RBNZ topped up stimulus with a new Funding for Lending Program to start in December, aimed at reducing banks’ funding costs and lowering interest rates. The bank’s economic projections were less pessimistic on growth and inflation and cut back the projections for peak unemployment. The cash rate was left unchanged at a record low 0.25% and the Large Scale Asset Purchase program remained at NZD 100 bln. The statement reiterated the commitment to use additional tools if necessary, but markets started to price out expectations that the bank will move towards a negative rate regime next year, on the back of the less pessimistic outlook.

Clearly the balance of risks remains tilted to the downside, but it seems in the central scenario further rate action won’t materialise.

Most Asian stock markets have moved higher meanwhile, and the rotation out of defensive stocks into those relying on overall economic growth continued. Mainland China bourses underperformed as the government announced plans to regulate the internet industry and root out monopolistic practices. JPN225 is currently up 1.8%. The Hang Seng has gained 0.2% and the ASX 1.7%, while the CSI 300 is down -0.8%. Treasury markets are shut today as the US honours Veterans Day, but across Asia yields continued to climb higher, with New Zealand bonds in particular selling off and the 10-year rate up more than 14 bp after the RBNZ sounded somewhat less pessimistic on the outlook, which saw traders pricing out expectations of negative rates.

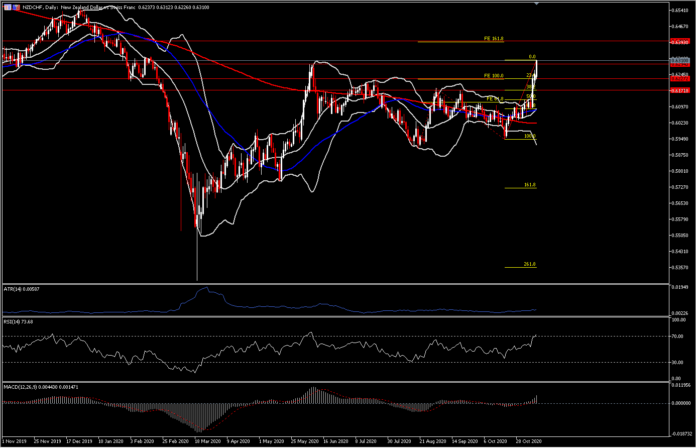

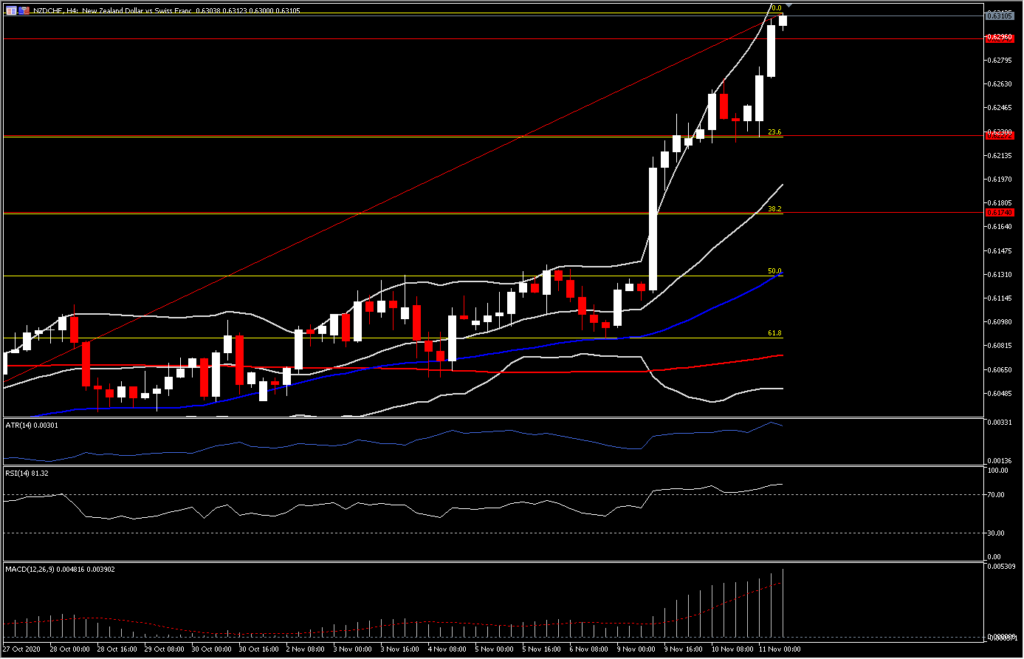

That in turn also saw NZD rallying sharply across the board. NZDCHF and AUDNZD have been the biggest movers so far, more than 1% up and -0.68% down respectively. They both approached key levels, as AUDNZD approached 6-month Support and NZDCHF broke 0.6294 which is a key resistance area that has not been rejected since February.

The move has strengthened ahead of the EU open, retesting 0.6300, while if support in the market is seen steady again at 0.6170-0.6225 (23.3% & 38.2% Fib.), the way will be open to testing the key overhead resistance at 0.6500-0.6550. This band is an important range for medium term Resistance. An immediate Resistance could also see at the 161.8% Fibonacci expansion from August-September swing high at nearly 0.6400.

Momentum indicators are moving strongly positively in the near and medium term timeframe, even though in the long term they still have to do more to suggest a bullish 2021 outlook. The intraday outlook is extremely positive with MACD extending further higher (4-Hour and Daily), and the RSI entering OB zone. However as the asset continues posting nearly full body candles, this suggests that any pullback could be just a correction on this strong 18-day rally.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.