Global stock markets are rallying and sovereign bond yields, led by US Treasury yields, are tumbling as investors warm to the idea of a split government that could finally bring additional stimulus, but keep overall spending and debt under control and thus support a low yield environment for longer. Markets are discounting a Biden presidency and a split Congress.

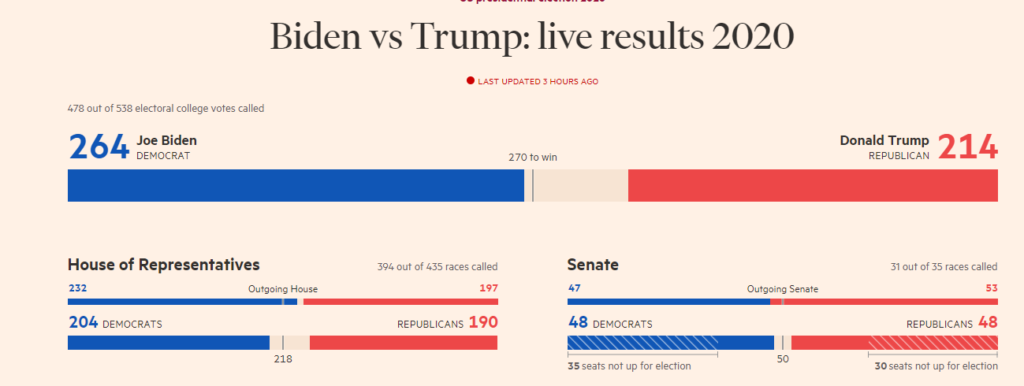

Although Democrats still have a narrow path to taking control of the Senate (there is a 48 versus 48 deadlock currently, with four seats left to be decided), most political pundits think it unlikely. At the same time Biden is the favourite to win the presidency, although there is still some way to go before vote counting will be complete, while Trump is mounting legal challenges. The general view is that Biden will reach the 270 winning electoral college vote threshold (he’s currently at 264 to Trump’s 214), as well as that Trump’s litigation efforts will come to naught.

Without the Senate, the Democrats big fiscal stimulus plans will be kept in check. This means both a reduced prospect for bond issuance and a reduced prospect for inflation, which is why Treasuries have been rallying strongly. The yield on the 10-year T-note has plunged by nearly 17 bp from the high seen just ahead of Tuesday’s election. The combo of lower yields, loose labour market conditions, the prospect of less competition for resources from the government, excitement about tech and the growing fad for WFH (work from home) stocks, and prospects for a Covid vaccine are among the factors underpinning Wall Street.

Hence since so far no one can celebrate a victory, you should focus on markets and how the scenario with US President Biden with a Republican Senate and a Democrat House might affect them in the near and long term future.

In the above scenario, there is firstly the concern whether US President Trump may chase some policies prior to Biden’s establishment in the White house. For example trade policy falls under the President in power, in contrast with fiscal policy and regulatory policy which fall under the US Senate in the face of a divided Congress. Another concern in a divided Government, in the long term, is the strive to achieve a sustainable fiscal position, as so far due to Covid-19 this has not been possible to accomplish. Meanwhile even without a final election outcome so far, questions have been raised in regards to prejudice, which would be corrosive to US competitiveness according to UBS.

However despite all this potential uncertainty and regardless if any of the above become true, the US economy is expected to show growth next year. According to Morgan Stanley,

In short term, the business cycle dominates the political cycle, especially when we’re so early in a recovery. Secondly, a viable vaccine is now close to being approved. This approval, along with a better understanding of the disease and how to treat it with therapeutics, should allow us to manage a second wave better than the initial outbreak. That means by spring, we should be fully open in the economy, with safe participation by most people. The timing and pace of reopening is perhaps the most important variable and driver of economic activity next year. It’s also what financial markets continue to look forward to and why they’ve traded so well this year.

Not exactly like March, but definitely a sell off has been seen in equity markets due to the election and as the virus and restrictions remain headwinds. Despite the latest swing higher, we could state that so far the pandemic’s second wave might not have been discounted from global markets. Hence since the Election will be soon be out of the way, then if the pandemic is settled within the year Equity markets could be boosted as business will not suffer anymore. As this implies the reopening of economies globally, stocks – not solely technology ones, but all others from the tourism sector, services sector, industrial sector, etc – could finally recover.

Just to highlight however that there is the risk still of a divided Congress with Mr Biden in the House. This would limit his ability to deliver a big fiscal stimulus package as he desires to raise corporate taxes to 28%, after Mr Trump cut the rate from 35% to 21% in 2018. However the drop in taxes increased corporate profits, spurring a jump in stock buybacks that has helped to boost share prices over the past two years. These repurchases increase earnings on a per-share basis, which can boost the stock price.