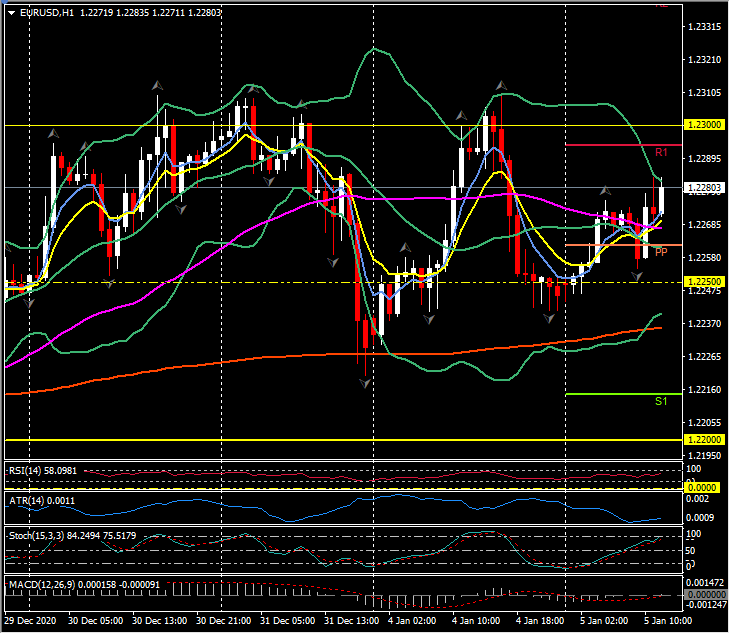

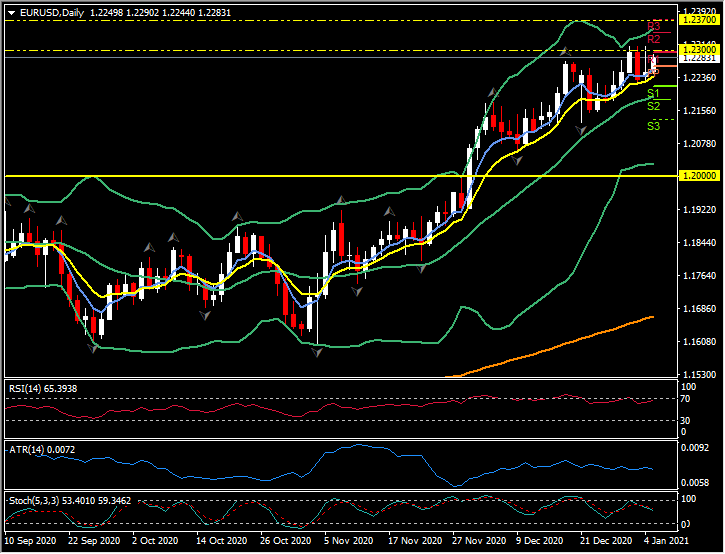

EURUSD, H1 & Daily

German jobless numbers better than expected in December readings, with the seasonally adjusted unemployment total unexpectedly falling -37,000 over the month, despite the tightening of lockdown restrictions last month that saw restaurants, hotels and non-essential shops closing once again. Expectations had been for a rise in the jobless total as well as the jobless rate, but in the event the rate remained steady at 6.1%. However, the fact that official numbers haven’t exploded is largely due to government wage support and job retention schemes, which have helped companies to hang on to staff. That is a costly exercise and not all companies will survive once government support ends and the ECB also starts its tightening policy. That means the real impact on the labour market from the pandemic will only become apparent over time and much later in the year.

Earlier, German Retail Sales rose 1.9% m/m in the November reading against expectations for a sizeable correction from the 2.6% m/m jump in October. The annual rate still dropped back to 5.6% from 8.6% in the previous month and the renewed closure of non-essential shops in December meant sales suffered again at the end of last year and are likely to remain depressed early this year. Online retailers are benefiting, but overall consumption remains depressed by virus restrictions.

Today Germany reported another 11,897 COVID-19 cases; this is relatively lower compared to the 2020 year-end figures of above 20,000 and the record 32,552 cases seen on 31 December. Unfortunately, however, deaths remain on the higher side with another 944 deaths reported today. That brings the total tally on that front to 35,518 persons. German lawmakers are set to announce an extension to lockdown measures sometime this week, prolonging the restrictions from 10 January to 31 January at least. Mrs. Merkel is due to discuss the plans with state leaders today.

The Dollar has been trading steadily so far today after yesterday rebounding quite sharply from 33-month lows. This has come amid a backdrop of sputtering stock markets, with narratives ascribing today’s two runoff elections in Georgia, which has existential implications for the incoming Biden administration (as the result will decide whether Democrats or Republicans will control the Senate), alongside the constant rise in positive Covid tests and associated restrictions, as providing excuses for markets to correct. The USDIndex has settled in the upper 89.0s, up from the trend low at 89.42. EURUSD has concurrently settled lower, in the mid 1.2200s, after yesterday foraying above 1.2300. EURUSD remains rangebound between 12250 and the peak at 1.2300. A break and hold of 1.2300, on the Daily time frame, which the pair has so far failed to do, could bring in 1.2370 (Daily S3), 1.2450 (3-year Weekly high) and 1.2555 (2018 high). Initial support is the 20-day moving average at 1.2190, the 50-day moving average at 1.2000 and the December low at 1.1920.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.