It has been a week of big moves for both bond and stock markets and investors have turned much more optimistic on the outlook thanks to virus headlines, but also political developments in the US. The EU will be hoping that a potential change in the White House will help to rebuild relations with the US, while Boris Johnson is feared to have lost a potential ally in his bid to reduce the reliance on EU trade as the UK leaves the trading bloc. There had already been speculation in the run-up to the US election that a Biden victory would make Westminster more open to a compromise in Brexit talks and that is clearly part of the rally in European stock markets this week, together with hopes that vaccination programs can be rolled out earlier than previously hoped.

With this week’s positive vaccine headlines, however, there is now a silver lining on the horizon and a tangible chance that a never-ending cycle of lockdowns and re-openings can be avoided. Against that background, the ECB remains on course to ease policy further in December, with officials currently working on a package of measures, to be announced at the next council meeting.

ECB’s Guindos earlier today highlighted the need for further fiscal stimulus, saying that fiscal support needs to be maintained and in certain areas even scaled up. At the same time, a necessary exit in the future needs to be carefully managed. No surprise there, really, but against that background the ECB clearly will want to extend and strengthen PEPP as a tool to manage yields and spreads and to facilitate the refinancing of governments that are forced to extend deficit and debt levels to manage the crisis. With inflation in negative territory, PEPP is still likely to be extended beyond the current time frame, which ends in June next year.

They could also boost regular asset purchase programs and improve TLTROs, although the final package will likely also depend on what happens on the virus front irrespective of the vaccine news. Meanwhile, further rate cuts may look less likely now, but that doesn’t means there won’t be additional monetary support, especially as strong fiscal efforts will be needed to support the global recovery even in the best case scenario that vaccination programs can begin next month. That ties in with suggestions that the EU should extend the suspension of debt and deficit limits laid down on the Stability and Growth pact.

Market eyes yields and stimulus moves

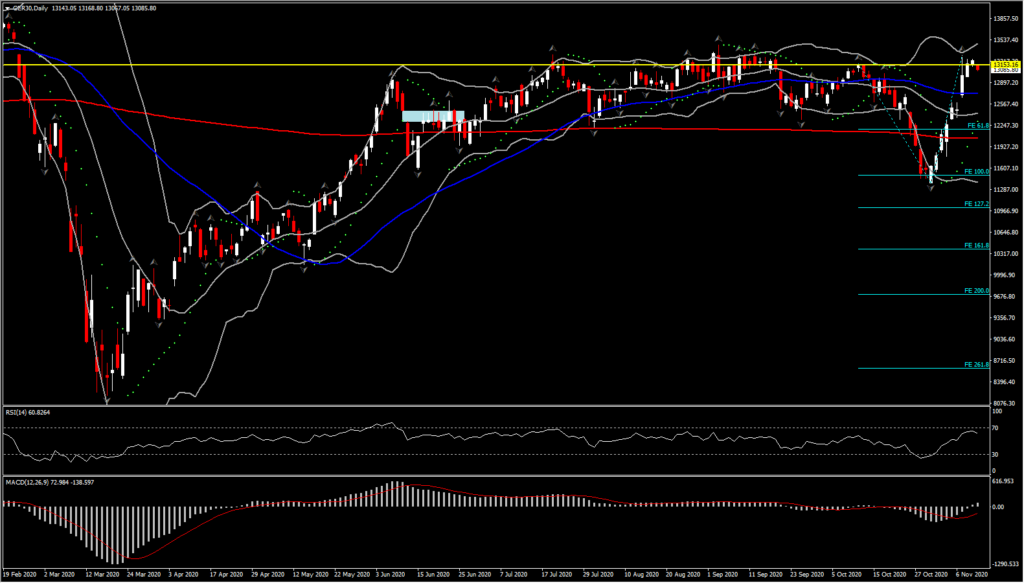

GER30 the past 8 days has seen a sharp rally towards positive sentiment on equities. Buying pressure has ramped up and there has been a significant buildup on the GER30, with the October high at 13,177 having been decisively broken. The asset is just 700 points away from confirming full recovery from February to March drift. Momentum indicators however are not decisively corrective in the medium timeframe, with indications of an outlook of a potential pullback into this sharp near term strength. The daily RSI stalled at 60, while MACD turned above 0, however signal line remains negative suggesting the near term pressure. We see 50-DMA at 12,730 as an immediate Support level. However only a move below 12,200 could neutralise this overall positive outlook.

