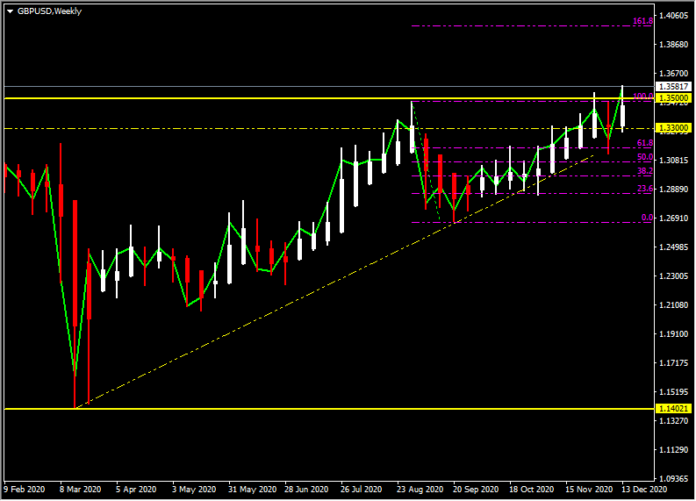

GBPUSD, Weekly

The BoE’s Monetary Policy Committee (MPC) convened for its two-day December policy meeting yesterday, with the announcement out today (12:00 GMT). No changes to policy settings is the universal expectation, which would leave the repo rate at 0.10% and the QE total unchanged at GBP 875 bln. The central bank is clearly keeping a close eye on Brexit talks, and with a deal looking much more likely than at the same time last week, the central bank is likely to hold its horses, especially as vaccinations offer a bright spot for next year. Things can still go wrong though and the BoE will want to keep its options open for now. A no-deal situation would put the BoE into crisis-response mode, and would increase the chance of the central bank implementing a negative interest rate policy. Still, the BoE’s Financial Policy Committee (FPC) affirmed on Friday that UK banks are able to withstand the shock of no-deal on top of the impact of the Covid pandemic. For many a negative interest rate policy in the UK is not the antidote and should be kept firmly in the toolbox, however, as with the protracted Brexit Withdrawal agreement and the down-to-the-wire trade deal (or no-deal), anything is possible and never rule anything out.

Sterling has the bid currently and expectations are that something will be agreed and the final “fishing” issue can be put to bed. Last week, EU sources talked of a deal by December 18 (tomorrow), which still provides enough time for draft legislation to be approved by year end. Then earlier this week stories started to circulate of “partial” ratification. The fudge continues.

Sterling remains bid versus the weaker USD and JPY, on the back foot versus the Antipodeans, moving higher versus the CAD & CHF and back to test 90.00 versus the Euro. The new 2020 high for Cable and the break and breach of 1.3500 could see an extension to initial 1.3680 and 1.4000 in the weeks ahead, should the Greenback continue to unwind. Key support is the 20-week moving average at 1.3100 and the 200-week moving average at the key psychological 1.3000.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.