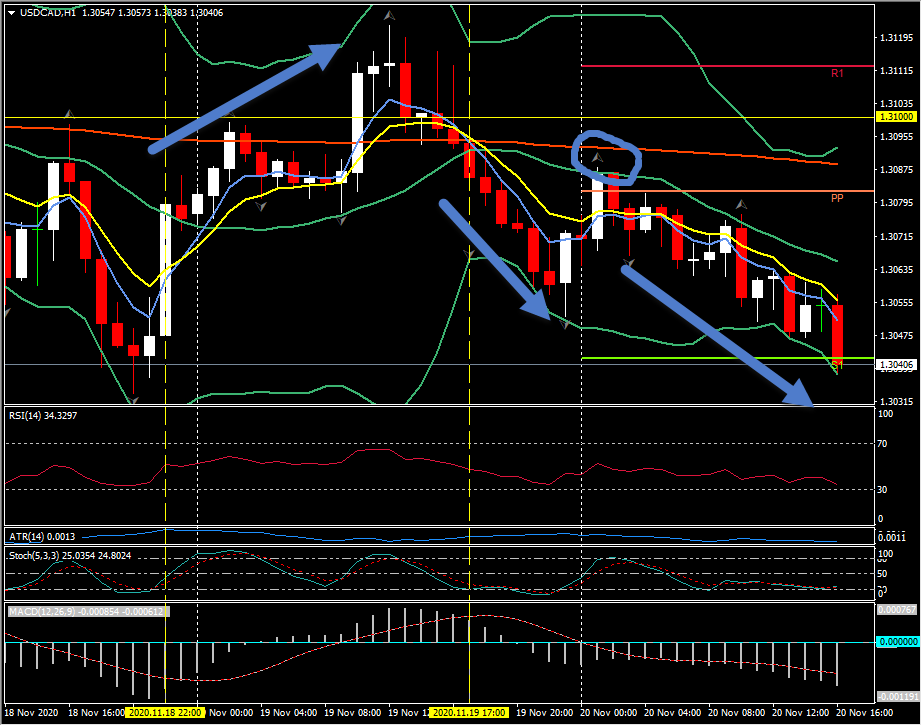

Canada’s retail sales jumped 1.1% in September while the ex-autos sales aggregate grew 1.0%. Both measures easily beat expectations for modest gains, and marked the fifth consecutive monthly increase since the record declines in April that came as the economy was shut down. Core sales, which exclude gasoline stations and motor vehicle and parts dealers, climbed 1.1% in September after the 0.4% gain in August, led by a 1.8% pop in general merchandise store sales that was the first gain in three months. Motor vehicle and parts dealers grew 1.5% for a third straight monthly gain to leave sales 1.7% above February levels. Moreover, new motor vehicle sales in September were 36.9% above the pre-pandemic level seen in February. Consumption retained solid post-shutdown momentum through September but looks to have eased a bit in October, with Statistics Canada projecting “relatively unchanged sales in October.” Retail sales have seen a higher path since the economy reopened following the April shutdown, with solid activity in Q3 supportive of our expectation for a 48.0% rebound in Q3 GDP following the -38.7% plunge in Q2 and -8.2% drop in Q1. The outlook for Q4 GDP is complicated by the virus surge and related restrictions, but expectations are for a slowing to a 2.5% growth rate.

