Qualcomm is an American company that develops and licenses wireless technology and also designs chips for smartphones. Its key patents revolve around CDMA and OFDMA technologies, which are standards in wireless communications and the backbone of all technologies such as 3G and 4G networks; it is also the world’s largest wireless chip provider supplying state-of-the-art processors to many top-tier phone manufacturers and poised to be a leader in 5G networking technology.

Qualcomm has positioned itself as an investment opportunity in recent days, due to the fact that it obtained a Price to Earnings Ratio (P/E)above its average ratio recorded 32.50 times in terms of its current P/E, and in addition, the beta value of 36-month is at 1.34. On the other hand, the company’s shares have risen 0.78% so far this week, with a monthly jump of 16.40% and a quarterly return of 23.57% while its annual rate of return touched 15%, when the volatility index for the week stands at 2.77%.

Similarly, the dividend payment in effect is expected at $0.65 per share on December 17 of the current year, while the last sale of Qualcomm on the previous trading day was $147.17, representing a decrease of -4.20% from the 52-week high of $143.33 and an increase of 153.74% over the 52-week low of $58.

During the period of the last 52 weeks, Qualcomm failed to recover from a stumble in the market, which made it settle for a –4.02% loss for the given period, maintaining volatility at 2.96%. However, during the last 50 days the stock is currently trading +32.96% higher since, during the last trading sessions, Qualcomm increased by +0.78% from the modification of the moving average for the 200-day period by +64.25% compared to the 20-day moving average that was settled at $142.53.

The reason Qualcomm shares rose 2.9% to $151.49 was the announcement of a new flagship chip for smartphones called Snapdragon 888, which will feature improved gaming and photography capabilities. The 5G chip will be manufactured by the manufacturing division chipset from Samsung Electronics and represents the top of Qualcomm’s line of mobile phone processors, a new generation of phones expected in the first quarter of 2021.

