumulated delivery of vehicles for the past three quarters (Q1 – 88,400, Q2 – 90,650 and Q3 – 139,300), an additional delivery of 181,650 vehicles is required to “comfortably exceed” the 500K target at the end of the year.

Tesla has also reported a total production more than total deliveries in the third quarter which stood at 145,036 vehicles. In general, Tesla has managed to recover part of its slump in new vehicle sales driven by increased demand in China, when most of its plants around the globe were forced to close following the spread of Covid-19. The majority of these sales were comprised of the Made-in-China Model 3 that is being produced at Gigafactory Shanghai. A price reduction on one of its models (Model 3 Standard Range Plus) would likely result in allowing Tesla to remain competitive and thereby undercut rival local EV manufacturers in China. Despite still being higher-priced than many other competitors, its Model 3 remains highly demanded due to its excellent technologies, features, safety, and performance. Besides that, ramped up production and deliveries of Model Y is seen likely to boost the company’s overall performance.

The Zacks Consensus Estimate for Tesla’s Q3 earnings is pegged at 55 cents per share. Q3 revenues is expected to achieve 30% (Y-o-Y) gains at $8.2 billion. The company is currently ranked #3 in Zacks ranking system which indicates investors to hold. On the contrary, the 12-month average price target for TSLA offered by 7 analyst firms in the last 3 months stands at $322.69, with an upper limit at $578 and a lower limit at $19.

According to Levy, senior equity research analyst at Credit Suisse, full-year delivery volume might be capped at 486,000. The company will need to achieve 30% (Q-o-Q) growth in shipment to hit its delivery target (500,000 vehicles), and that it is unlikely as “the average and median seasonality” suggest 9% and 14% growth, respectively. Nevertheless, Levy emphasized that investors’ sentiment is likely to remain positive even if Tesla misses its delivery target.

It is worth noting that while TESLA has racked up impressive gains in sales with consistent profitability during the Trump presidency, there may still be plenty of growth potential for the company if Biden wins the election on 3rd November. Biden’s climate plan may serve as a positive catalyst for TESLA to go on another bull ride.

Technically, on the Weekly chart the #Tesla share price remains consolidated for the past 7 weeks since its massive plunge through the week of 23rd August which accounted for a loss of over 80%. The asset price is currently trading well above the key support level at $400.00, while it remains pressured below the Alligator’s moving averages. The MACD fast line remains negatively configured while its slow line approaches the neutral line. MACD has displayed diminishing momentum below 0.

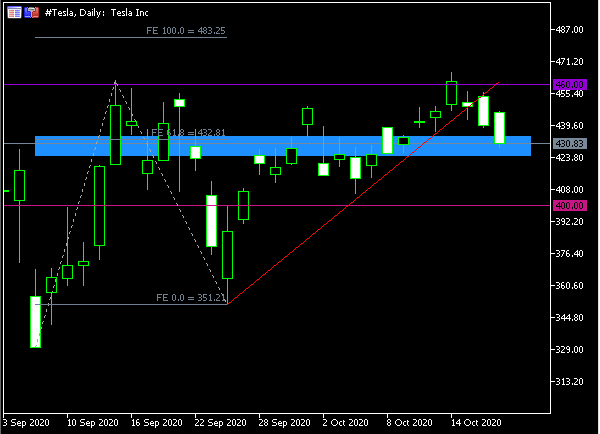

Looking at the Daily chart, Tesla share price is seen trading lower following rejection of the key resistance level at $460.00. The short-term price behavior suggests the asset will continue testing the support zone around $430.00 which corresponds to the 61.8 FE level. A successful closure of the candlestick below $420.00 may suggest the asset price will extend its losses towards the next support level at $400.00.

Click here to access the Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.