Global stock markets are mostly higher, resuming yesterday’s stellar day on Wall Street as the indexes raced sharply higher on surprisingly positive vaccine news from Pfizer and BioNTech. News from Pfizer that its COVID vaccine is very effective prompted risk-on conditions globally, lifting stocks, yields and crude oil prices.

In the Asian market equities petered out amid the realisation that there are still considerable challenges ahead in the fight against Covid-19, however there is at least a light at the end of the tunnel now that will also reduce the pressure on central banks to add ever more stimulus. Currently however equities other than the European ones have settled in a comparatively narrow range.

The GER30 is up, after correcting some of yesterday’s sharp gains, but is holding above early lows. Other European indices are higher, with the UK100 gaining a further 0.8%, the CAC 40 up 0.5% and the Spanish IBEX 1.8%. The wider Euro Stoxx 600 has risen 7% over the past 5 days, but is still down 6% over the year, highlighting that there is still room for further improvement if and when it is confirmed that the virus situation is under control and Europe doesn’t face a further cycle of lockdowns and restrictions.

On the US side however the USA100 holds in the red after it closed yesterday -1.5% lower. The hopes for a more normal life saw investors pile into travel and leisure sectors, and flee the stay home sectors. Hence, the USA100’s gains lagged through for a second consecutive day and the index fell into negative territory. The USA100 was hit by the rotation out of defensive technology stocks into shares that will benefit most from an end to lockdowns.

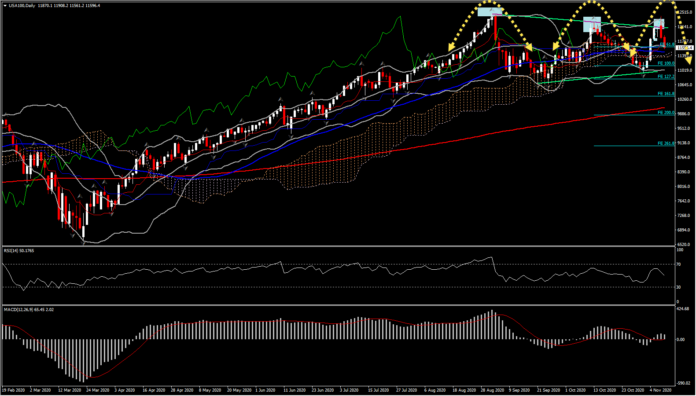

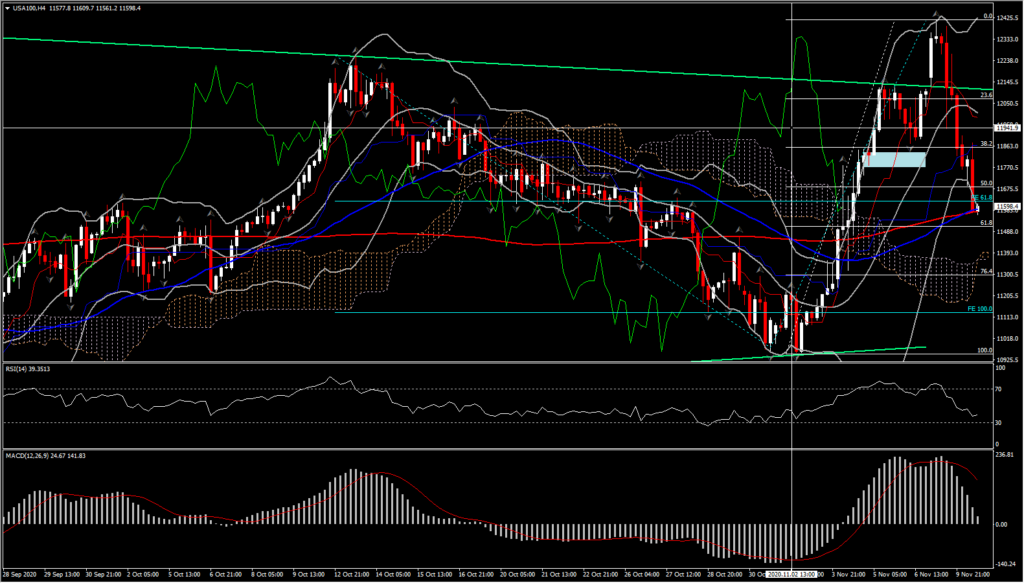

The asset is in a dramatic shift this week towards negative sentiment. Selling pressure has ramped up and there has been a significant breakdown on the 20-day SMA and a reversal of more than 50% of last week’s gains. The latest higher high at 12,422 has been rejected suggesting that the 3-month descending triangle is still in place and consolidation is underway. Momentum indicators are now flat to negative in the daily chart, while intraday they are decisively negative, with 4-hour RSI consistently failing under 40 and MACD readying to turn negative. This suggests an outlook of selling into near term strength.

Hence now the November higher low and 100FE at 10,929 and 11,155 are the areas to be seen of overhead supply and a near term sell-zone for any bounces this week. Breaking down below the 10,929 and more precisely 10,700 (September low & 3-month support) could confirm a medium term bearish outlook with immediate support levels on the March-September upleg. There is initial resistance at 12,000 – 12,422 .

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.