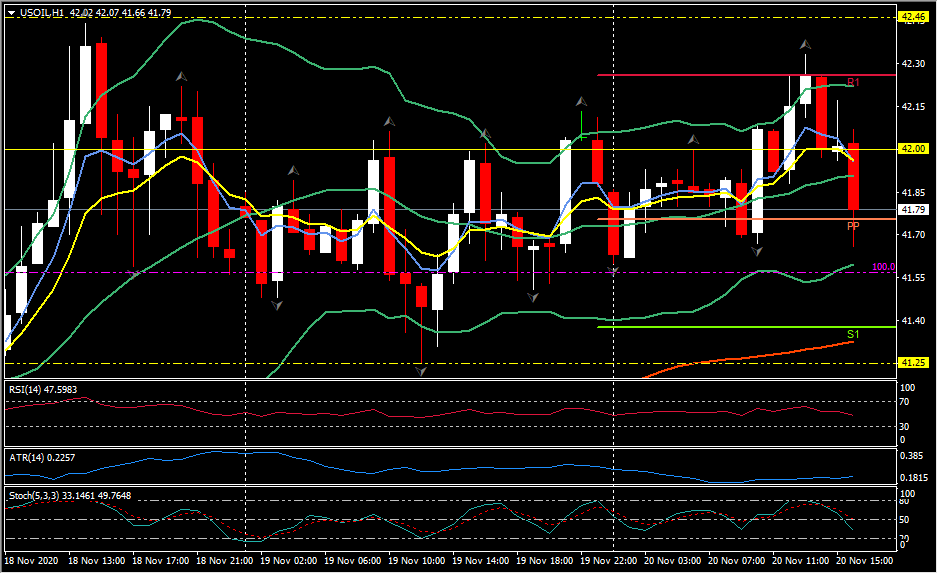

USOIL hit $42.35 highs in London morning trade, up from Asian lows of $41.68, only to return under $41.80 at the US open. Dollar weakness, along with prospects for OPEC+ to extend their current product caps by up to six months starting in January have been supportive factors this week, though countering to a degree have been the surge in Covid-19 cases and accompanying lockdowns, which continue to cap demand. Libya has returned its production to pre-blockade levels of over 1.2 mln bpd, further complicating OPEC’s plan to balance the oil market in 20201. Libya is exempt from production limits until its output reaches 1.7 mln bpd. Wednesday’s $42.46 high is the next upside target, with support at Thursday’s $41.25 low.

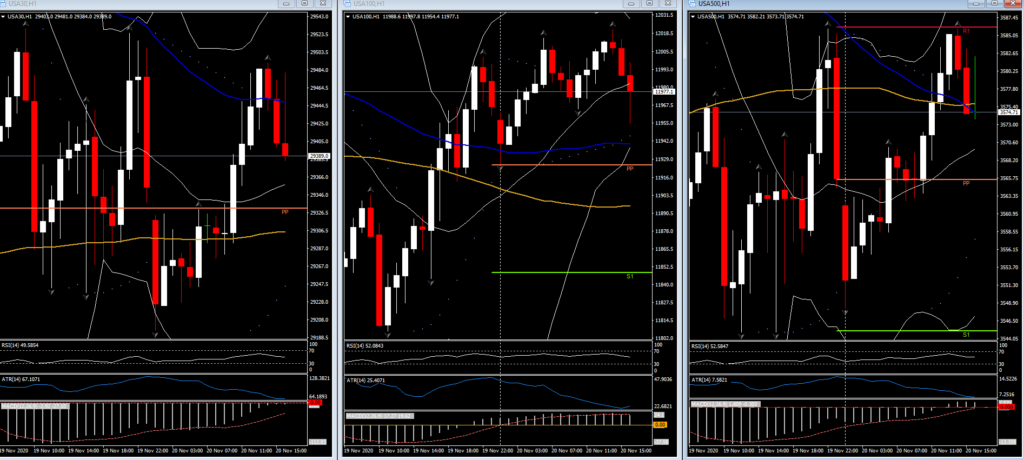

US equity markets have opened mildly lower amid cautious trading conditions ahead of the weekend and the Thanksgiving holiday next week. The market continues to evaluate the acceleration in virus cases and return of restrictions, weighing those negative developments against ongoing good news on the vaccine front. Notably, Pfizer filed with the FDA for emergency use of its vaccine. Meanwhile, there are tensions between the Fed and Trump administration — Treasury Secretary Mnuchin said he’d let some of the emergency programs expire at the end of the year. But the Fed shot back, announcing the programs would continue. The spat has added to the short term negatives (rising virus cases and return of restrictions are at the top of the list) with which the market must grapple. As such, the USA30 is down -0.3%, the USA500 is also off -0.3% and the USA100 has tip-toed back into the red with a -0.02% slip.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.