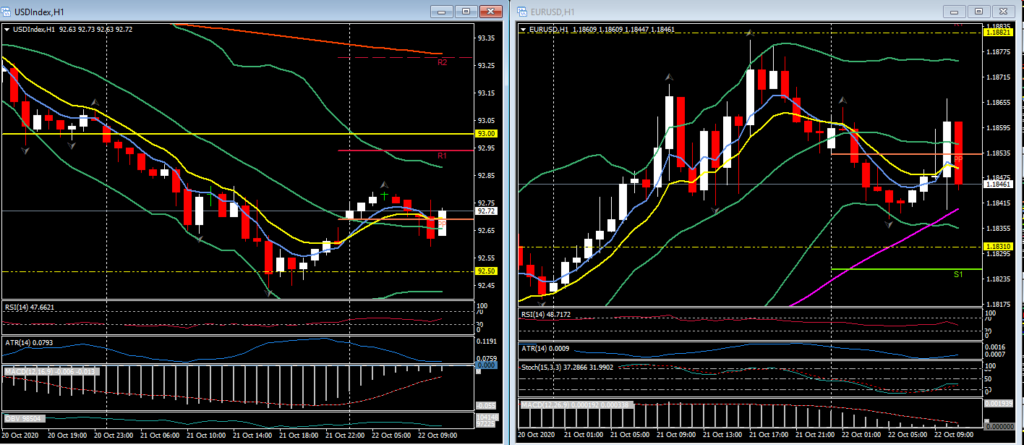

The Dollar has settled after dropping quiet sharply in recent days.

The USDIndex has come to rest around the 92.70-75 area after diving over the previous four days, from levels near 94.00. EURUSD has settled off the five-week high that was seen yesterday at 1.1882. USDJPY has steadied in the mid 104.00s after dropping 1.1% yesterday, which is an unusually large magnitude of movement for this pairing by the norms of recent years. Cable moved over 1.7% yesterday breaching both 1.3000 and 1.3100 to stall at 1.3150 zone.

One Dollar bearish structure to be aware of is a combination of real interest rate differentials and the Fed’s recent regime shift to a lower-for-longer policy rubric, which is specifically aimed at stimulating inflation. September US inflation was at 1.4% y/y in the headline and 1.7% y/y in the core, which compares to the near zero or negative rates in Japan and the Eurozone. US inflation is also some way higher than other major economies, including the UK and Canada. With nominal interests in all at or near zero, this leaves the US with the lowest real interest rate. This, combined with the Fed’s policy stance, establishes a mechanism for nominal Dollar weakening, all else equal (and is something that ECB policymakers have been aware of, with one complaining that “the market may interpret interest rates as being structurally higher in the euro area, which could lead to further appreciation of the euro”). Add in suspected down weighting of Treasuries in Chinese reserve holdings. The lower Dollar/lower global stock market dynamic this week shows that the market hasn’t been trading the Dollar as safe haven at this juncture.

This week’s strong showing of investor demand for the EU’s first joint offering of social bonds, which will finance a jobs program, has shored up the reputation of the Euro. The Pound, meanwhile, has rallied quite strongly as markets discount a limited free trade deal between the EU and UK. Face-to-face talks between the two will resume today. Market participants are still having to navigate a sea of uncertainty, including the surge in Covid-19 cases in Europe and in many US states and Canada, and the associated restrictions they bring, along with continued uncertainty about the next fiscal package in the US. The approaching US elections present event risk, given the perceived risk of the outcome being contested, which in the event would throw the country into political disarray.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.