Month-end trading saw Wall Street tip lower on profit taking but following record highs last week. Treasuries were little changed. Chips were taken off the table as November came to a close after a stellar month for stocks that saw double digit gains and fresh record highs last week. November had a record rally for the USA500 and Russell 2000, and the best performance for the USA30 since 1928. The USA100 evidenced its best November since 2001.

- Strong start for equities to the month in Asia – JPN225 up 1.3%.

- Markit/Caixin Manufacturing PMI for China hit a decade high.

- Japan’s reading was the highest since August last year, which boosted recovery hopes.

- Confidence that vaccination programs will help to get the world economy back on track helped to bolster risk appetite and the US 10-year yield lifted 0.3 bp to 0.84%. Moderna completed its COVID-19 immunization Phase 3 trial, confirming around 94% efficacy.

- RBA vowed to do more if needed while stressing that the recovery will need substantial monetary and fiscal support to boost employment and lift wages and inflation in the long term.

- GER30 and UK100 are posting gains of 0.4% and 0.1%.

- NO sign of an agreement on the Brexit front and the ECB remains on course to deliver additional stimulus next week.

- The US Dollar and Yen retreated amid risk appetite.

USD set to post its worst month since July.

- EUR and GBP rising against a largely weaker USD

- EUR – up at 1.1964, above PP with next Resistance at 1.1980

- GBP – spiked to 1.3392, retesting 3-month peak again.

- JPY – slightly lower after yesterday’s peak at 104.45

- CAD – resuming a fall from 1.300, next Support at 1.2945 and 1.2922

- AUD – comfortably above 0.7300. Currently above PP at 0.7365 with R1 at 0.7385

- USOIL – steady at the $44-$45 area as OPEC+ continues to debate an extension of output cuts, without an agreement so far. Will now meet again on Thursday

- GOLD – resuming some gains at $1770 – Currently at $1788 area

- BITCOIN – new high at 19,855

Today – Today’s Eurozone HICP reading for November could surprise on the downside after weaker German numbers yesterday, which would only add to the arguments of the dovish camp in Frankfurt. Final manufacturing PMI readings for the Eurozone and the UK meanwhile are likely to confirm that the manufacturing sector at least continues to benefit from the ongoing recovery in major export markets such as China. The US ISM manufacturing index is expected to ease. Chair Powell will testify on the CARES Act on Capitol Hill, to the Senate Banking Committee.

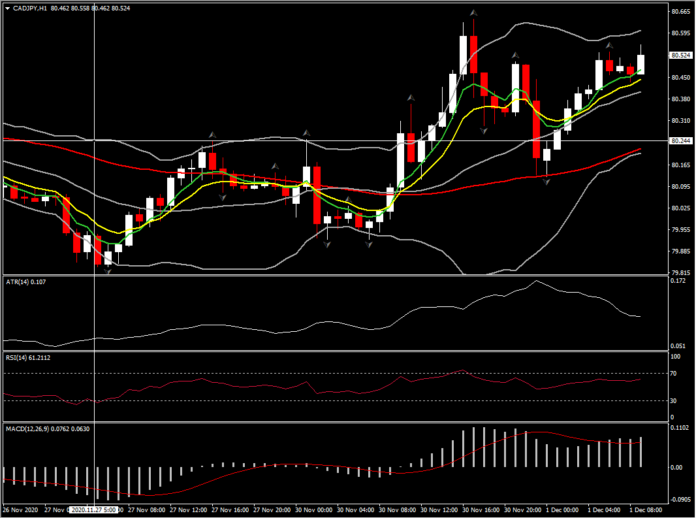

Biggest (FX) Mover – CADJPY up at 0.45% – The asset extended its rally to 80.35 with intraday momentum indicators pointing further northwards. The fast MAs resumed the incline with RSI at 61 and MACD posted a bullish cross. However the asset remains below November’s peak at 81.45. H1 ATR 0.107, Daily ATR 0.538.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.