It has undoubtedly been a great 12 months for Tesla, despite the imminent delays they suffered due to government orders to try to stop the spread of the coronavirus that forced the company to temporarily close its factories. It is not surprising that its investors continue to celebrate the achievements that have driven the company to meet its year end goal of half a million vehicle deliveries in 2020. The share price rallied into year end last week to close 2020 at $705.67 on Thursday. It rallied another 3.42% yesterday on the first trading day of 2021, to close at $729.77 as the wider USA500 declined 1.49%.

This was an important achievement for the company, as now it is likely that Tesla will set new goals related to remote commercial transactions between its electric cars and its consumers based on a strategy that combines car sales for both corporate and rental, for both car rental companies and sellers.

On the other hand, it is worth mentioning that if the Tesla price target with a value of $730 is broken, the currently a bullish target price of $1,000 could appreciate, representing a significant upward increase. This may also encourage the forecast that future sales of electric vehicles could increase up to 10% by 2025. However, the market close in the last week of the year gave fund managers one last chance to change their holdings before investors’ year-end updates, by buying from the best performing figures and ditching those figures that have lagged behind.

The shares of a company as large as Tesla come with tax implications. With President-elect Joe Biden announcing that he will raise taxes on capital gains of investors that reach a value of at least one million dollars from next week, investors may be inclined to sell their shares and withdraw part or all of their profits before the end of the year in order to avoid paying taxes on their profits.

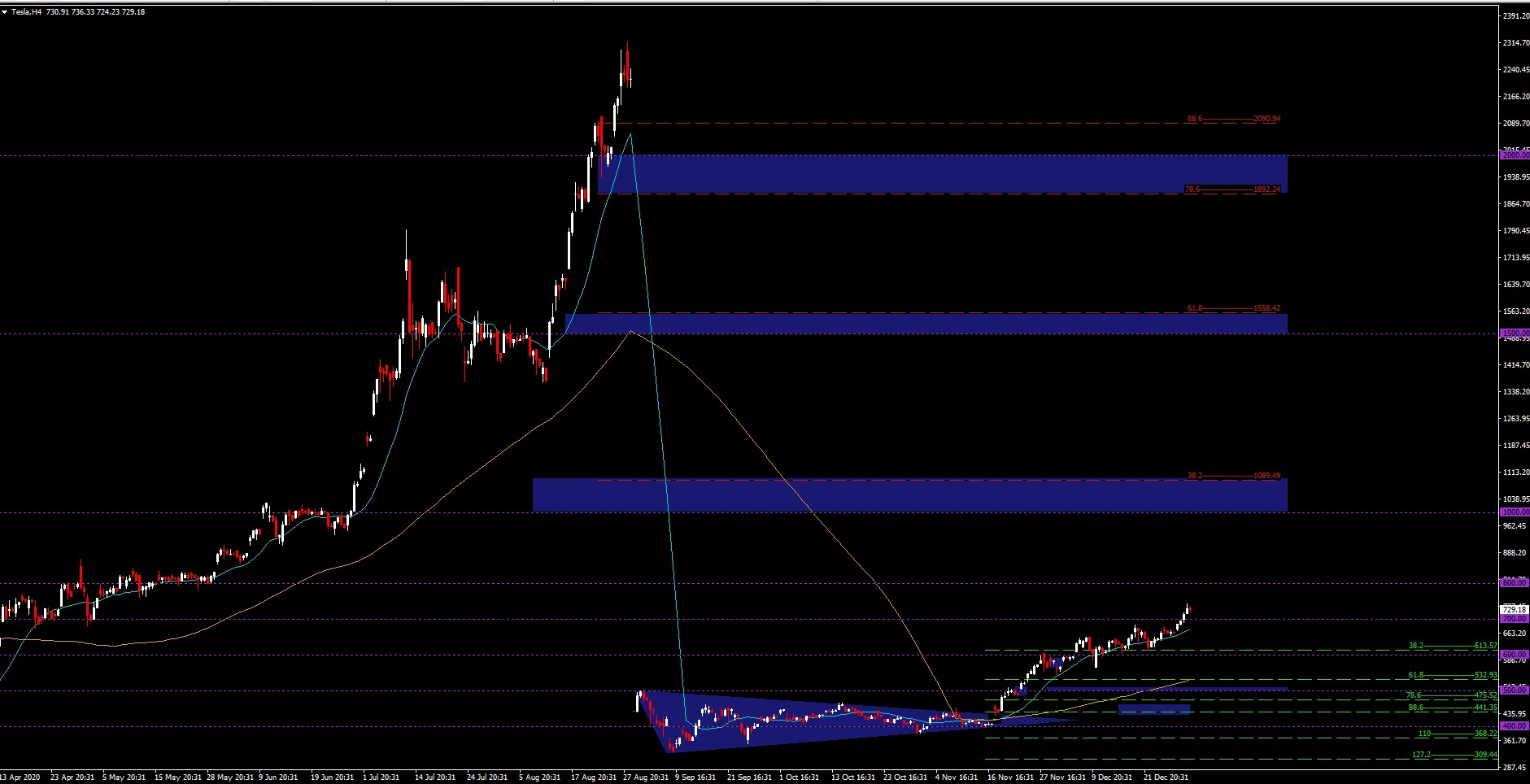

The price of Tesla has continued the bullish rally that started in November of last year, rising from $379 to its current price of $729 with a very good respect of the moving average of 17 daily periods. The price has exceeded the moving average of 100 daily periods and stopped very close to the 750 level, and could maintain levels above 700; otherwise support is at the SMA of 17 daily periods in H4, the Fibonacci level of 38.2 at 613.57, the psychological level of 600, Fibo 61.8 at 532.93 which coincides with the SMA of 100 H4 periods and up to the psychological level of 500.

As resistances and next targets we have the moving average of 200 daily periods near 800, followed by Fibo 38.2 at 1089.49, as well as the psychological levels of 1000, 61.8 at 1558.42 as well as the psychological level of 1500 creating resistance ranges with the latter which goes from Fibo 78.6 at 1892.24 through to the psychological level of 2000-2090 (Fibo 88.6.)

Click here to access the HotForex Economic Calendar

Aldo Weidner Z.

Market Analyst – HF Educational Office – LATAM

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.