US equity markets have opened weaker, as doubts over the outlook continue to fester. Specifically, rising virus cases in the US and the resultant increase in shutdowns, the lack of stimulus, and frustration over the seemingly endless Brexit talks has prompted some profit taking from record or near record highs. Adding to the angst was Pfizer’s announcement yesterday that it will not be able to supply the US with more doses than planned until about June. On the upside both the FDA and EUA find the Pfizer vaccine 95% effective, safe and highly effective across all demographic groups. An official announcement from the FDA is expected on Thursday with the EUA yet to schedule an announcement, though the news is very much “priced-in” and the risks associated with a successful roll-out and uptake of the vaccines remain.

The sentiment was also lifted with the UK and EU having agreed all issues on UK/NI protocol – in principle, it has been confirmed that the UK will withdraw controversial clauses from Internal Market Bill, and with the UK having backed down, logic seems to point therefore to compromise on the key trade deal, but still we await the Johnson/Van der Leyen meeting confirmation. Also the UK announced they had signed trade continuity deals with Norway and Iceland – not major trading partners but major fishing nations – back in the 1970s after getting involved in the Cod Wars with Iceland. Just a coincidence or a positive sign?

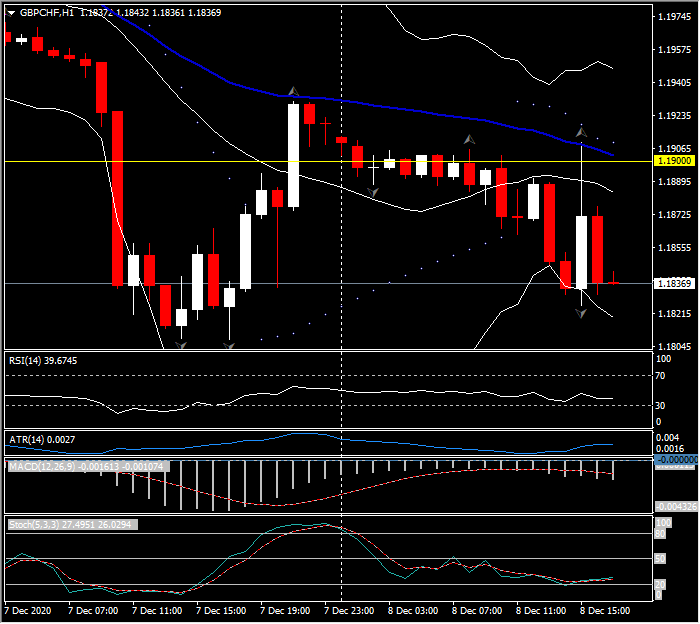

The USA30 is down -74 points or -0.25% at 29995.60, the USA500 is off -11.47 points or -0.32% at 3680.28 and the USA100 has declined -27.9 points or -0.23% at 12489. The biggest mover of the key FX pairs is GBPCHF, down -0.55% at 1.1837, on the continuing sterling stress. USDCHF touched a new 6-year low yesterday at 0.8875, today is little better, changing hands for 0.8880.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.