A reflation trade is finding a foothold, joining vaccine inspired risk-on flows to drive sovereign yields higher. Treasuries have led the charge with the 1.75% 30-year yield the highest since March. The selloff was exacerbated Friday by the tepid increase in payrolls that boosted expectations for fiscal relief. Solid gains in average hourly earnings and the dip in the unemployment rate weighed too, especially as the FOMC will allow inflation to run hot. Meanwhile, the equity rally continues with Wall Street at new highs as promising vaccines developments overshadow rising virus cases and more stringent lockdowns.

Amid that background, attention will be on the ECB. But those looking for another easing bonanza are likely to be disappointed. Brexit is also a focus. There’s also a busy data slate in Asia where Chinese reports should further confirm the recovery is broadening.

The US calendar will play second fiddle with just CPI and Treasury supply of much interest. At the meantime US stimulus deal hopefully on track for action near term. Negotiations continue on the bipartisan $908 bln deal and Bloomberg reports details could be forthcoming today. There’s talk of $300 bln for small businesses, $180 bln for unemployed workers, and $160 bln for state and local governments. A couple of major sticking points are cash to individuals with another $1,200 checks supposedly not on the agenda, which the Democrats want, while the Republicans balk at the aid to states. The GOP is also arguing for a liability measure. There are plans to attach a relief bill to a stop-gap spending bill, which is needed by Friday to keep the government running.

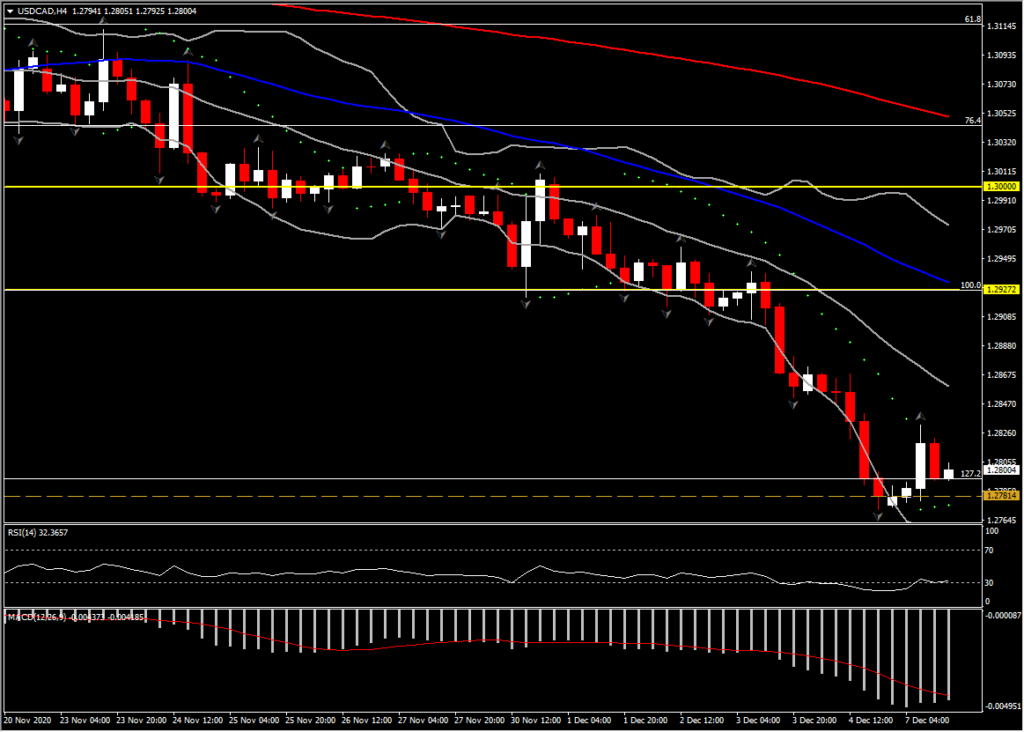

In Canada, the Bank of Canada’s announcement (Wednesday) is the focus this week. However, it expected to be an as-expected affair, with no change in the 0.25% rate setting alongside a reiteration of their commitment to hold rates at 0.25% into 2023, which is when “economic slack is absorbed so that the 2% inflation target is sustainably achieved.”

