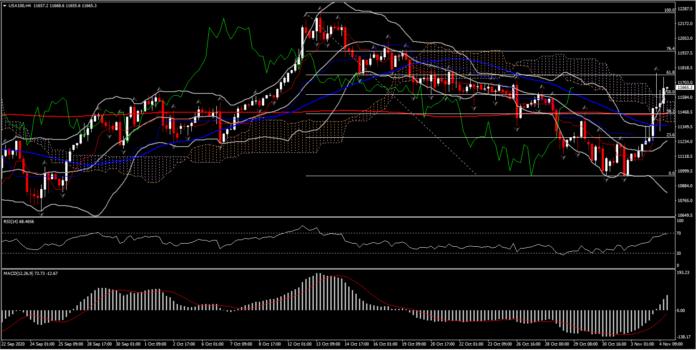

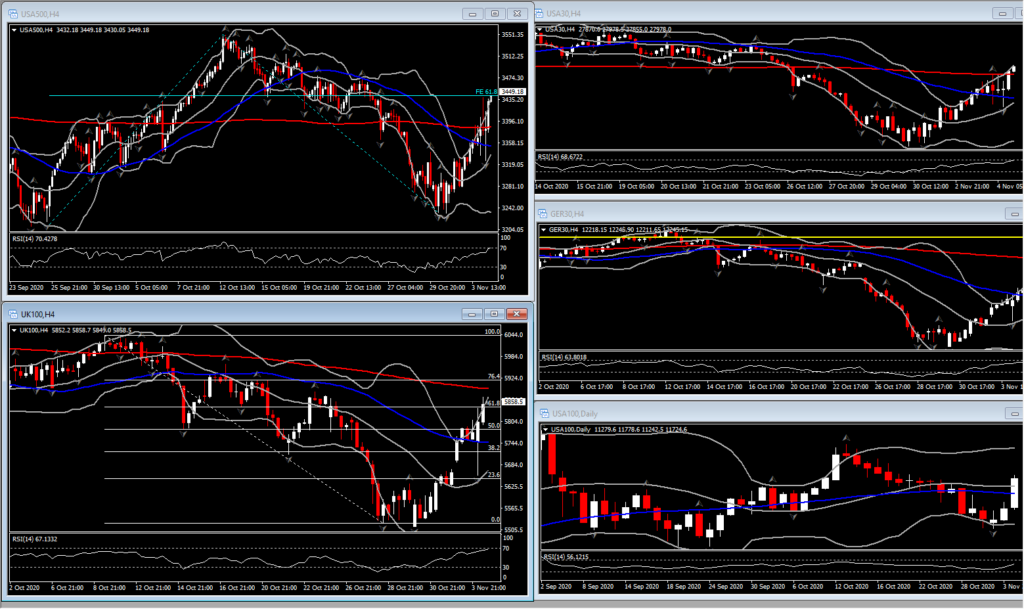

A contested election was the nightmare scenario and that’s what came to pass, upsetting the “blue wave” that had been projections. However, it appears the Republicans retained control of the Senate. The markets were choppy overnight on the uncertainties, but US equity futures and Treasuries are all bid. The Republican hold of the Senate makes a harsh antitrust judgement against big tech unlikely, hence the rally in the USA100 . Of course, a GOP Senate also diminishes the chance for a massive stimulus should Biden be declared the victor. The House remains in Democratic control. The USA100 is up 3.6% in pre-market trading. The USA500 has risen 1.7% and the USA30 is 0.6% in the green.

Elsewhere European stock markets are moving higher, as risk appetite improves, despite the unclear US election. GER30 and UK100 are currently posting gains of 1.7% and 1.3% respectively. Bonds remain supported, and Eurozone peripherals, which underperformed during the AM session, are outperforming now versus Bunds. The German 10-year is still down -2.2 bp at -0.64%, while Gilts continue to outperform, with the U.K. 10-year rate down -6.2 bp at 0.21%, versus a -13.8 bp drop in Treasury yields. In Asia, Japan’s Nikkei 225 rallied 1.7% and China’s CSI 300 closed with a 0.8% gain. With the final result of the presidential election likely some time in coming, we looks for market to be choppy.There were a lot on today’s calendar, meanwhile, with data including the ADP jobs report, the ISM services index, and the trade report.

US ADP reported private sector jobs rose 365k in October, shy of expectations, after climbing 753k (was 749k) in September. Jobs in the service sector climbed 348k, while the goods producers added 17k.

The US trade deficit narrowed to $63.9 bln in September as expected, from a slightly revised 14-year high of -$67.0 (was -$67.1) bln in August, with small upside surprises for both exports and imports. The all-time high was a $68.3 bln deficit in August of 2006. We saw September goods and services gains of 2.6% for exports and 0.5% for imports, after respective August gains of 2.2% and 3.2%. We saw a slight September narrowing in the bilateral trade deficit between the U.S. and China to -$29.7 bln from -$29.8 bln in August. We now expect a slightly smaller trimming in Q3 GDP growth to 32.8% (was 32.7%) from 33.1%, followed by 6.4% growth in Q4. The Q3 GDP trimming will now included a $3 bln boost for exports. Our Q4 GDP estimate assumes a -$65 Q4 net export subtraction, following an estimated -$232.7 (was -$235.X) bln subtraction in Q3. We expect export growth rates of 19% in Q4 after a 60.6% (was 59.7%) pace in Q3, and import growth rates of 22% in Q4 after a 91.1% pace in Q3. We expect the current account deficit to widen sharply to a 13-year high of $193.3 bln in Q3 from a 12-year high of $170.5 bln in Q2, versus a low in the last recession of $87.1 bln in Q2 of 2009. We expect the annual current account deficit to widen sharply to a 12-year high of $674 bln in 2020 from the $480.2 bln high from the last expansion in 2019.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.