China consumer prices fell 0.5% over the year in November, after still rising 0.5% in the previous month. The number was much lower than anticipated and in fact the first decline since October 2009. Much of this was driven by improvements in pork supply, which recovered from the impact of the African swine fever in recent years. That drove pork prices lower, which means the unexpected drop in the headline number is not necessarily a sign of a drop in demand, which should leave the PBOC looking through the headline numbers.

The data sparked risk appetite again with Treasuries returning under pressure and the US 10-year rate up. However the Japanese machinery orders which rose at the fastest pace in more than a decade, along with the new proposal for a US stimulus package, have revived investor confidence since yesterday and helped in general to underpin sentiment. Hence as Treasury secretary Mnuchin presented a new USD 916 bln proposal for a relief package, Wall Street turned higher as risk appetite improved and has been sustaining highs since then. The MSCI Asia-Pacific (ex-Japan) index also hit a new record peak. JPN225 closed 1.3% higher, but remained just off its 29-year peak.

What dominated our attention, however, was the rise of base metals, with the likes of zinc, nickel and tin posting new one-year plus highs.

Copper and aluminium prices gained, even though they have remained off their recent trend highs so far today. Precious metals came under pressure with Gold and Silver drifting to the $1,850 and $24 area respectively, while the notoriously volatile Bitcoin is down, earlier retesting the $18,000 key barrier. Oil prices found a foothold after dropping over the last two days.

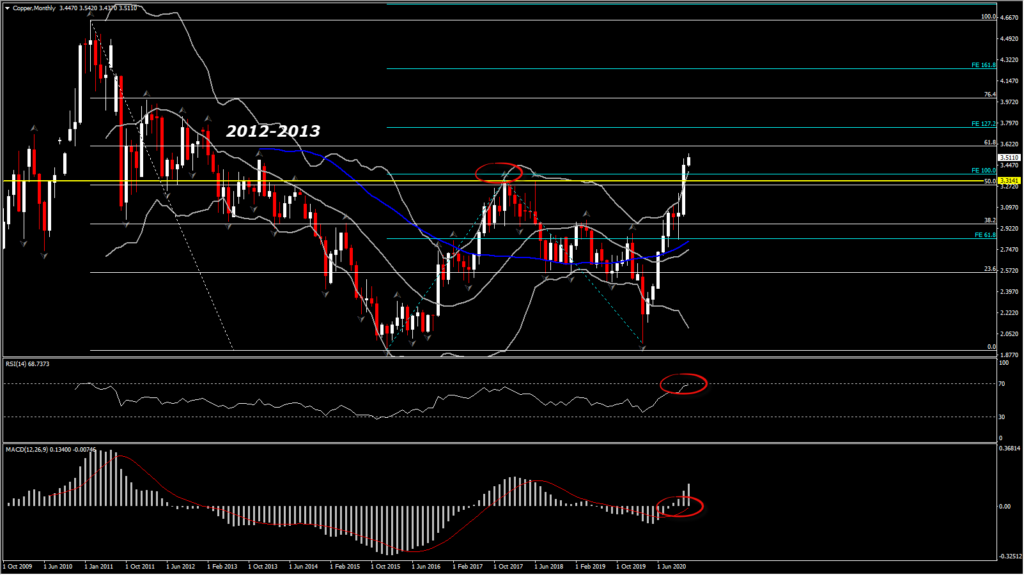

Copper has spiked to 7-year highs since last week, breaking the previous Resistance at 3.30 (in 2017), and turning to 3.50. The spike in Copper the past 8 days is considered significantly important at least from the technical perspective as it alerts the rejection of 50% Fib. retracement level from the downleg seen since 2011 (all record highs), but also the retest of the 61.8% level at 3.60.

Copper has appreciated this year, as it was one of the few assets that positively responded to the easing of restrictions imposed to contain the spread of coronavirus as well as to the announcement of the vaccination program. The asset is the world’s most important industrial metal but also a key economic health indicator, which was why it rebounded in April from 2.14 lows due to the positive headlines related to the pandemic (easing of Covid-19 during the summer). With vaccine related developments picking up pace since then, later on, on the confirmation of the vaccine and the actual start of the vaccination program copper prices have scaled multi-year highs.

The main reason for the above is the increasing demand. After the very first lockdown the demand for the particular metal grew since it is used in almost all construction projects and major appliances. The metal has risen 25% this year since the consumption of metal after easing of lockdowns boosted. The reopening of the Chinese economy, along with continuous signs of rapid recovery, lead to huge amounts of refined copper imports due to voracious commercial demand and government stockpiling. China meanwhile aims for more sway over copper prices after it launched new futures contract for copper, which would help increase its influence on pricing in a market that is critically important to its economy, and also assist efforts to expand the use of its Yuan in the global financial system.

Nevertheless, according to Citigroup, Copper was boosted by hopes for a wave of “green” economic stimulus as well. More precisely it was driven also by the US elections as two of the candidates’ agendas were indirectly correlated with the demand of Copper. Citigroup stated that:

If President Trump had won the US elections he had planned to spend more on roads, bridges, and airports and signalled very little interest in ‘green’ investments. Joe Biden, had in contrast, said that he will spend around $2 trillion over four years to improve infrastructure, create zero-emissions, public transport and create clean energy jobs. So, a Biden Presidency stands to encourage significant green tech spending. That was expected to be a boost for copper demand and has helped the metal move higher

Against that background, the appreciation of Copper could be good for the economy as the higher the price turns the more the incentive of new supply and balance the market will be in the next few years. Additionally, as the Financial Times stated, “for an increasing number of investors copper is emerging as one of the best ways to gain exposure to a rollout of more wind, solar, batteries and electric cars, owing to the metal’s use in electric wiring”. That said, Copper is already used for wind turbines, for connecting renewable sources of generation to the grid and hence for electric cars, which contain 3 times more Copper than the usual cars. Hence in the long term you should be aware that Copper demand is expected to reach 50% of global demand due to its use for renewable sources. Goldman Sachs International is anticipating a rise in copper prices to $10,000 a tonne by 2022.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.