Like in the Eurozone, in the UK, the October production numbers still looked pretty good, with a rise of 1.3% m/m. Three-month GDP came in higher than anticipated at 0.4%, which left the three-month rate at 10.2%, down from 15.5% in the three months to September. So the rebound started to slow down even ahead of the November lockdowns.

The UK ILO unemployment rate rose to 4.9% in the three months to October, with 370K people losing their jobs as the government discussed the future of the furlough scheme. It was extended in the end, though there was a marked rise in October, which also reflected the sharpest annual drop in employment for a decade. Still, the uptick was in fact less pronounced than feared and with the government eventually extending the furlough scheme, claimant count numbers for November actually suggest that the measures helped to limit the impact of the UK’s second lockdown. Wage growth was actually higher than expected in the three months to October and the hope is that the programs will flatten the curve of likely job losses over the difficult winter months.

Meanwhile after today’s UK’s preliminary composite PMI for December, which missed expectations, there has been noticed a particularly strong performance in manufacturing, a sector that has remained open despite the Covid restrictions, and where activity has been boosted by a temporary boost to purchasing ahead of the December-31 Brexit deadline. Business optimism for the 12-month outlook remained upbeat, although slightly off November highs, hinged on the presumption that Covid vaccination programs will successfully restore the domestic and world economies to something approaching normality.

BoE expected on hold this week

The BoE’s Monetary Policy Committee convenes for its 2-day meeting today – with an announcement due Thursday. No changes to the policy setting is the universal expectation, which would leave the repo rate at 0.10% and the QE total unchanged at GBP 875 bln. Investors will be looking for comments on Brexit risks, although with talks continuing now BoE officials will likely remain tight lipped in order to prevent being seen as interfering in political processes. A no-deal situation would put the BoE into crisis-response mode, and would increase the chance of the central bank implementing a negative interest rate policy. However, the BoE’s Financial Policy Committee affirmed last Friday that UK banks are able to withstand the shock of no-deal on top of the impact of the Covid pandemic.

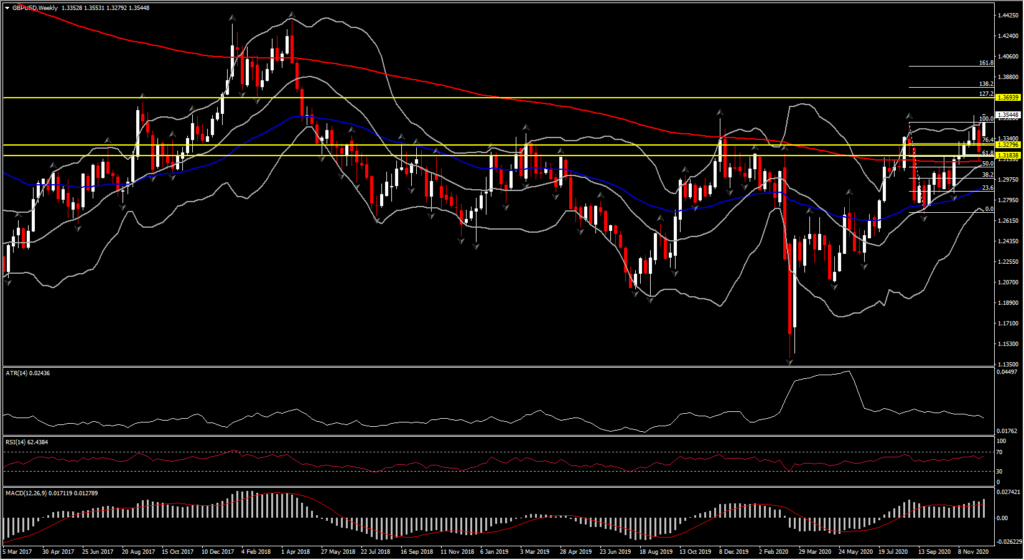

Sterling continues to eye Brexit talks

The Pound today lifted back towards highs with markets factoring in prospects for the EU and UK to reach a future relationship deal as soon as this week. UK prime minister, Johnson, continues to signal that the country must be ready for a no-deal outcome in future relationship negotiations with the EU, but investors seem to have more confidence in a deal, after both sides agreed to continue to talk. Irish foreign minister, Coveney, also said that there are signs of progress, adding that it is a positive sign that the negotiating teams have gone quiet. Any concrete news of a deal with the EU would spark further gains. Markets would then have to assess what hit the UK’s terms of trade would take over the nearer term as a consequence of leaving the common market and customs union, which may well curtail the currency’s upside potential.

While there would likely be at least near-term arguments to be bearish on the Pound, there are also bullish considerations for 2021, including:

- the long-awaited lifting of Brexit uncertainty, which should help revive business investment;

- the argument that the UK, having seen the biggest peak-to-trough GDP contraction in 2020, is likely to rebound with inverse strength in the anticipated vaccine-assisted return toward societal and economic normalcy;

- the fact that the Pound is undervalued, near multi-decade lows in the BoE’s measure of the real effective exchange rate;

- the relatively low valuations of UK equities, which may be attractive to foreign investors should the recent value-seeking trend in global markets continue;

- and the dollar’s downtrend, which we expect to persist in 2021.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.