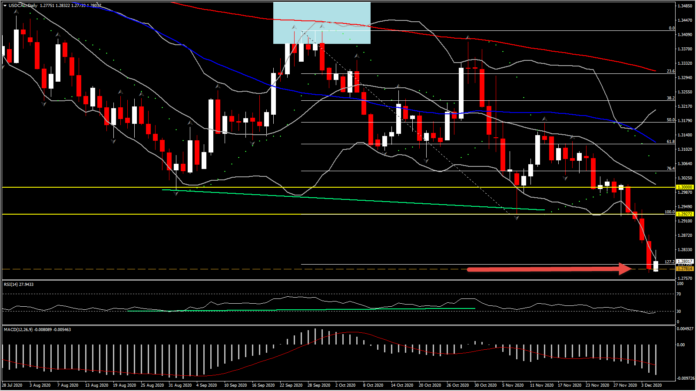

USDCAD has found a footing, and may be in for a relatively sustained rebound after posting a 26-month low at 1.2770 on Friday. It bounced to 1.2833 highs as Oil prices were pushed lower by a Brexit related wave of risk-off. Crude prices have since moved off their lows, allowing USDCAD to dip back below the 1.2800 mark. The Greenback revealed a slightly higher bias overall, though has again come under pressure since Asia trade. Oil prices and overall USD direction will continue to drive USDCAD.

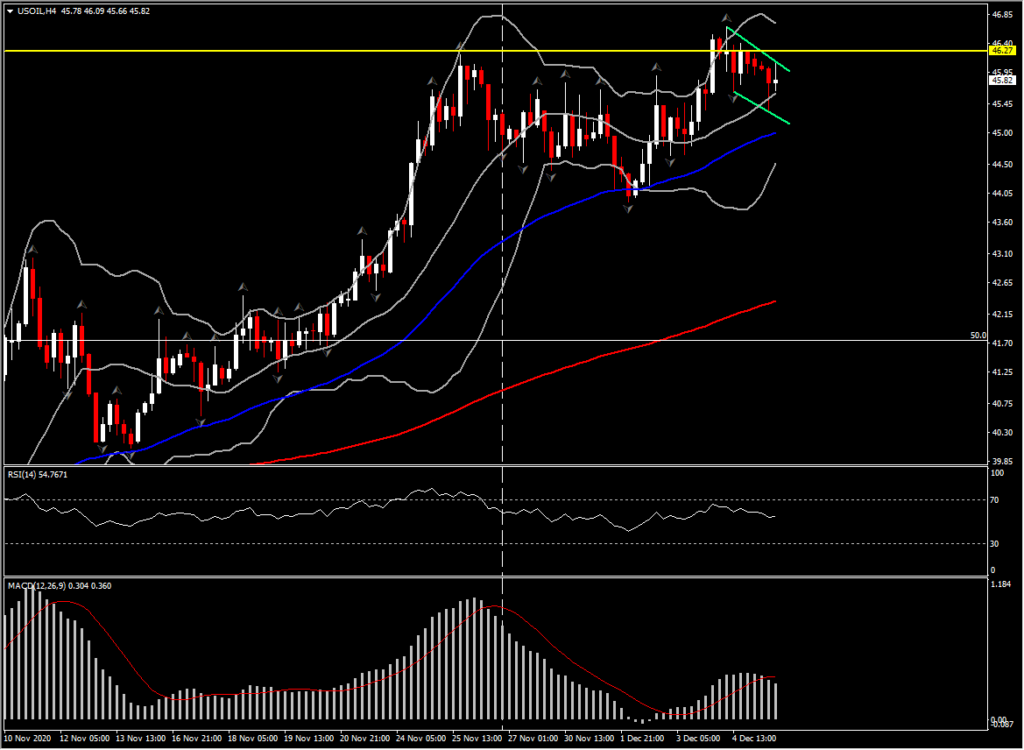

USOIL opened the Asian session at $46.25 highs, then traded in a narrow band into the London open. From there, reports that the EU-UK trade talks may be in trouble again, saw the backdrop shift to risk-off, which resulted in crude prices tumbling to $45.36 lows. Prices have since recovered slightly.

Oil prices have softened after reaching a nine-month peak on Friday, and there may be more to go in this theme. While the bigger picture prospects remain bullish for oil and oil-correlating currencies, such as the Canadian dollar, the nearer term looks more challenging. Oil supply is on the up, with Libyan supply going back to pre-blockade levels, Norway having announced a rise in output, and the OPEC+ group having announced a 500k barrels per day increase from January. There are also signs that OPEC dissent is increasing, as highlighted by a Chatham House last week, with multiple participants in the output quotas unwilling to comply any longer. There is also expectations that US president-elect Biden will reduce will lift sanctions on Tehran, which would see Iranian output increase. All this comes amid increasing Covid-related restrictions across North America, and with Europe is maintaining restrictions. While Covid vaccination programs have started in Russia and will start in the UK this week, and in the US as soon as next week, these won’t have much impact in alleviating restrictions over the northern hemisphere winter.

Nevertheless, even though OPEC’s decision to increase production modestly in January disappointed markets, prospects for Covid vaccines, and for a US fiscal stimulus package have limited crude’s downside potential. Friday’s 9-month high of $46.68 is a key upside Resistance.

The scene looks to be set for a near-term correction in oil prices, which would see USDCAD’s directional bias shift from the downside to the upside for a period.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.