The NZDUSD currency pair is classically a risk sentiment related instrument. NZD tends to rally when risk sentiment is positive and vice versa; a decline in risk sentiment is positively correlated with the New Zealand Dollar. The US Dollar is still seen as a safe haven, although this has weakened this year as US interest rates have been trimmed, with the Federal Reserve’s short-term interest rate target now in the lower boundary of zero (0.00 to + 0.25%).

As the NZD exchange rate is an important commodity currency for New Zealand for its export purposes, there is a possibility that the market views the potential combination of natural balancing through trade and the potential for RBNZ intervention to soften the currency, especially when the NZD is strong internationally, as a viable way to increase competitiveness.

Due to the increased risk sentiment the USD has fallen out of favor in recent months, while the NZD has recovered on the back of risk-taking activity and cautious optimism. But the COVID-19 crisis remains, and despite hopes for a new vaccine, the short to medium term is still fraught with uncertainty.

In terms of inflation and interest rate dynamics, the US Federal Reserve has cut interest rates from 1.50-1.75% to 0.00-0.25%, as previously mentioned. This represents a cut of 150 basis points. The RBNZ has cut its comparative rate from 1.00% to 0.25%. Meanwhile, US inflation has fallen from 2.3% y/y in December 2019 to 1.4% in Q3 2020 (also reported slightly lower inflation in October, at 1.2%). New Zealand’s inflation also fell. Reported on a quarterly rather than monthly basis, New Zealand’s inflation has fallen from +190 basis points (or 1.9%) in Q4 2019 to +140 basis points (or 1.4%) in Q3 2020.

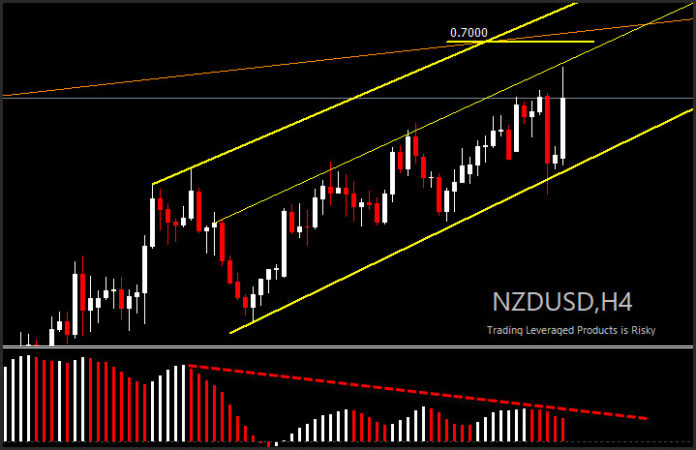

Meanwhile, this morning the NZDUSD pair moved higher, driven by New Zealand’s year-end 2020 Budget deficit of NZ $23.06 billion v NZ $17.82 billion seen in May, but mainly driven by the Government’s calls for help.

The New Zealand Finance Minister Grant Robertson urged the RBNZ to include housing price stability as part of its broad monetary policy. Speculation was sparked that the central bank will refrain from launching a massive stimulus round, including negative interest rates., boosting the NZD. The government has conceded that soaring house prices are increasing inequality and poverty. On this headline, NZDUSD spiked just a breath below the psychological level of 0.7000, while it remains below it so far today.

In a report to RBNZ Governor Adrian Orr, Robertson said he was concerned about the recent rapid rise in house prices and that this forecast would continue, as it could pose a financial stability risk to the economy, especially when monetary policy returns to a more normal setting.

As policymakers grapple with soaring house prices and the risk of a property bubble, Robertson said the government was reviewing housing policies, and had written to the Reserve Bank of New Zealand (RBNZ) asking what it could do to help slow a property boom. He proposed taking house prices into account while formulating monetary policy, along with the bank’s existing mandate of inflation and maximum employment.

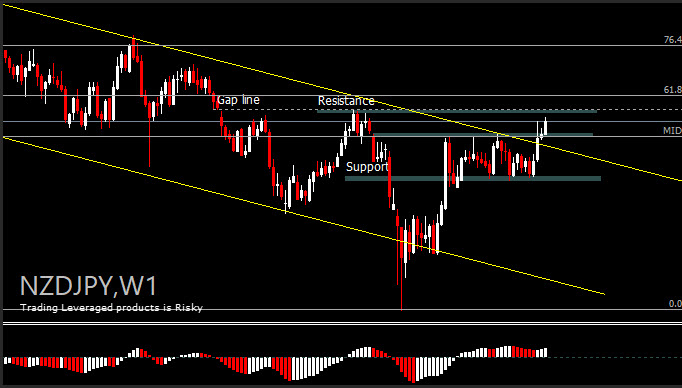

Other than NZDUSD, NZDJPY is also chasing its key Resistance area. The asset lags somewhat from a medium-term point of view. However, if it continues to advance from 59.51, a decisive break of the resistance at 73.53 could suggest further bullish implications. NZDJPY could then retest the 61.8% Fib. retracement of the 83.17 to 59.51 drawdown at 74.56 in the medium term.

Click here to access the Economic Calendar

Ady Phangestu

Regional Market Analyst – Indonesian

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.