The second wave of Covid infections globally has caused increasingly stringent lockdowns, which in turn have led to a resurgence of uncertainties over the near term growth outlook and are overshadowing the positive vaccine developments that offer a more optimistic view for the medium term. Granted, moderation in activity was widely expected after the Q3 surge as economies reopened following the pandemic shut-downs. But while the new restrictions are less onerous, winter conditions will exacerbate the negative effects and will add to worries over a dreaded double dip recession.

Concurrently, US growth is seen at risk given the lack of additional fiscal stimulus with many of the relief measures expiring at the end of the year. Hence, attention will be split between the virus and the lockdowns, and the cornucopia of data that will reflect more of the Q4 economy. Producer sentiment, for instance, is poised for a November pull-back to still elevated levels, with headwinds from rising Covid-19 fears and emerging lockdown disruptions. Upward pressure on production remains in place due to lean inventories and continued strong sales, despite new restrictions on travel and restaurant activity.

The Equity markets meanwhile are in positive territory to begin this holiday truncated week. An announcement from AstraZeneca that its vaccine is 90% effective in trials puts a third treatment for the virus in the works, supportive of an upbeat medium term outlook for the economy. Additionally, there were signs of progress on Brexit, which also provided some support for equities. The USA100 is 0.4% higher in pre-market trading, the USA500 is up 0.6% and the USA30 has risen 0.7%. European bourses are cautiously higher, with the GER30 0.6% in the green but UK100 flat. Japan’s stock market is closed for a holiday.

Commodities however are a bit mixed, with energies and the majority of metals (copper, platinum, palladium) on bid at levels last seen in September as the Covid vaccine front provided support, along with expectations that OPEC+ will extend oil production cuts for an additional 3 months starting in January. Gold and Silver however are excluded as precious metals demand is under pressure this year, while the rise in risk appetite is weighing on precious metals and bonds as well.

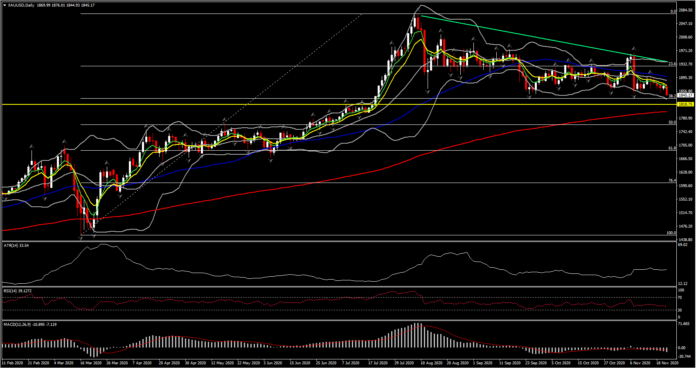

Technically, long term Gold bulls still hold the control as the asset remains well above the March panic and the key Support at $1,800. It has been choppy the past 3 weeks within the $1,850-$1,970 area, forming a descending triangle, after retreating from record highs and the 50-DMA.

However there is an unclear outlook as the asset holds within the triangle presenting a neutral outlook, with momentum complying with this scenario as well, as daily MACD and RSI are close to neutral, promoting consolidation in the yellow metal. The short term outlook reflects an increasing bearish pressure, however as long as the floor at 1,835 – 1,840 (38.2% Fib and double daily fractal) remains untouchable, the pullback could be limited. A breakout of this area could open the doors to July’s peak (1,818), 200-DMA (1,800) and even the 50% Fib retracement (1,760) set from the 2020 bottom.

To the upside, key resistance could be the upper line of the descending triangle which coincides with 23.6% Fib. level, at 1,932, along with the latest peak at 1,970. Traditionally , gold is appreciated in December and January. As you can see below, historically, Gold and in general precious metals tend to surge during the first couple months of the year, as it is in a rally the last month of the year (December) but depreciates at the beginning of the new year before another surge.

Hence bulls’ next upside price objective could be to produce a strong close in December futures but only if they manage to overcome the key resistance at the November high of $1,966.10.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.