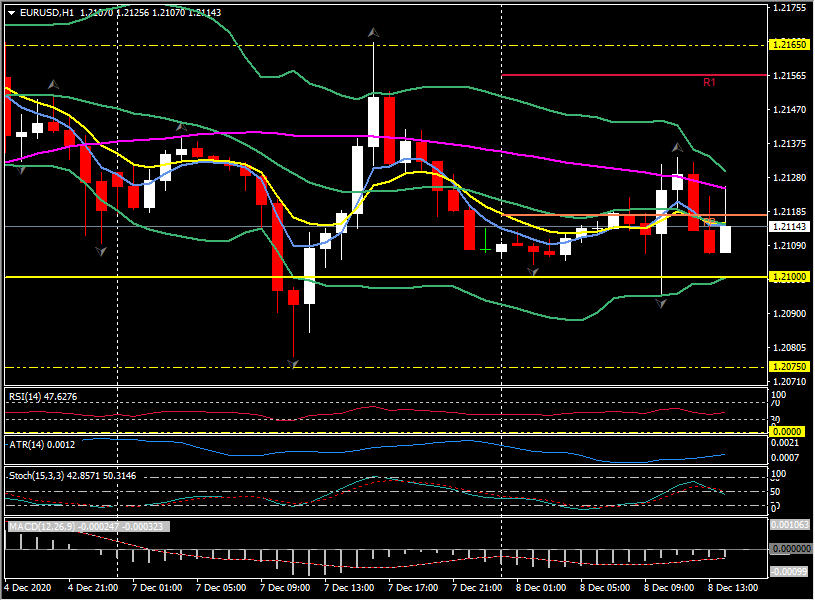

EURUSD, H1

Eurozone Q3 GDP was revised marginally lower – to a still very strong 12.5% q/q from 12.6% q/q in the previous quarter. Despite that the annual rate was actually revised slightly higher – to -4.3% from -4.4%.

The breakdown, which was available for the first time, confirmed that both household consumption and investment rebounded over the summer as lockdowns were lifted. Employment rose 1.0% q/q, but remained down -2.3% y/y, despite the fact that wide spread government support measures have helped to prevent an even larger wave of job cuts. Nothing unexpected there and largely a confirmation of what had been evident from other data. With subsequent virus developments leading to renewed lockdowns across most Eurozone countries, the chances that GDP will contract once again in Q4 are pretty high, even if ongoing support in the manufacturing sector is helping to keep things afloat.

German ZEW investor confidence jumped to 55.0 from 39.0, more than anticipated, although with stock markets rallying in November on the back of vaccine developments an upside surprise was always a possibility. The current conditions indicator actually came in worse than expected at -66.5, which highlights that despite the prospect that vaccination programs will help to facilitate a strong recovery next year, the short term outlook remains pretty negative as the services sector remains severely restricted.