EURUSD on the other hand

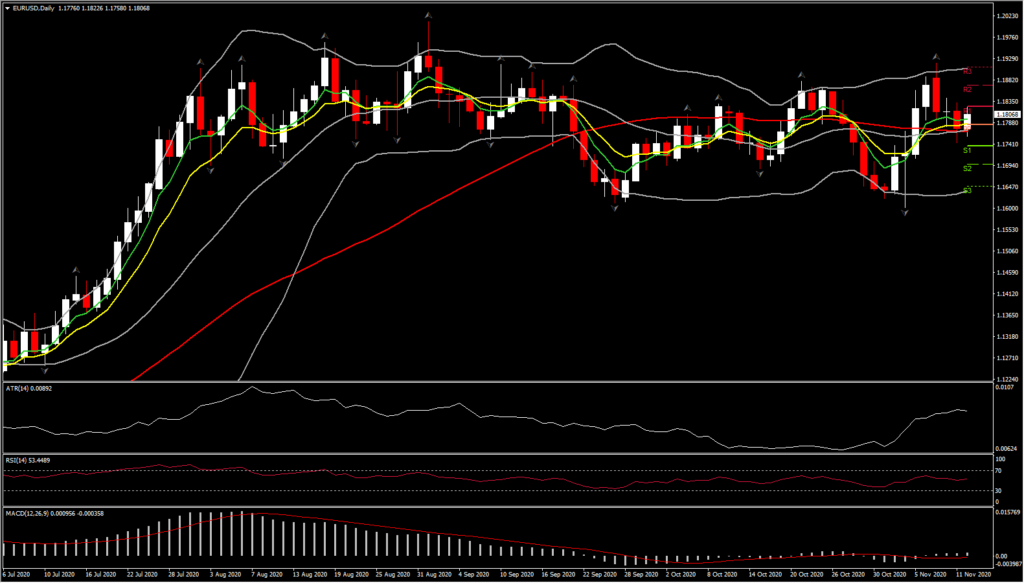

EURUSD has lifted back above 1.1800, lifted by broad gains in the Euro this week. In posting a low at 1.1745 yesterday, the pair completed a more-than 50% retrace of the outsized gain the pair saw last week through to Monday. However in contrast with DAX, EURUSD daily/weekly outlook remains neutral. Ahead however, there are numerous speeches from Fed policymakers scheduled over the coming days which could change this.

The negative real interest rates and yields in the US and the Fed’s lower-for-longer monetary policy rubric are a US Dollar weakening fundamental, but in the case of the EURUSD pairing, there are countervailing forces at play. Even though the relative economic growth outlook favours the US over the Eurozone, the politics however do the whole work. Concerns about the political situation in the US, which is diminishing the prospect of fiscal stimulus further down the road, are emerging, which presents a contrast to the eurozone situation and course.

There is disquiet about Trump’s refusal to accept the election results: the changing of national security leadership (his firing of the defence secretary and shake-up of Pentagon personnel) amid ongoing claims of election fraud, have led to some fearing that he will try to stay in office. Unnamed Trump aides cited by the Washington Post, however, say that he has no real plan to overturn the results — and election officials in all 50 states reported that there were no voting irregularities.

Most likely, Trump’s legal route to overturning the election result will come to nothing, and he will leave without formally conceding and set up a median network in his brand. But the transition process is in disarray, with Trump denying Biden resources and access to security briefings, which is very much outside of the norm in presidential transitions. A Washington Post article highlights a number of natural security crises and threats have occurred during past transitions, and noted a finding from an investigation of the rocky transition from between Bill Clinton and George W. Bush in 2000 that it hampered the new administration in making key appointments and might have compromised the ability to detect the terrorist threat that ultimately led to the 9/11 attacks.

The article, citing a prior national security adviser, said that members of Trump’s administration and career employees at agencies will work on making a successful transition regardless, though the situation is far from ideal. Consideration of this could increase the attractiveness of the Euro over the Dollar, particularly if risk appetite holds up in global markets.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.