USDJPY, H1

The dollar’s correlative pattern with stock markets has inverted, with the currency now rising in step with rallying global stock markets. The catalyst for the change was the Democrat wins in the Georgia runoff elections, which heralds the prospect of much greater deficit spending and warranting higher growth expectations for the US economy.

US Treasury yields have also spiked more than peers, and much more so in the case against JCB and Bunds, which appears to have offset implications for lower real interest rates and real yields from the anticipated higher inflation curve. The dollar’s new correlative pattern may not persist, as the global reflation trade may still ultimately suck more capital out of richly valued US assets and into more cheaply priced assets around the globe.

In global markets today, the MSCI Asia-Pacific equity index posted a fresh record higher, and Japan’s Nikkei a 30-year peak. This followed the main indices on Wall Street posting fresh record highs yesterday, and the Stoxx 600 European Index hitting new 11-month highs. Front-month USOil prices hit a new 11-month high earlier, at $51.33.

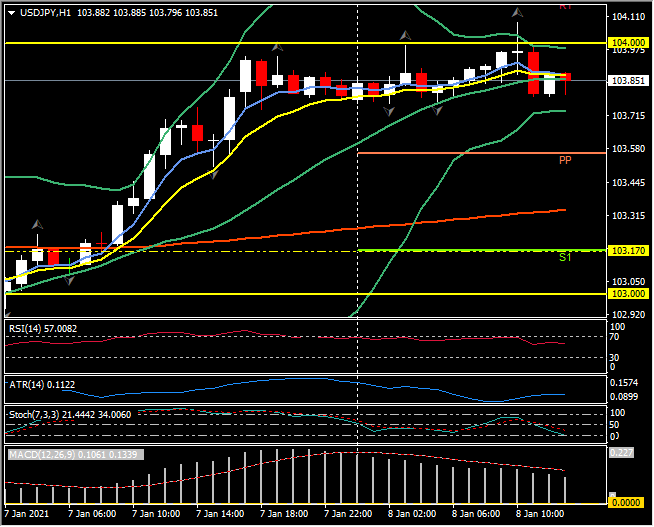

In the forex realm, the USDIndex posted a 10-day high at 90.03, while EURUSD etched out a four-day low at 1.2234 and USDJPY lifted to a 24-day peak at 104.00. Cable settled in the mid 1.3500s, above the 10-day low the pair saw yesterday at 1.3532. The dollar bloc currencies remained in relatively narrow ranges in a consolidating pattern under the 33-month highs that were seen against the US Dollar earlier in the week. Bitcoin settled after yesterday storming to yet another record high, this time above 40,000. The cryptocurrency is up 364% since last September, which has come amid a growing sense that the new asset class is coming of age, being more accepted by institutional investors and competing with gold as an inflation hedge.

One thing to be aware of is that UK scientists have expressed concern that the current vaccines may not be effective in protecting against the new ‘South Africa’ variant of Covid. Incoming data on this will throw better light on this over the coming weeks. Any verifiable signs that vaccinations prove ineffective against new strains would be majorly dispiriting for investors. Things in life tend to happen in threes; so after the UK and SA – where will it appear next ? New Zealand, Russian Federation, Czech Republic, South Korea, North Korea ?? – let’s hope not.

US and Canadian Jobs top the data later, both announcements at 12:30 GMT.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.