EURUSD, H1

The Dollar has finally found its feet, concomitantly with global equity markets coming off the boil. Some market narratives have pinned this on news that Pfizer will under-deliver vaccine doses to the US next week, though the Moderna vaccine will reportedly win FDA approval today/Saturday. News that the US is blacklisting more Chinese companies has been in the mix, too. The wind down into the Christmas and new year holiday period may be a further factor, which can inspire investors to put on hedges, if not trim positions.

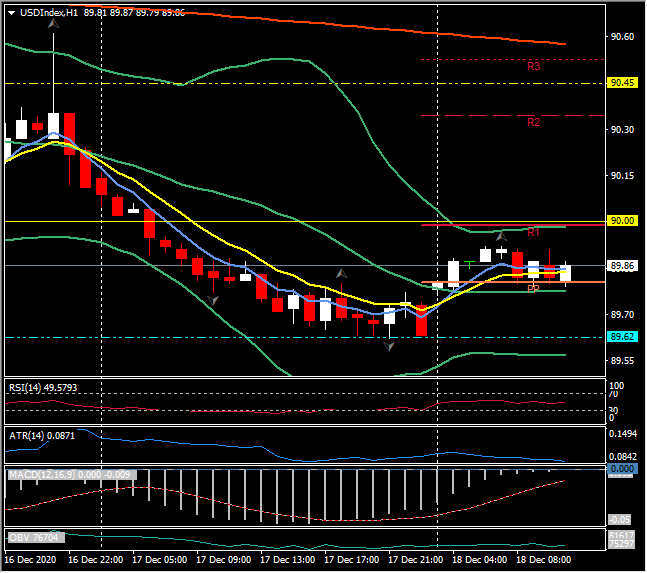

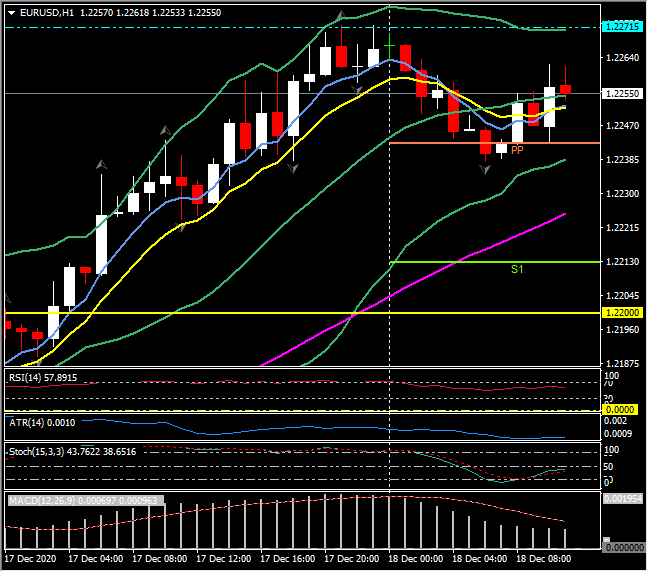

The USDIndex has lifted back towards 90.0, which follows a four consecutive days run lower that culminated yesterday with a 32-month low at 89.62. EURUSD has ebbed, although only modestly, to the the mid 1.2250s. The commodity-correlating dollar bloc currencies have softened, while USDJPY has lifted back to the mid 103.00s after posting a nine-month low yesterday at 102.88. The BoJ extended its Covid measures, including increased asset purchases and a corporate lending facility, out to next September from March, while leaving the major monetary policy settings unchanged. This met market expectations, while Governor Kuroda reaffirmed the central bank’s pledge to ease monetary policy further if necessary.

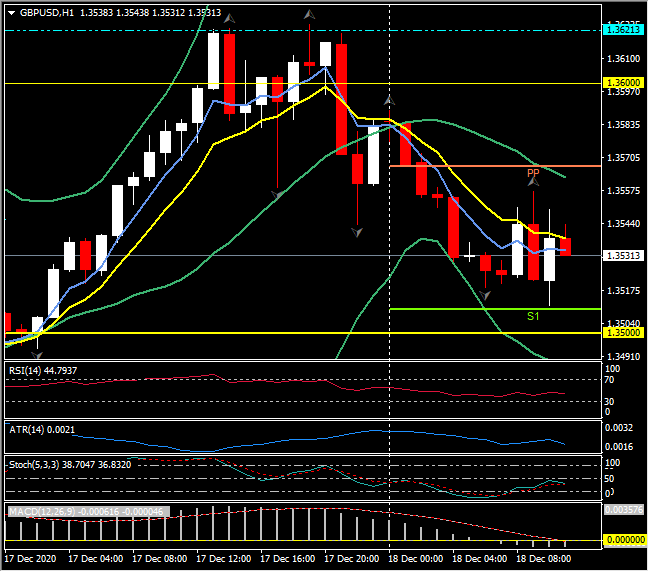

Elsewhere, the Pound has been in correction mode after a four-day ascent. Cable has tumbled back toward 1.3500 after peaking at a 31-month high yesterday at 1.3622, though continues to show a net gain of well over 2% from week-ago levels. UK PM Johnson spoke with the EU’s von der Leyen late yesterday, and reportedly warned that negotiations would collapse unless the EU moves “substantially.” Fishing rights remain a sticking point, while the state aid issue has also resurfaced as a difficulty, though it’s difficult to know exactly where negotiations are, and it might be that the UK government is tactically maintaining the maximum threat to leave without a deal, sensing that Brussels is genuinely worried about what an untethered UK might do. Reuters cited EU sources, meanwhile, saying that a deal is possible in the coming days, though difficult, while Ireland’s deputy PM Varadkar said both sides were edging towards a deal, and EU chief negotiator Barnier said that a deal by as soon as today is “difficult but possible.” The European Parliament yesterday demanded that a text of an EU-UK agreement must be made available by this Sunday for there to be sufficient time for them to scrutinize it before a ratification vote ahead the December-31 deadline.

Later there is Canadian Retail sales and the US current account and leading index indicator ahead of the December Quadruple witching where stock index futures, stock index options, stock options, and single stock futures all expire simultaneously. The last big trading day for many.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.