FX News Today

- Geopolitical uncertainty back again! – Reports that China hasn’t really complied with the phase one trade deal and concerns over how US-China relations will develop under a new administration in Washington

- JPN225 up 0.9%, USA30 and USA500 lower on profit taking, sliding -0.58% and -0.16%, respectively,

- Defensive stocks rise – USA100 rallied 0.48% to a fresh new peak at 12,210.

- Treasuries were generally firmer as risk appetite faded.

- European stock markets are mostly lower in quiet trade,with the UK100 underperforming and down -0.5%, the GER30 down -0.06%.

- Lingering risk aversion, also fueled by Brexit headlines highlighting the lack of progress in talks weighed while the holiday in the US means lower volumes.

- Both EU and UK officials have stressed that they would prefer a deal but not at any price, so the game of chicken continues. The EU is unlikely to ever walk away from negotiations, but developments highlight that we are quickly getting to the point where an “accidental” no-deal scenario is possible, if neither side blinks and judging by track record of the whole Brexit process so far, that is unlikely to be the EU – at least on fundamental issues like the integrity of the single market, which means levels playing field rules and the governance of a deal will be central to Barnier’s mandate.

- FED: no indication of a change as soon as the December 15-16 FOMC – “immediate adjustments to the pace and composition…were not necessary”

- German GfK consumer confidence dropped back to -6.7 in December from -3.2 in November. That is a sharper than expected decline and indeed the lowest reading since July, highlighting the impact of the latest Covid-19 restrictions, which led to the closure of restaurants and bars.

- Germany has been more successful at keeping infection and mortality rates low than other European countries, but ironically that is playing into the hand of those protesting and ignoring measures that are nowhere near as stringent as elsewhere in Europe. The latest measures seemed to have helped to flatten the curve once again, but the numbers from yesterday and today have highlighted that it is too early to loosen restrictions.

Along with ongoing crosscurrents regarding record increases in virus cases and more stringent lockdowns, against increasingly promising vaccine news, the mass of US data showed weakness in jobless claims but strength in durable orders and home sales. – The dollar has remained soft. Although risk appetite has waned in global markets, it hasn’t been sufficient to warrant safe haven positioning, which would have put the U.S. currency in demand.

Today – ECB Lane and Schnabel speech, ECB Minutes and Tokyo Inflation

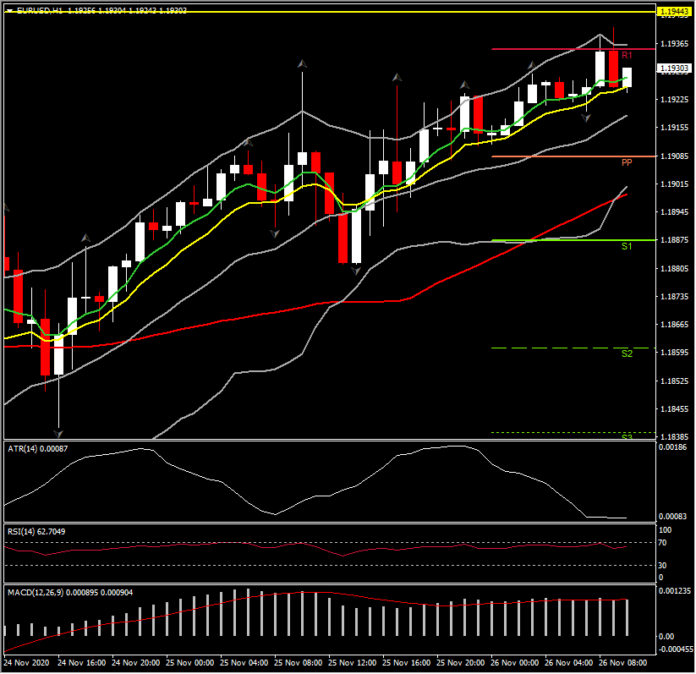

Biggest (FX) Mover – EUR the biggest gainer with EURUSD at +0.22% as of 10:00– It sustains month’s gains but remains off Augusts highs. It retested its R1 earlier but the flatted fast MAs and the shrinking BB suggest consolidation or even a near term pullback. MACD and RSI also flattened .H1 ATR 0.00085 Daily ATR 0.00625

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.