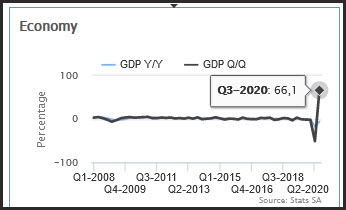

The South African economy grew by an annualized 66.1% in the third quarter of 2020, recovering from a record 51.7% decline in the April-June period and beating market expectations of 52.6%. It was the strongest pace of expansion since at least 1993, with manufacturing, trade and mining the biggest growth drivers after the easing of COVID-19 lockdown restrictions. Despite the rebound, the economy is still 5.8% smaller than at the end of 2019.

Manufacturing rose at an annual rate of 210.2%, driven largely by increased production of base metals, petroleum, vehicles, food and beverages. The trade, catering and accommodation industries increased by 137%; mining and quarrying increased at a rate of 288.3%. Spending on GDP increased at an annual rate of 67.6% in the third quarter, as household consumption, exports and investment recovered. Source: Statistik Afrika Selatan

Manufacturing rose at an annual rate of 210.2%, driven largely by increased production of base metals, petroleum, vehicles, food and beverages. The trade, catering and accommodation industries increased by 137%; mining and quarrying increased at a rate of 288.3%. Spending on GDP increased at an annual rate of 67.6% in the third quarter, as household consumption, exports and investment recovered. Source: Statistik Afrika Selatan

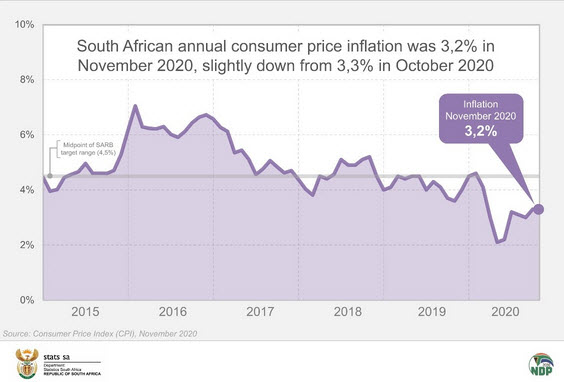

The Rand has benefited from the decline in the US Dollar since the election, despite Fitch and Moody’s recently downgraded credit ratings. Annual consumer inflation fell slightly in November, to 3.2% from 3.3% in October. There are no monthly changes in the index. Prices of food and non-alcoholic beverages continued to rise, posting an aggregate annual increase of 5.8%, up from 5.4% in October. Food inflation contributed 1.0 percentage points to the November headline level of 3.2%.

The country will also see retail sales released, with analysts expecting a 2.6% figure. Retail Sales in South Africa increased 1.10 percent in September 2020.

USDZAR fell past the 15.00 level this week and the pair has now surpassed this level. A move back above 15.00 could see the formation of a medium term lower high in the downtrend channel, but another rejection at that level would make USDZAR move towards the 14.00 level as a fresh low on the demand level. Overall the bearish trend is still strong and has not found ground.

Click here to access the HotForex Economic Calendar

Ady Phangestu

Analyst – HF Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.