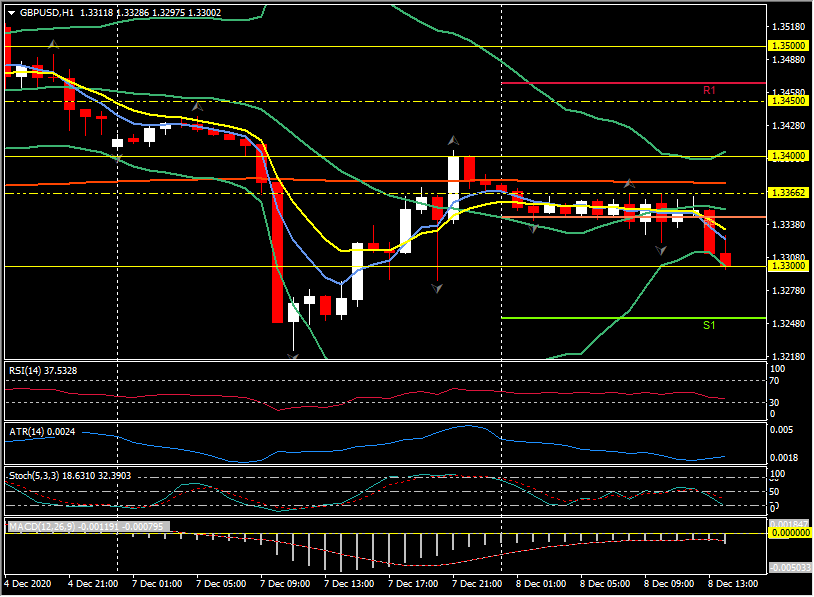

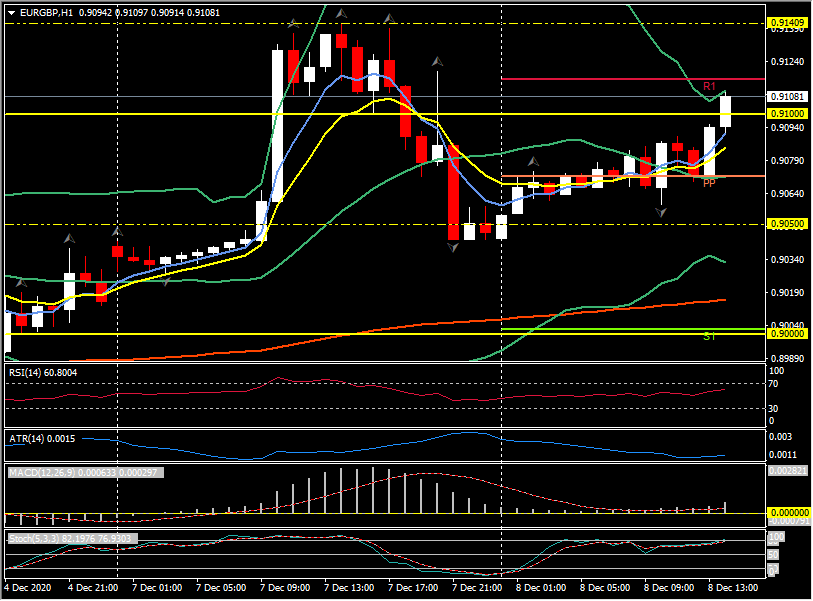

Sterling has traded softer on Brexit anxiety, as negotiations go down to the absolute wire, but declines have been far from dramatic, with the currency remaining above lows seen yesterday against the Dollar, Euro and other currencies. UK PM Johnson offered a concession to the EU, to remove the offending elements of the controversial internal markets bill, which was likely his intention all along. Johnson will be in Brussels “in the coming days” for face-to-face meetings. Both he and a government spokesperson yesterday touted his call with EU’s von der Leyen late yesterday as make or break. If not a ‘make’, it clearly wasn’t a ‘break’. France minister for foreign affairs Beaune said early that there is still room for a deal, while mentioning the complexities involved. There is a sense that the negotiating teams have gone as far as they can, and it’s now, finally, down to the heads of state to bring matters to a close.

Expectations are for a deal, (6 banks Reuters polled yesterday had the odds averaging at 65%) though the risks of no-deal seem palpable, with France maintaining a more hawkish stance on fishing than many anticipated. There have been reports that fishing is a sideshow, however, being used by the EU to pressure the UK. State aid, and more particularly the issues of governance and an associated appeal process, are the fundamental issues, with the UK seeing the EU’s demands as undermining its sovereignty. There are strong win-win incentives for both sides to reach an accord, even if only a narrowly based one. Johnson will need to have enough to sell it to the powerful Brexit ideologue faction in his party, as his position as leader will weaken further if not. As for the deadline, EU chief negotiator mooted yesterday that Wednesday (tomorrow) is the “hard” deadline. We shall see. The EU Summit looms on Thursday/Friday and the Johnson/Van der Leyen face-to-face in a room in Brussels is still subject to confirmation. Rule nothing out on this one. The transition phase ends in 23 days – December 31.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.