The Dollar is firmer against a backdrop of tumbling global stock markets as an ongoing surge in new positive tests for Covid in Europe and the US, and the course toward tighter restrictions, dulls the economic outlook.

The US and France set new records for positive tests for the coronavirus, while Spain announced a state of emergency. It should be noted (though often isn’t) that there is likely a false positive issue (many academic papers have discussed this), which may be exaggerating the true picture of Covid prevalence. Hospital respiratory-condition ICU occupancy and the mortality rate from respiratory conditions are at near normal levels for this stage of the season across Europe. However, the fear is that this won’t remain the case and we’ll see a similar impact as we did back in March and April, and the dominant approach to tackling the coronavirus is to implement restrictions and lockdown if necessary.

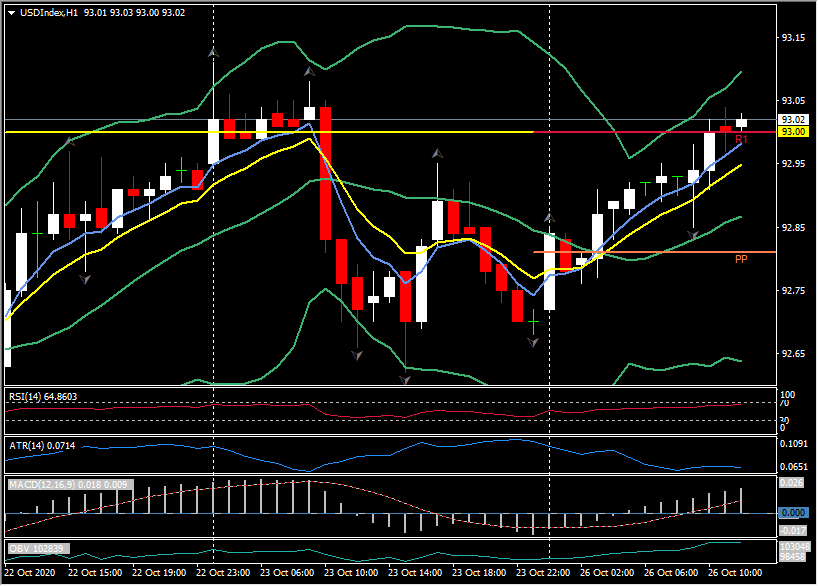

This backdrop has seen risk-off positioning take a hold again, which has been the on-and-off case over the last two weeks. More of the same seems likely in the weeks ahead. The USDIndex gained 0.3% in posting a high at 93.02, which reverses most of the decline seen on Friday. EURUSD concurrently ebbed to the lower 1.1800s from levels above 1.1850. USDJPY lifted to a five-day high at 104.98. Cable dipped briefly below 1.3000 for the first time since last Wednesday, before lifting to test 1.3048 again. The Pound also traded modestly softer against the Euro and other currencies, remaining comfortably within recent ranges. The EU’s trade envoy, Barnier, and his team have extended their time in London through to this Wednesday as intensive talks on the future relationship continue. Brandon Lewis, a senior member of Boris Johnson’s cabinet, said yesterday that “there is a good chance we can get a deal.”

Elsewhere, commodity prices are lower, and front-month USOil futures in particular dropped about 3% in posting a three-week low at $38.42. This helped lift USDCAD to a six-day high at 1.3185. Gold slipped on open to $1890 but has since recovered to test $1902. The US elections are now just eight days away.

European stock markets are selling off, with the GER30 down -2.2% (big revenue miss from SAP weighs significantly)¹, and the EuroStoxx 50 down -1.50% as virus developments raise fears of a double dip recession. The UK100 is outperforming slightly, but still down -0.3%. US futures are also extending losses as a stimulus program remains elusive, USA500 trades at 3428 down some 37 points (-1.0%) from Friday’s close on the cash market at 3465.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.