The risk appetite is on the rise to begin the last full trading week of 2020. Positive Brexit headlines, with the headlines that the EU and UK agreed to extend talks, have added to the vaccine rollouts, while US stimulus is still a possibility. European bourses have led the rally in equities with gains of over 1% on the GER30 and CAC40, while the UK100 lags due to the firmer GBP.

US Equity futures are higher as the vaccine rollouts and news that the UK and EU have agreed to extend talks lift sentiment. US futures are following the led with the USA500 up 0.75% and the USA30 0.8% higher and the USA100 about 0.6% firmer. Asian markets closed mostly in the green too with the CSI gaining 0.9% and the JPN225 0.3%. Bonds are weaker, led by the Gilt which has cheapened 6.5 bps to 0.234% in a bear steepener. Treasuries have also given up ground after last week’s gains. The 30-year bond is 3.5 bps higher at 1.662% and the 10-year is up 2.5 bps to 0.921%. The 2-year has risen 0.8 bps to 0.123%. The curve widened to 79.6 bps from 77 bps Friday.

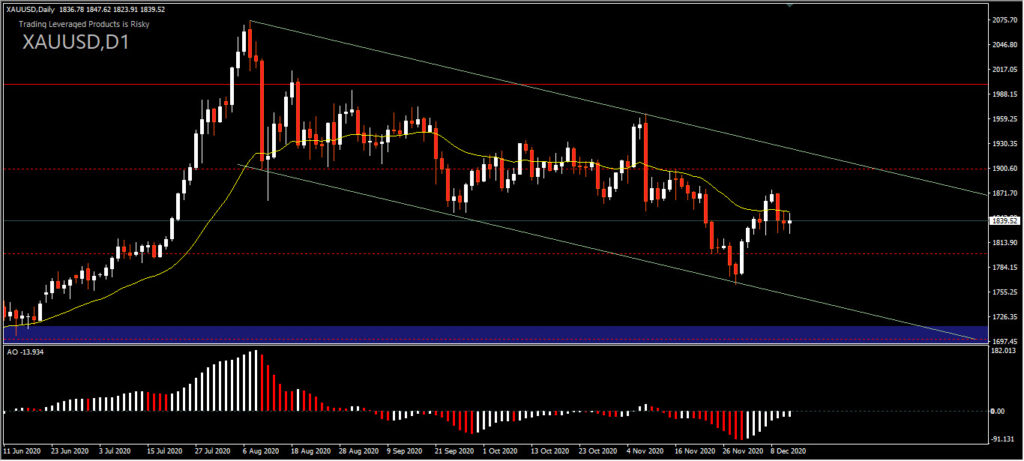

Gold prices have been trading around the 23.6%-38.2% Fib. level of the up and the 20-day SMA and have been in a descending channel since August 6.

According to the CFTC Traders’ Commitments report for the week ended December 8, NET LENGTH Gold futures rose +8906 contracts to 269,220.

Gold prices were sluggish on Friday, with narrow gains against the US Dollar and cautionary action, as investors grappled with postponing the US COVID-19 aid package. The main focus going forward will be on the size and scale of US stimulus, vaccines, Dollar trajectory and inflation. US House of Representatives Speaker Nancy Pelosi said on Thursday that Congress could work on a COVID-19 aid package until December 26, amidst an expiring emergency aid program.

The main focus going forward will be on the size and scale of US stimulus, vaccines, Dollar trajectory and inflation. US House of Representatives Speaker Nancy Pelosi said on Thursday that Congress could work on a COVID-19 aid package until December 26, amidst an expiring emergency aid program.

The USDindex edged up 0.1%, making gold bullion a little expensive for currency holders. Technically, the first support zone is currently placed at $ 1,823 . For a clearer bullish signal, now calls for a price move beyond the peak reached earlier this week at $ 1,875. The bearish scenario also remains dominant, with a downside bias forming, a move below the $ 1764 support would target $ 1,700.

Gold, seen as a hedge against inflation and currency depreciation, has risen 21% this year amid massive stimulus measures aimed at reviving the pandemic-hit economy. We’ll probably see a stimulus deal at the end of the month and the US Federal Reserve will keep its very loose monetary stance going and that should help prop up gold into 2021.

Click here to access the Economic Calendar

Andria Pichidi and Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.