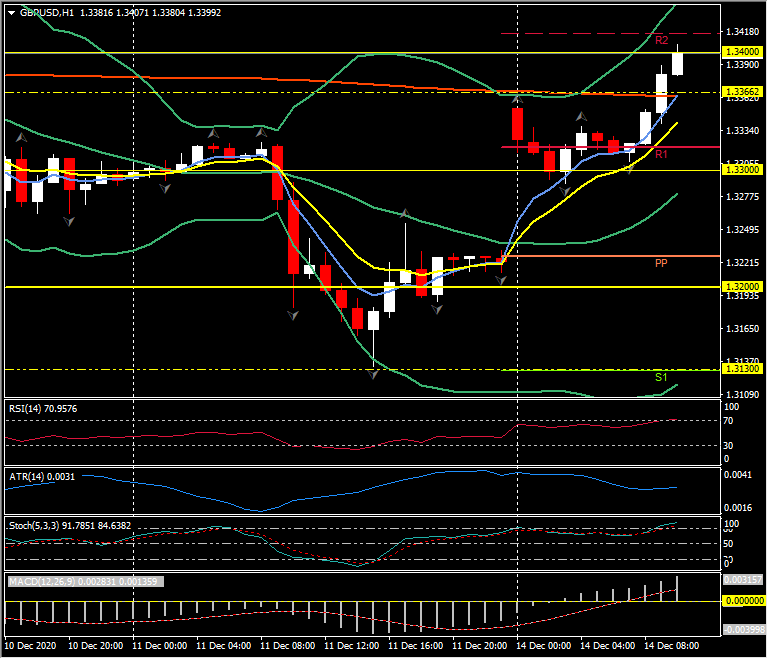

GBPUSD, H1

The Pound has rallied by over 1% against the Dollar and Yen, and by nearly 1% against the Euro.

This comes with the EU and UK announcing agreeing to extend trade negotiations. Leaders had last week set yesterday as being the make or break moment. Neither side was willing to walk away and evidently both sides see that a deal is worth pursuing. A joint statement issued on Sunday was upbeat in tone, and was notable for not mentioning that large differences remained. No new time limit was given. The only legal deadline is December 31. When the two sides will ratify any deal has become a moot point at the moment. UK PM Johnson and his government have continued to warn that leaving the common market without a trade deal is a real possibility, unless the EU changes position, and the EU’s von der Leyen said large gaps remain. Johnson appears to have been successful in convincing the EU that the UK was serious about the no-deal option. Crucially, there has appeared to be signs that Brussels has softened its position, particularly on the arbitration issue. Reporters have been having a hard time digging out precisely what is going on at the negotiating table, as the teams on both sides have been tight lipped, but it appears that the EU has dropped its demands for a so-called ‘ratchet clause’ — aka dynamic alignment and regulatory cooperation, which would automatically bind the UK to EU rules and would give the EU unilateral powers to be judge and jury, and retaliate against any break in rules with tariff penalties. The focus now is back on ‘managed divergence’, which would allow the UK to diverge from EU rules while still provisioning Brussels with the power to impose tariffs to offset any consequential competitive advantages by UK businesses – but only after a joint consultation between both sides. This is the source of optimism that a deal can be reached, quite possibly by the end of the week.

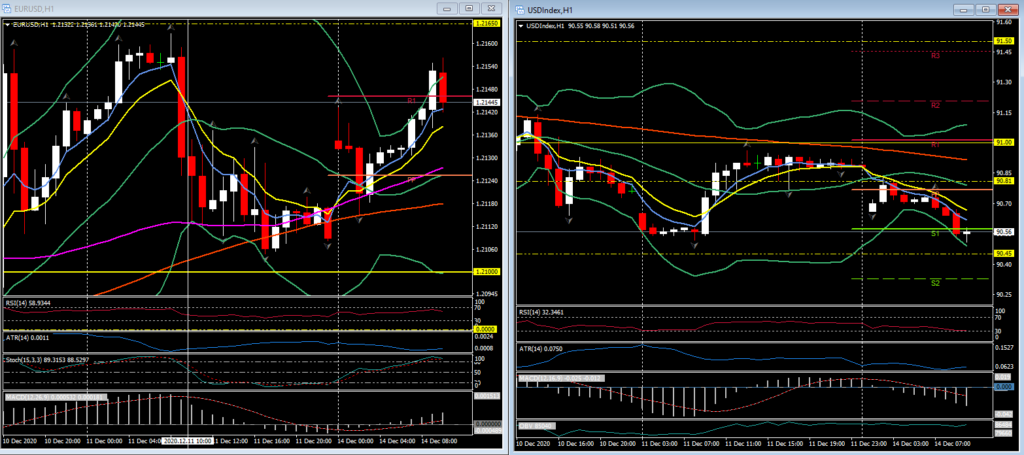

Cable has posted a four-day high at 1.3407. Elsewhere, most Dollar pairings and crosses have remained within their respective Friday ranges. The Dollar and Yen have been soft amid a backdrop of buoyant global asset markets. The gains in Cable dragged the USDIndex to a 10-day low at 90.50, even though EURUSD has remained below recent highs. The Dollar bloc currencies have remained underpinned, though off trend highs.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.