The vaccine rollout began last week in the UK, paving the way for vaccinations to begin in the US as early as this week. While vaccines will eventually end the pandemic, it will take time, and activity in the here and now remains under increasing pressure from surging infections and increasingly restrictive lockdowns.

Concurrently, the expiration of the US CARES relief measures and the lack of additional fiscal stimulus are eroding the outlook, as are heightened risks of a no-deal Brexit. Hence, the markets will be buffeted by worsening Q4 and Q1 outlooks that contrast with rapidly improving recovery prospects for 2021. Many central banks meet, including the FOMC, BoE and BoJ with the potential for each to extend measures to support their economies.

Speculation is riding high that the Fed will extend the duration of its QE program. In Europe, a no-deal situation would put the BoE into crisis-response mode and increase the chances of the BoE implementing a negative interest rate policy. And the BoJ could extend its emergency funding programs to help ease corporate funding strains from virus outbreaks in Japan. Overall, the markets will continue to evaluate the escalating downside risks to the near term versus the increasingly solid outlook for the new year.

The US will focus on the vaccine rollout, though attention will shift temporarily to the FOMC amid the potential for a duration extension in QE purchases. Additionally, the Electoral College meets today to officially cast their ballots for the president, widely expected to be Biden. And, there will be last ditch stimulus negotiations to try to craft a package before Congress recesses and the CARES measures expire on December 26.

The data calendar is heavy as well with several key reports due. The markets have been in rally mode this month. Treasury yields have dropped after longer dated maturities hit their highest levels since March, amid a return to haven buying and front running a potential move by the FOMC to extend QE duration. The 30- and 10-year rates richened to 1.59% and 0.871% on Friday, while the 2-year dropped to 0.115%. Wall Street managed more new highs this month too thanks to vaccine developments and stimulus hopes.

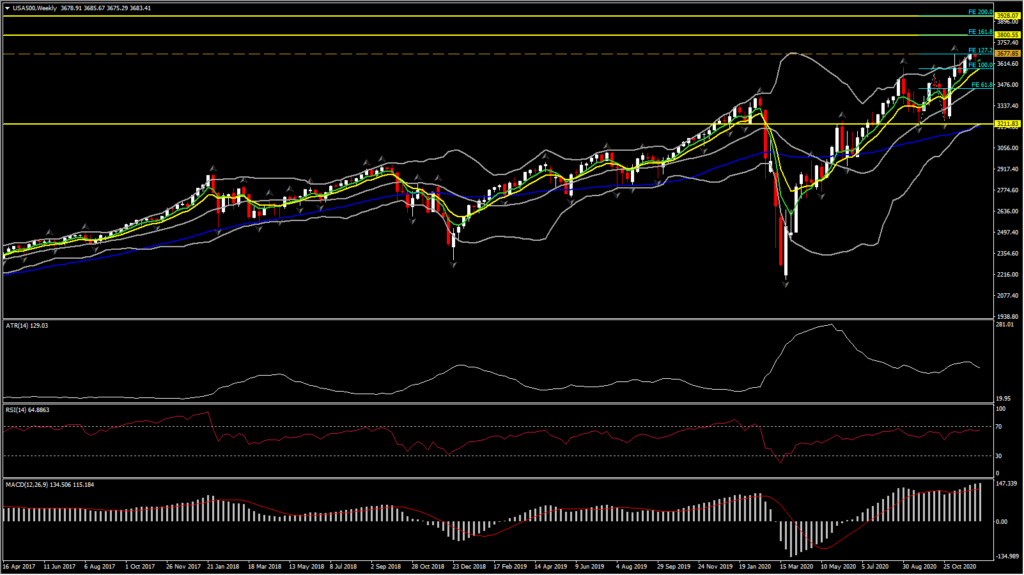

The USA500 seems to be fading from its record high of 3,715 as the near-term positive bias is losing steam ahead of FOMC. Nevertheless, the 50- and 200-day SMA are maintaining their bullish tone, preserving the positive structure, but 20-day SMA has been flattened indicating the near term pullback the past 3 days. That said, the medium term oscillators are suggesting continuation of the overall positive bias with a fading of the negative price action in the short term. The daily MACD in way above neutral, while the RSI is pointing in the bullish territory. To the upside, instant resistance may occur from the record highs at 3,715. Triumphing above this, the USA500 may catapult towards the Fibonacci extension at 3,800 barrier (FE 161.8) and 3,930 (FE 200.0).

All in all, the US indices are in focus as we are turning our eyes to the FOMC’s asset purchase plan which is the focal point of this week’s meeting (Tuesday, Wednesday). The potential for the Fed to extend out duration in its QE is expected to remain supportive for buying alongside demand for safety as the record increases in virus cases and more strict lockdown measures threaten the recovery, especially as fiscal relief remains elusive.

There’s widespread speculation the Fed could extend the duration of its QE program where it’s purchasing $120 bln assets, including $80 bln in Treasuries and $40 bln in MBS. That Chair Powell and other Committee members have stressed downside risks to the economy, especially given the lack of fiscal support suggest they are ready to act. And that potential has increased given the record surge in virus cases and more stringent lockdowns that threaten further moderation in the labor market that’s already been losing momentum. However, we suspect the Fed will take a wait-and-see stance at this point with vaccines now a reality. The FOMC minutes from the November 2-3 meeting also did not suggest much urgency to act. The minutes also indicated there would be an update on forward guidance, and that could be seen this week with the Fed again committing to supporting the economy for as long as necessary.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.