The Wendy’s Company (Nasdaq: WEN), one of the largest fast-food chain in the world, shall report its third quarter earnings results before the market opens on 4th November 2020. Established since 1969, Wendy’s has developed to becoming the world’s most thriving and beloved restaurant brand with more than 6,800 restaurants operated globally.

In August 2020, the company reported an unaudited summary for the second quarter. Following the pandemic-led reduction in sales and franchisee royalty earnings, the company’s total revenues were down 7.6% (Y-o-Y) to $402.3 million. Subtracting advertising funds revenue from the total revenues, the resulted adjusted revenues stood at $324.2 million, down 7.0% from the same quarter in 2019. Despite an unpleasant decline in revenues, it is being viewed optimistically by CEO Todd A. Penegor that a solid growth in building breakfast daypart, growing digital business and expanding international footprint shall position the company to manage through future challenges and eventually emerge as a more resilient brand. In Q2, breakfast daypart and digital sales (through the launch of a mobile app to accommodate digital ordering, payment, and delivery) of the Wendy’s Company performed strongly at an approximate 8% and 5% of US systemwide sales respectively. Positive growth in these aspects may help to alleviate the impact of lower sales driven by the virus pandemic.

According to Zacks Consensus Estimate, the Wendy’s Company is expected to post a decline in its earnings by -10.5% (Y-o-Y) for the third quarter at $0.17 per share. Revenues are expected to hit $455.63 million, up 4.05% from Q3 2019. Earnings ESP stood at -16.42%, indicating bearish views of the analysts on the company’s earnings prospects. All in all, the company was ranked #3 by Zacks, suggesting investors to Hold. On the contrary, consensus price target issued by 24 Wall Street analysts in the last 12 months indicates a possibility of +3.88% to $23.00 from current price. 14 out of these analysts have rated “Buy” while the rest of them have rated “Hold” for the stock.

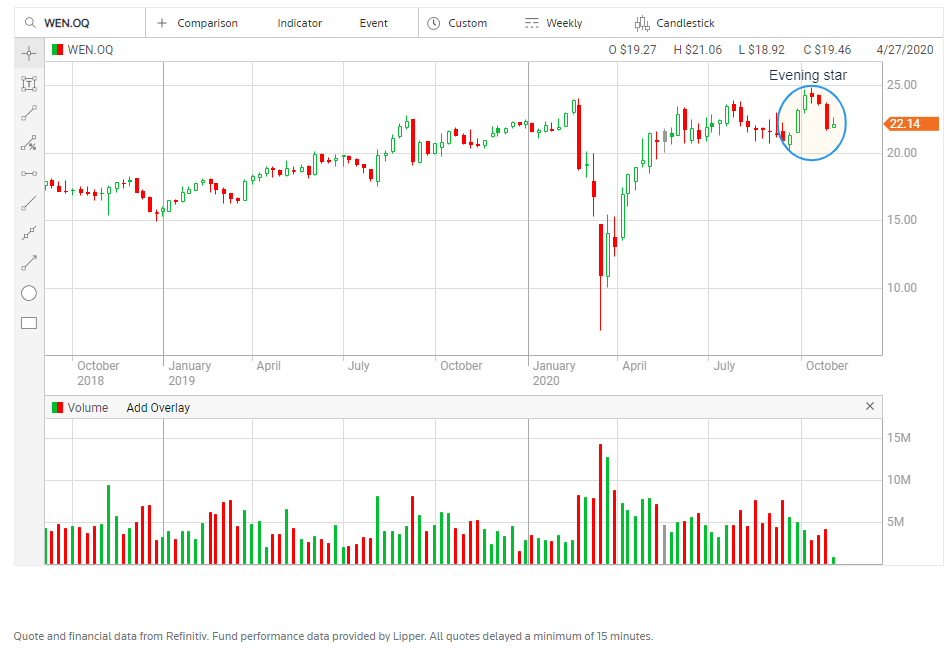

As displayed in the Monthly chart above, Wendy’s company share price reached its all time high last month (October 2020) at $24.91 before paring its gains by 14% and closed below its near four-year high ($21.97), at $21.85. At the end of the 1st trading day in November, the company’s share price was last seen slightly above the low of the previous month ($21.69).

Following the formation of evening star candlestick pattern as seen from the Weekly Chart, the share price of the Wendy’s Company plunged over 9% last week. The Daily chart has also displayed that its price just closed below its previous support – 100-MA line. Levels to focus in near term:

R1: 1D 100-MA line at $22.30-$22.40, S1: 1W 23.6% Fibonacci Retracement at $20.60

R2: 1D $22.90, S2: 1W 100-MA line at $20.00

R3: 1W $24.90, S3: 1W 38.2% Fibonacci Retracement at $18.00

Click here to view the economic calendar

Larince Zhang

Market analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.