GBPUSD, H1

The Pound gained moderately against the Dollar and Euro before ebbing back. Brexit remains front and centre. The coming week was being touted as the ‘final final’ deadline for a future relationship deal to be reached to allow time for the ratification process ahead of the UK’s departure from the common market and customs union on January 1, but it has become clear that negotiations could be pushed further out still. France’s EU minister said on Friday that a “fixed, scientific deadline” has never been set, but if this happens after the end of November “we will be in trouble.” There is even the possibility for a ‘technical’ delay, though the political mood in the UK is against this, with Boris Johnson set on following through on a fundamental manifesto promise after building up a notorious reputation for U-turning on policy decisions this year.

Another consideration is political developments, with the UK government’s director of communications Lee Cain and prime minister adviser Dominic Cummings having left their positions. The take on this is that this weakens the influence of the ideologically Brexit ‘Vote Leave’ campaign members, meaning there could be a softer and more pragmatic attitude to Brexit. But often 2+2 does not equal 4 and always assume nothing. Johnson’s reset has got off to a bad start, as he’s been forced into self-isolation having come into contact with minister who has been tested positive for Covid-19. There has still not been a breakthrough in negotiations between the EU and UK. Evidently, given the Pound’s performance, the prevailing market expectation remains that there will be a last minute climbdown and the two sides will strike a deal, which is what expectations have been all along, but time ticks on. Both sides will have to make concessions if a deal is to be achieved. There is an axiom that all things Brexit go down to the wire, and fitting this neither side has been willing, as yet, to make the first move in the concession game. Too much is at stake for both sides — surely — for there to be a failure in statesmanship. Given (1) the emergence of pro-EU (including a strong Irish heritage) Biden as president elect in the US, (2) news that Dominic Cummings is out of Johnson’s administration, and (3) the backdrop of the Covid-19 crisis, the scene is set for a deal to be made. The question remains as to when?

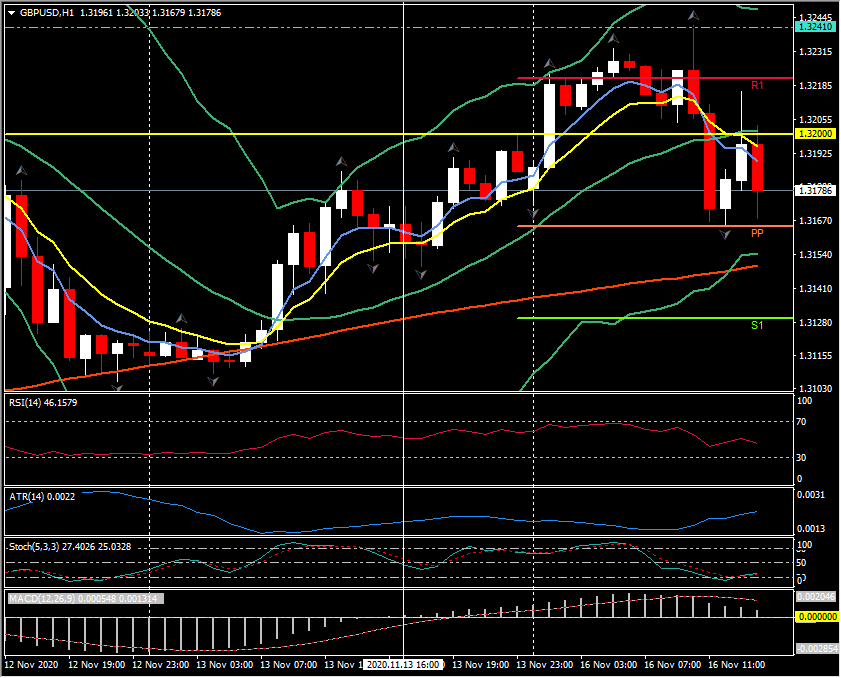

Last week, GBPUSD rotated over a 200+ pip range from 1.3100 to 1.3300. So far today the pair have rejected 1.3240 and moved to test the pivot point at 1.3165. The 200-hour moving average at 1.3150 and S1 at 1.3120 are the next key support areas. Below the daily high, sits R1 at 1.3220 and the psychological 1.3200. Us data today includes the Empire State manufacturing Index and a speech from Fed vice chair Richard Clarida.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.