The markets were shaken up to start the week on reports of a mutation in the virus spreading in the UK.

A new strain of the Covid-19 coronavirus in the UK is reportedly more transmissible — though not, according to scientists, more virulent nor likely to render vaccinations obsolete — which has sparked a bout of hedging in reflation positioning. The news prompted EU nations to ban UK travel and halt Channel freight. While positive tests results have spiked in the UK, it’s worth noting amid the panic that UK hospital admissions are as yet about normal for the time of year, with the number of Covid-19 patients receiving treatment in ICU are still a fraction of the peak seen during April. There has been many thousands of mutated variants of Covid-19 detected during 2020, with some virologists arguing that this new variant is likely to be less virulent (as less infected people are made ill by it and therefore remain in circulation among the population). However, these considerations are moot points given the political necessity for an extreme response. Parts of the UK, including London are now in the top-level lockdown, which will have an economic impact similar to that seen in the first lockdown.

Concern over a new variant of Covid-19 continued to weigh on confidence during the Asian session. Wall Street had managed to pare most of its early gains and major indices closed narrowly mixed, but Asian markets sold off, with ongoing signs of US-China tensions adding to virus jitters.

The US yield slipped overnight, supported by ongoing risk aversion, but sentiment in Europe started to stabilise in the latter part of yesterday’s session, after the initial sell off on Brexit concerns and virus jitters. Not that there has been a confirmed breakthrough yet, but there was some positive noise from the UK on concessions on fisheries. Meanwhile, the UK and France are working on a solution to the border problem, with France’s decision to close the border due to virus concerns causing major disruptions to deliveries. France’s idea to demand negative virus tests from drivers is not a solution, however, that will work in the short run. So there is still plenty of downside risks, even as the GER30 future is suggesting a stabilisation.

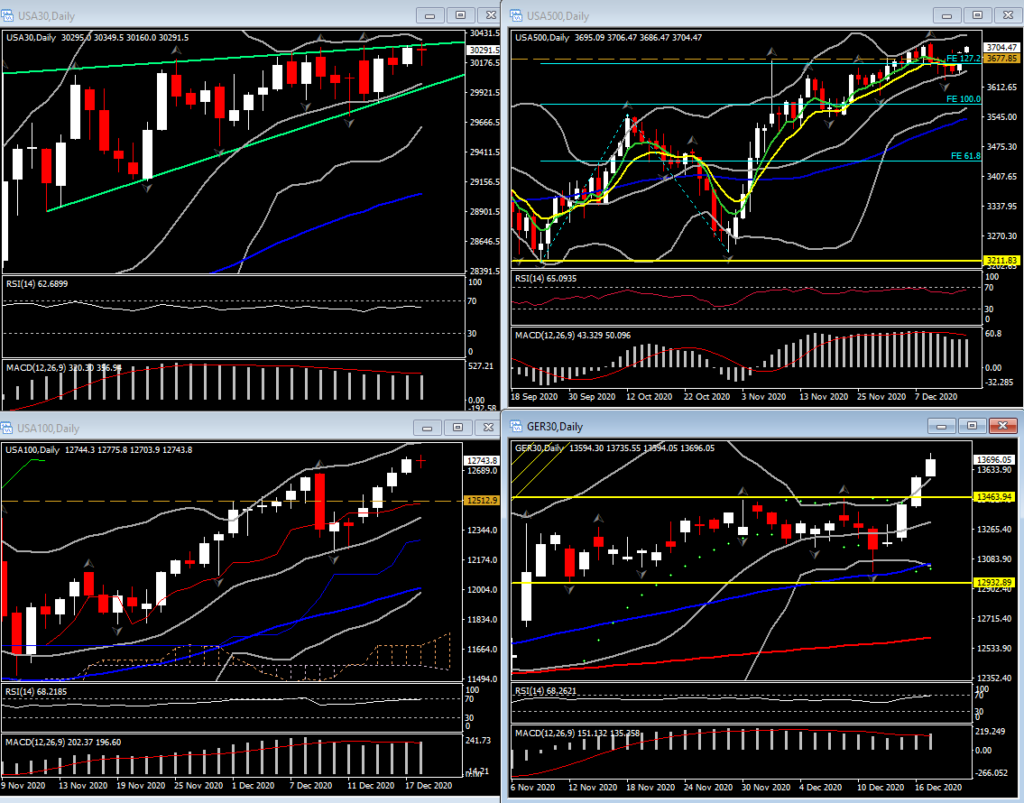

Meanwhile, the USA30 later recovered its near 500 point drop to climb back into the green. The USA500 and the USA100 were also well off their lows but still underwater with losses of -0.5% on the former and -0.2% on the latter ahead of the close. The recovery was supported by the $900 bln relief bill expected to be signed, and as the worries over the mutating virus eased a bit.

Today, the markets will continue to assess the threat from the new strain of virus and the more stringent lockdowns. As several countries banned travel to and from the UK, this will be a heavy data/events slate. December US consumer confidence highlights. It should improve to 98.0 from 96.1. November existing home sales are forecast to ease slightly to a 6.800 mln pace from 6.850 mln. The third look at Q3 GDP is due and we’re forecasting a small revision to 33.2% from 33.1%. Final Q3 corporate profits are also slated. The December Richmond Fed index is expected to dip to 12 from 15. There’s also weekly chain store sales. The Treasury will auction $15 bln of reopened 5-year TIPS.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.