Verizon Communications Inc. (NYSE: VZ) is expected to report its most recent quarterly results at market open on October 21, and expectations are not very favorable.

There seems to currently be a second global wave of Covid-19, with countries choosing to tighten prevention and health security measures and again closing shops for a period of time. In addition to the blow it has given to consumers since the beginning, this second wave could make an already difficult recovery even slower, with stores closing again, increased costs with security, transportation among other things.

Wireless stocks in a coronavirus market

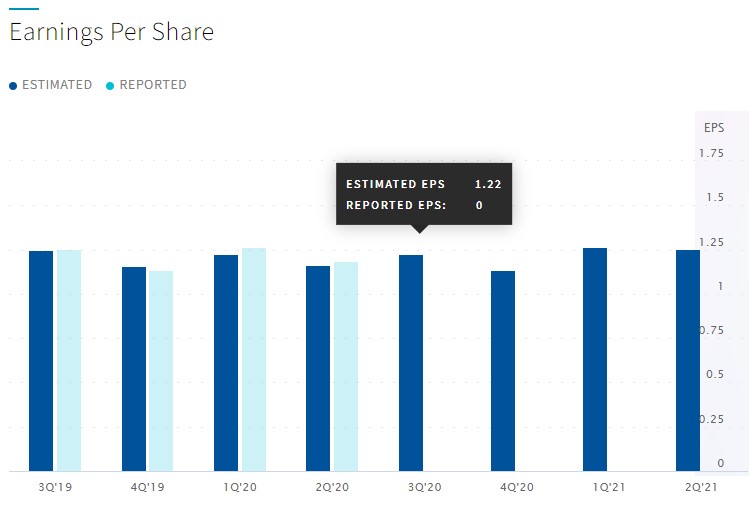

Consensus analyst estimates are $ 1.22 in EPS and revenue of $ 31.59 billion. Compared to the third quarter of last year that reported EPS of $ 1.25 and $ 32.89 billion, giving a -2.4% for EPS and -4.0% for income compared to the same quarter of the previous year and equal to the third quarter of 2018 for EPS. Analysts are also forecasting $ 11.9 billion in Ebitda, down from $ 12 billion and $ 12.2 billion in the third quarter of 2019 and 2018, respectively. However, the stock traded over $ 58 on Friday and are up 0.9% in the last six months compared to 5.7% for the Telecoms sector and the last two quarters has beaten consensus. The consensus price target is $ 61.26 and the 52-week trading range is $ 48.84- $ 62.22.

Verizon has been investing in 5G infrastructure for years, which is why Verizon CEO Hans Vestberg spoke at last week’s iPhone 12 event about these being Apple’s first 5G-capable smartphones, meaning the consumer iPhone (which occupies 46% of the total smart cell phone market, according to Counterpoint) will join the 5G network from which it has focused on the wireless spectrum of greater capacity and less range. Investors seem to agree, as Verizon shares soared as much as 1.3% in the 30 minutes after.

On Monday, he mentioned that he has reached agreements with Microsoft, including that Azure, Microsoft’s cloud computing service, will run on Verizon’s 5G network to process the data generated by machines in local facilities and use artificial intelligence. to automate operations. Verizon also partnered with Bluegrass Cellular to acquire certain assets, this is a wireless service provider in rural Kentucky with 210,000 customers in 34 counties in rural service areas in central Kentucky increasing dominance in the area. Likewise, he signed with Nokia to enhance the ability to target business customers by offering them the ability to automate factories, floors, reduce costs, and accelerate data traffic over private 5G networks, as these eliminate the need to compete for speed with others on a network and help enable data-intensive applications that use computer vision, augmented reality and machine learning to increase productivity. A Speedtest test revealed a true average 5G download speed of 494.7 Mbps on Verizon’s network, 10 times higher than 4G speed.

According to Barrons , last month, the company agreed to a $ 6.3 billion deal to purchase TracFone Wireless from América Móvil. In a move to expand Verizon’s presence in the value and prepaid segments of the US wireless market.

Separately, it announced on Tuesday that it launched its next-generation mobile service nationwide. In theory, many of the operator’s customers will be able to access its 5G across the country, as the network covers an area occupied by 200 million people in 1,800 municipalities across the country and VZ’s 5G coverage is currently focused on cities and its 5G Ultra Wideband, which runs on high-band millimeter wave frequencies that can support much more robust 5G functionality, is now available in limited parts of 55 cities. They include New York; Baltimore; Arizona; San Francisco, among others.

On the technical side, we have a monthly exhaustion gap between July and August, September formed a bearish Hammer and October seems to leave a pattern known as Shooting Star, all this in the area of $ 60, which they have not been able to since the last quarter of the year last, giving a bearish outlook for the next few months probably. With supports in 56.06 / 55 / 52.22 / 49.48-50.

In the Daily time frame, we have a failure and rejection around 60 in early to mid-September, and 4 days ago it made a bearish continuation gap that reached its support of 56.67 that if we break it we could see a fall to Fibonacci 61.8 at 53.68 to even test lows at 50 or up to the bullish guideline intact since (NOV. 08).

Click here to access the HotForex economic calendar.

Do you want to learn how to trade and analyze the markets? Join our webinars and get analysis and trading ideas combined with a better understanding of how markets operate. Click HERE to get FREE!

Aldo Weidner Z.

Market Analyst

Liability notice: This material is provided as a general marketing communication with informational fines specifically and does not constitute independent investment research. Nothing in this communication contains, must obligations it contains, an investment advice or an investment recommendation or a request for the purpose of buying or selling any financial instrument. All confirmed information obtained from reputable sources and any information that contains an indication of past performance is not a guarantee or a reliable indicator of future performance Users acknowledge that any investment in leveraged products is characterized by a certain degree of uncertainty and any investment of this nature that implies a high level of risk for which users are solely responsible. We do not assume any responsibility for any loss derived from any investment made based on the information in this communication. This communication should not be reproduced or distributed without our prior written permission.