The Dollar and Yen have declined with coursing risk appetite in global markets driving gains in other currencies and asset markets. US Treasury yields have remained in decline, narrowing the yield spread versus the Bund, gilt and JGB yields, among others. Markets are essentially discounting a Biden presidency and a split Congress. Although Democrats still have a narrow path to taking control of the Senate (there is a 48 versus 48 deadlock currently, with four seats left to be decided), most political pundits think it unlikely. At the same time Biden is the favourite to win the presidency, although there is still some way to go before vote counting will be complete and Trump still has a narrow path to win. Trump is also mounting legal challenges. The general view is that Biden will reach the 270 winning electoral college vote threshold (he’s currently at 264 to Trump’s 214), and that Trump’s litigation efforts will come to naught. Without the Senate, the Democrats big fiscal stimulus plans will be kept in check. This means both a reduced prospect for bond issuance and a reduced prospect for inflation, which is why Treasuries have been rallying strongly. The yield on the 10-year T-note has plunged by nearly 20 bp from the high seen just ahead of Tuesday’s election. The combo of lower yields, loose labour market conditions, the prospect of less competition for resources from the government, excitement about tech and the growing fad for WFH (work from home) stocks, as well as prospects for a Covid vaccine are among the factors underpinning Wall Street.

The S&P 500 closed with a 2.2% gain yesterday, and S&P 500 E-mini futures were up 1.8%, as of the early London afternoon session. The risk-on theme has imparted a downside bias on the Dollar and Yen. The USDIndex fell to a ten-day low at 92.45. EURUSD rallied back above 1.1800, extending the solid rebound from yesterday’s low at 1.1603. A nine-day high was logged at 1.1819. USDJPY ebbed to a low at 103.60, despite yen softness against other currencies. The dollar bloc and other commodity-correlating currencies have been outperforming. The Pound has gained moderately versus the Euro, and more so versus the Dollar and Yen. The BoE surprised to the upside by expanding the QE total by 150 bln — 50 bln more than expected — while leaving the repo rate unchanged at 0.1%, as had been widely expected. The UK’s finance minister has also announced that the furlough scheme (which pays employees up to 80% of their wages) is to be extended until the end of March 2021, covering the key winter months and the end of the EU-UK transition period, should there be no trade deal. Sterling likes the news as Cable rallies to 1.3107 and GBPJPY moves over 136.00.

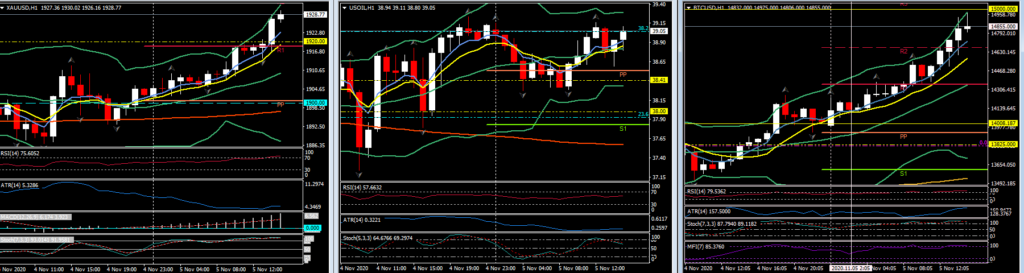

The weaker USD has seen Gold touch a 10-day high over $1925.00, USOil, moves down from $39.00, ahead of inventory data later and BTCUSD trade with $100.00 of $15,000.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.