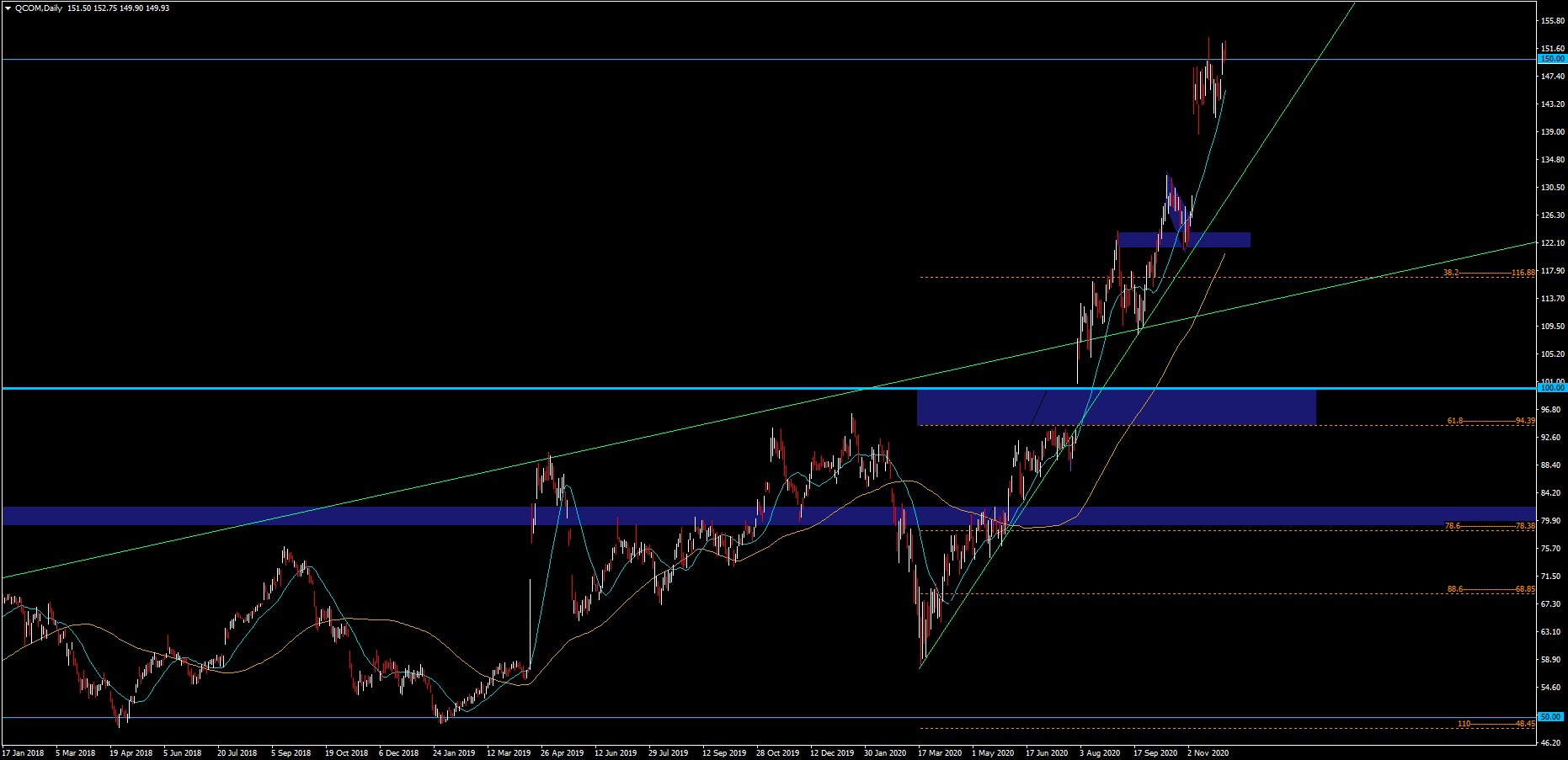

Qualcomm has been on a bullish rally since March this year, staying above the daily moving averages of the 100 and 21 periods since March and since April, the price has surpassed its psychological level of 100.

We have supports in the 21-period moving average 147.17 and in the 100-period 132.10, while during its bullish period, the range was marked by prices between the Fibonacci 61.8% and its psychological level of 100 (94.39-100).

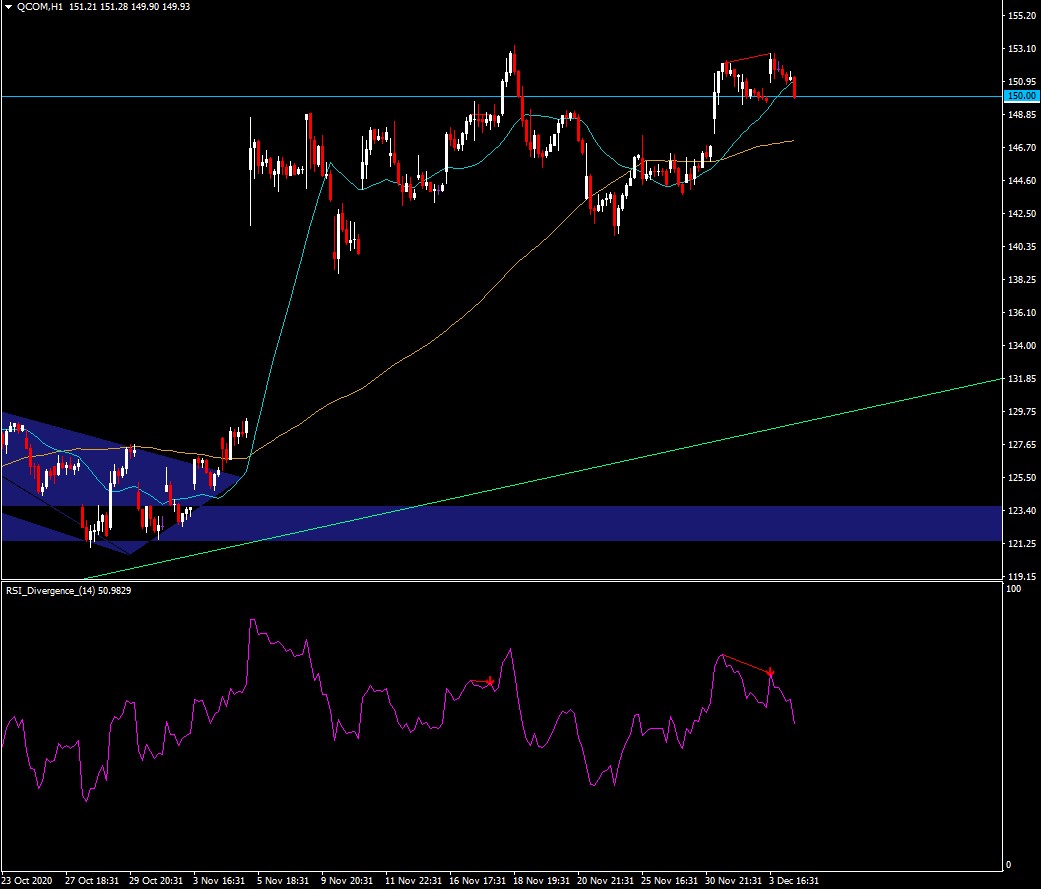

Price is currently at 149.93. It has left the historical November 15 maximum at 153.29 and evolved with a third false break of the 150 resistance without managing to stay above it, creating a bearish divergence in the 1-hour RSI .

Click here to access the Economic Calendar

Aldo Weidner Zapien, Market Analyst – HF Office of Education – Mexico

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.