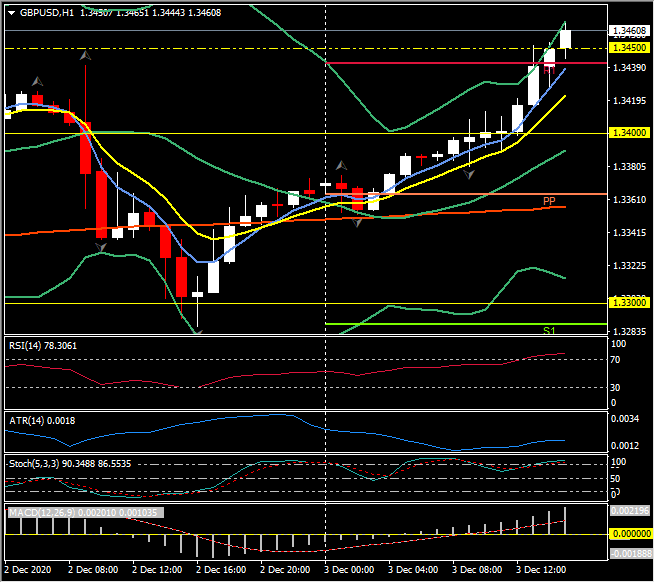

GBPUSD, H1

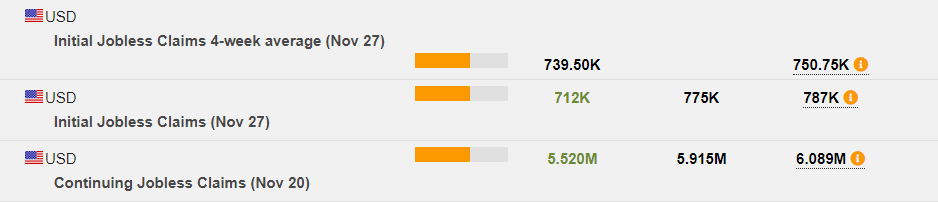

US initial jobless claims dropped -75,000 to 712,000 in the week ended November 28, much larger than expected, after rising 39,000 to 787,000 (was 778,000) in the November 21 week. This week’s figure broke a string of two consecutive weekly increases in claims. The 4-week moving average fell to 739,500 from 750,750 (was 748,500). Initial claims not seasonally adjusted declined another -122,500 to 713,800 following the 86,900k increase to 836,300 (was 827,700). Continuing claims plunged -569,000 to 5.520 million in the November 21 week versus the -281,000 prior dive to 6.089 million (was 6,071 million). The insured unemployment rate slid to 3.8% from 4.2% (was 4.1%).

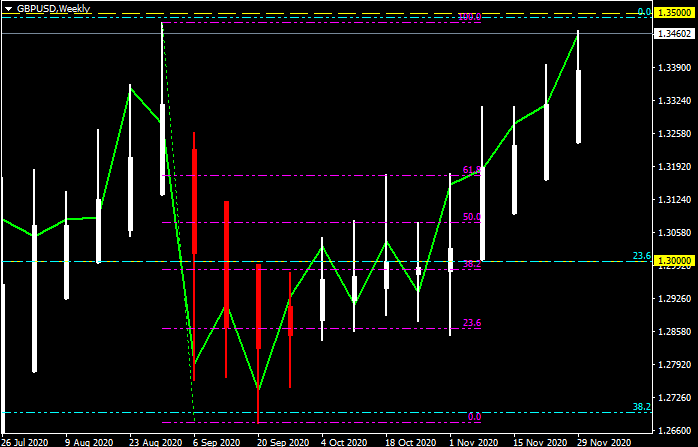

The Dollar edged slightly higher following the jobless claims data, which saw initial and continuing claims fall more than expected. USDJPY moved from 104.02 to 104.08, as EURUSD dipped to 1.2144 from 1.2157. Cable remains on track as the biggest mover today up 0.75% at 1.3458 as the market prices in a UK-EU trade deal as 1.3500 comes very much into focus.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.