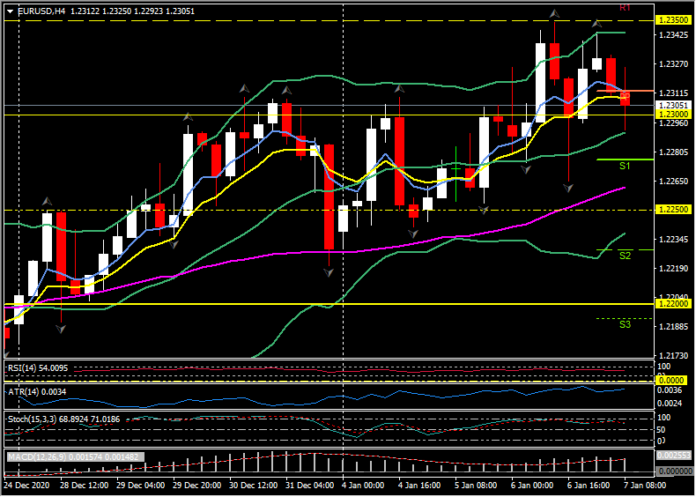

EURUSD, H4

German manufacturing orders jumped 2.3% m/m in November, which unexpectedly continued the pretty impressive rebound that the sector has seen since the last lockdown. Expectations had been for a slight correction from the 3.3% rise in October, but in the event the inflow continued at a robust pace, with domestic orders rising 1.6% m/m and foreign orders 2.9% m/m. The annual rate is now at 6.4% y/y – based on the seasonally adjusted series, and thus clearly above pre-virus levels. This is of course data that preceded the latest lockdown, although it is expected that the renewed tightening of virus restrictions won’t hit production too much, even if it means further hardship for the services sector. The latter also means that there still is the risk of a technical recession despite the impressive orders number. Indeed, part of the surge in orders may be due to precautionary stock building in the UK ahead of the official Brexit date and that could mean a drop back in orders at the start of this year as companies reduce stockpiles.

US Initial jobless claims preview: Initial claims are expected to slip -7,000 to 780,000 in the week ended January 2 after a -19,000 drop to 787,000 from 806,000 at the end of December. Claims have been elevated in recent weeks amid the surge in virus cases and the more stringent lockdowns have seen renewed layoffs. Additionally, the holidays have been distorting. Remember, seasonal adjustments were switched in September, and the usual seasonal rise in NSA claims through the holidays may be lifting the reported SA data given the unusually high level of claims. Claims are expected to average 835,000 in December, following averages of 749,000 in November, 786,000 in October, and 855,000 in September. The 892,000 December BLS survey week reading exceeded recent survey week readings of 748,000 in November, 797,000 in October, and 866,000 in September. Expectations are still for a December payroll rise around 100,000 though risk is for a weaker print, and potentially a decline, (Barclays have a -50,000 figure) especially given the -123k decline in the ADP report yesterday.

US trade balance preview: the deficit is expected to widen to -$67.2 bln in November, a 14-year high, after edging out to -$63.1 bln in October, and was at a 12-year high of -$64.9 bln in August. We expect exports to increase 0.7% to $183.2 bln, while imports rise 2.2% to $250.4 bln. The November petroleum price rebound has likely boosted both exports and imports of petroleum. We saw November pull-backs in vehicle trade after huge increases in every month since June, but large declines in each prior month since February. We expect a sustained high November bilateral goods deficit between the US and China of about -$30 bln as businesses rebuild inventories. For the year, we expect a -$55.9 bln average deficit, versus a -$48.1 bln average in 2019.

US ISM services index preview: we expect the index to dip to 55.0 in December. This would be a third straight monthly decline as service sector activity slows, especially with the delayed stimulus, the surge in virus cases and renewed shutdowns. The index had surged to 58.1 in July, an 11-year high, amid reopenings of the economy. It was at 54.9 last December. Producer sentiment has remained firm despite the fall’s moderation as businesses scramble to rebuild inventories.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.