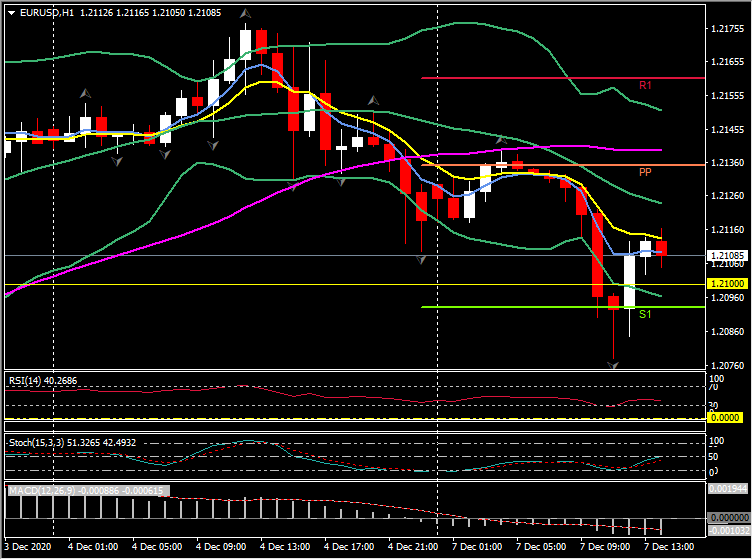

EURUSD posted a correction low at 1.2078 before finding a footing and recovering 1.2100. The low marked a near 1 big figure pullback from Friday’s 32-month peak at 1.2177. A near 1.5% tumble in Cable exerted a drag on EURUSD, especially with the Euro itself not being immune from no-deal Brexit risk. Recent gains in EURUSD have mostly been reflective of broader Dollar weakness, with the imbalance in richly valued US equities versus lower valued European and emerging market equities having rendered the Dollar apt to underperformance amid a backdrop of rising optimism about longer-term global economic prospects. More of the same is expected over the coming months, though the pair may be ripe for a pause in its up trend. The ECB will announce its latest “policy recalibration” this Thursday, which is almost certain to involve a strengthening of the PEPP and TLTRO programs along with a more symmetric inflation target, although anyone hoping for another easing bonanza are likely to be disappointed.

In the US, November inflation data this week will interest given that the relatively high inflation differential versus the eurozone and other major economies has been a negative for the Dollar, given the resulting loosening impact on real interest rates in the US, particularly with the Fed’s new average inflation policy strategy allowing inflation to run hot. Expectations are for a slight slowing to a 1.1% y/y clip for the headline CPI, versus the 1.2% y/y prior pace. Core prices should remain steady at a 1.6% y/y growth rate. These are hardly hot numbers, but y/y base effects in energy prices and a recovery in economic activity (assuming a successful Covid vaccination program, release of pent up consumer demand, stimulus etc) should mean higher inflation ahead, resulting in greater loosening in real interest rates.

European stock markets are broadly lower, with the UK100 a notable exception, although a lower Pound will likely have played a role and not all UK indices are up on the day. The lack of progress in Brexit talks is adding to the cautious backdrop this morning and saw the German GER30 overlooking much stronger than expected production numbers at the start of the session and falling -0.4%. US futures are also down, with the USA100 future outperforming slightly as defensive tech stock is back in fashion. Wider markets continue to wait for a US stimulus deal, while trying to weigh the prospect of a recovery next year against the short term prospect of a difficult winter in Europe and the US. China data meanwhile continued to confirm that the recovery continues with very strong export growth fuelling a record trade surplus. Signs of fresh US-China tensions, however, added to a cautious backdrop overnight and the Nikkei closed with a loss of -0.8%, the Hang Seng dropped -1.2 and the CSI -0.9%, while the ASX outperformed with a gain of 0.6%.

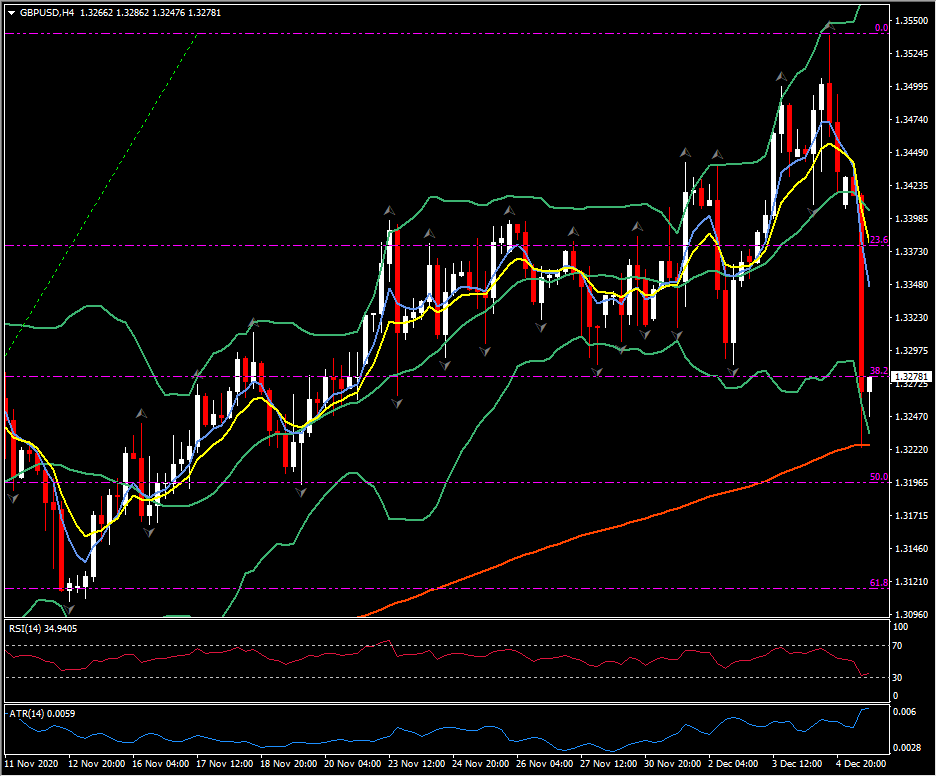

Technically, with today’s movement the GBPUSD bias has turned neutral and some consolidation could be seen. A break of the psychological level 1.3500 or resistance 1.3538 could target the fib projection of 1.3956. However, it will be temporarily delayed after today’s news. On the downside, a break of 1.3195 and the 50.0% fib will indicate a short term top and turn bias to the downside at 1.3115 and the 61.8% fib level from November 12/13.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.