Risk appetite is waning as the vote count in the US continues with Biden apparently inching closer towards victory. Markets also await key US payroll numbers later today.

The Dollar has found a footing after tipping sharply lower over the last three days, which mirrors a petering out in the risk-on positioning theme in global markets today. We’re still awaiting on the US election result. Markets are pricing in a Biden presidency and a split Congress, with Republicans likely to retain the Senate and with the Democrats retaining the House. Regarding Trump’s litigation efforts, the general view seems to be that senior Republican leaders will break with Trump — and many are already distancing themselves from him — if and when the courts reject his claims of widespread voter fraud, assuming that Biden does indeed reach the 270 electoral college count threshold to win the presidency. The pricing out of a ‘blue wave’ Democrat sweep sparked the sharp drop in US Treasury yields on the prospect for more restrained fiscal stimulus, and thereby prospects for less Treasury issuance. The 10-year T-note yield, even after rising out of lows, remains about a net 16bp lower from levels prevailing on Tuesday ahead of the election results, and yield differentials with gilts, bunds and JGBs, among other sovereign benchmark yields, remain narrower by 12bp-plus. The narrowing in yield differentials vectored the dollar’s decline this week.

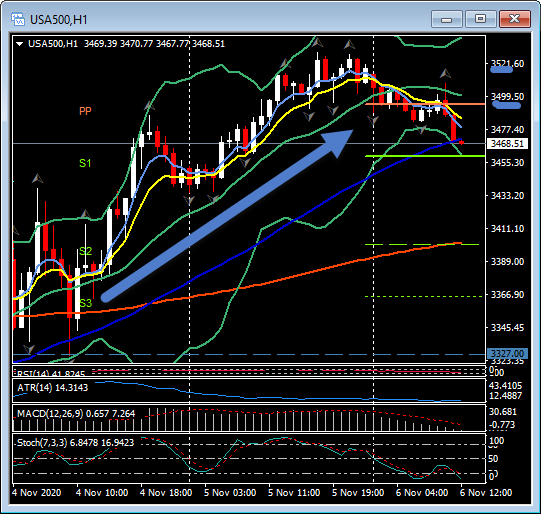

As for Wall Street, the lack of Democrat control of the House spells a prospect for less tax and less regulation than there would have been otherwise. The S&P 500 closed yesterday with a 7.4% gain on the week so far. The biggest gains out of the main currencies have been the dollar bloc and other commodity-correlating currencies. Most commodity prices are up strongly versus week-ago levels. Oil prices are up over 7% and Gold spiked over $1950 yesterday, up 3.88% this week.

The Pound has been mixed this week, gaining on the Dollar, holding near net unchanged levels versus the Euro, while losing ground to the Australian Dollar and other commodity correlators. EU trade negotiator Barnier raised eyebrows earlier in the week by stating that “very serious divergences remain” with the UK, a message that has since been repeated by other officials. Judging by the performance of the Pound, markets are evidently not perturbed, expecting a last minute climbdown. The final deadline for a trade deal is understood to be the end of next week. The US October payrolls report is up today, where markets are expecting the headline to show the lowest job gain in five months as a consequence of flagging momentum due to fiscal stimulus ending and new Covid restrictions being implemented in various parts of the country.

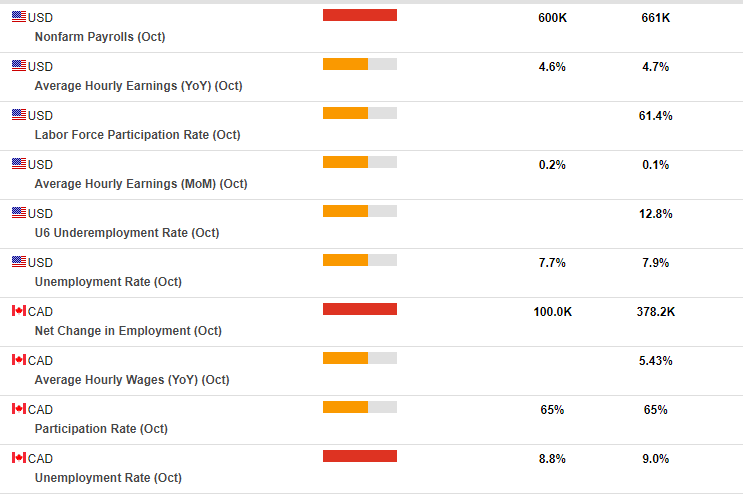

US Nonfarm Payrolls has a wider than usual variance this month; the range in the Reuters poll estimates varies from 300,000 to 1.221 million. The consensus sits at a 600,000 increase for October nonfarm payrolls, after gains of 661,000 in September, 1.489 million in August, and 1.761 million in July. Assumptions are for a 50,000 factory jobs gain after the 66,000 September rise. The jobless rate should fall to 7.7% from 7.9% in September, versus a 14.7% peak in April. Hours-worked are assumed to grow 0.6% after a 1.1% September gain, with the workweek steady from 34.7, matching the 19-year high of 34.7 in May. Average hourly earnings are assumed to rise 0.1% in October, with a headwind from further unwinds as the April distortion from the concentration of layoffs in low-wage categories slows. This translates to a y/y gain of 4.4%, down from 4.7%. We expect the payroll rebound to continue through Q4, but the climb will still leave a net drop for employment for 2020 overall. This week, ADP and Weekly Claims numbers could bias the headline NFP number to the downside.

Asian equity markets closed broadly higher, the Nikkei225 closed at 29-year highs after a 4% gain this week, and Chinese indices pared losses. The GER30 and UK100 are currently down -0.4% and -0.2% respectively and US futures are also in the red.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.