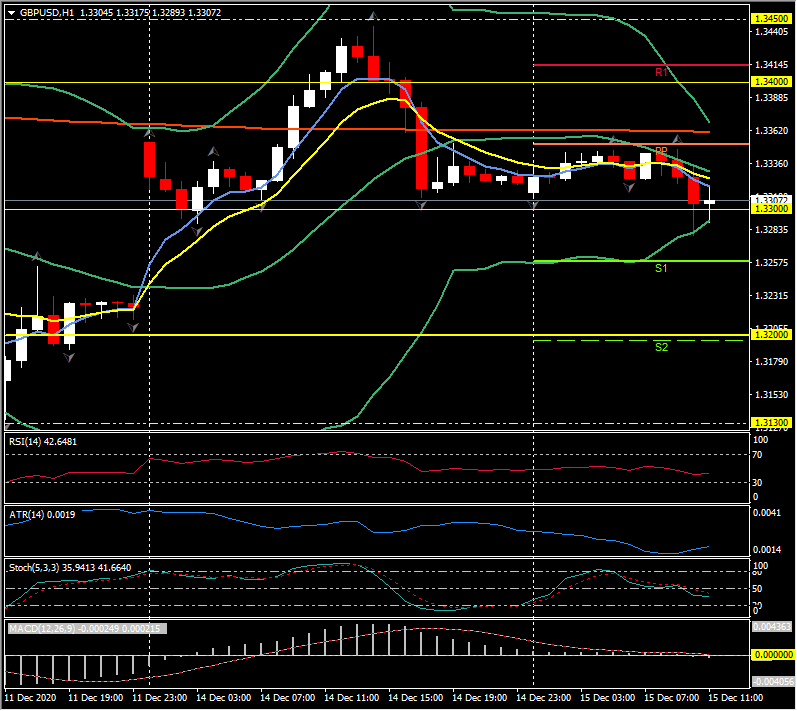

GBPUSD, H1

Narrow ranges have been prevailing among the main Dollar pairings and associated cross rates. This has been seen against a backdrop of sputtering global stock markets. Data showing Chinese industrial production rising 7.0% y/y in November, a 20-month high, along with a rise in retail sales, didn’t have much impact. Commodities have also been lacking direction after recent gains.

The surge in new positive test results for Covid in northern hemisphere countries, ranging from Japan and South Korea, to Europe and the US and Canada, along with more restrictive measures (tighter measures are due to be implemented in London from tomorrow, for instance), is being cited in market narratives as driving the risk-cautious sentiment in markets. While the bigger-picture outlook remains bullish, the view across the valley is being fogged out by the seasonality driven rise in coronavirus cases. The usual year-end wind down in investor commitment is also afoot. The roll-out of Covid vaccination programs in the months ahead won’t be sufficient to make much impact over the upcoming winter months.

The Brexit endgame, meanwhile, remains in focus, though the negotiation teams are being tight lipped and it is difficult to be sure exactly what the state of play is. The Pound has steadied after rallying yesterday. We do know that both sides have offered concessions, and have entered a post-brinkmanship, pragmatic phase, focused on a ‘managed divergence’ solution. The best market guess is that an agreement will be announced by the end of the week, however a no-deal outcome can’t be ruled out and remains a real possibility.

On Friday I wrote that “UK data flow recently has been remarkably resilient in the face of the pandemic and the ongoing Brexit uncertainty. Today data is expected to show unemployment stable at 4.8%, claims increasing significantly to 50,000 and earnings slipping to under 1.0%.” The results earlier were much darker than expected, as official unemployment ticked higher to 4.9% but this hides the significant number of people (3.7 million) who remain furloughed. The claims did indeed increase, and significantly more than the 50,000 that were expected, coming in at 64,300. Although Earnings did beat expectations at 2.7%, due to one off bonus payments, the outlook remains subdued due to the new lockdown tier 3 regimes, set to cover an additional 10.8 million people, 61% of England’s population – or 34 million people – under the toughest restrictions from Wednesday.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.