After a 3-day losing streak, the EURUSD yesterday closed up 0.57%, at 1.2205. Before President-elect Biden announced a new round of stimulus plan for facing pandemic and Fed Chairman Powell’s speech, the dollar bulls seemed to choose to take profits to close their positions and maintain a wait-and-see attitude.

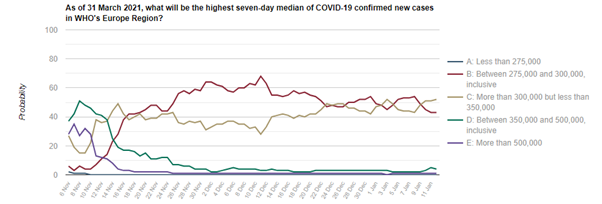

Figure 1: The 7-day highest median and probability of new confirmed cases of coronavirus in the WHO Eurozone. Source intercepted from:

https://goodjudgment.io/superforecasts/#1431

In any case, the economic outlook for the Eurozone is still not optimistic in the short term. Affected by the surge in new virus infections and the spread of variant strains in the UK and South Africa, many governments in the euro area are implementing strict restrictions. Among them, German Chancellor Merkel urged the relevant authorities to extend the blockade measures for ten weeks to curb the rapid spread of the mutant virus, otherwise Germany may need to upgrade the restrictions again at the end of March. At present, Germany has limited the restriction period to January 31, but the situation has not improved significantly. It is expected that the government will unanimously agree to extend the blockade period after a meeting on January 25.

In addition, according to the data provided by the prediction platform Good Judgment (Figure 1), by March 31 this year, the 7-day highest median of new confirmed cases of coronavirus in the Eurozone is expected to exceed 300,000 but be less than 350,000. The probability is 52%, which is a 7% increase from a week ago. Compared with last week, the prediction results given by the platform showed signs of deterioration.

In addition, the vaccination delays in the Eurozone due to various factors and the trade interruption caused by Brexit have deeply affected the economies of European countries, and the Eurozone economy may fall into a double-dip recession. In order to avoid a series of negative effects caused by the possible occurrence of a “hard Brexit”, many euro area companies shipped their products to the UK before the end of last year, and therefore exports may weaken. Regarding the Eurozone GDP forecast for the first quarter, ING believes that under the “most optimistic” scenario, the Eurozone GDP will still record zero growth and will not return to pre-pandemic levels until 2023.

Obviously, achieving mass vaccination in the first quarter is still a difficult problem, let alone achieving herd immunity. In this context, the government not only needs to do everything it can to solve the problems related to vaccine storage, logistics and human resources, but also to ensure that the virus can be further effectively controlled during the lockdown. In terms of fiscal policy, the EU Recovery Fund and long-term budget are still expected to be sufficient to cope with the current crisis and support economic growth; in terms of monetary policy, loose monetary policy is extremely important. The European Central Bank may increase the scale of bond purchases or extend the bond purchase period to maintain normal operation of the economic system.

Once people achieve herd immunity, the virus dissipates, and restrictions are relaxed, the demand that has been suppressed for a long time will be released, thereby promoting economic growth. According to the latest data, the current Eurozone savings rate is above 20%, and consumers are likely to turn up to 100 billion euros of this into expenditures in the second quarter, thereby boosting inflation in the short term.

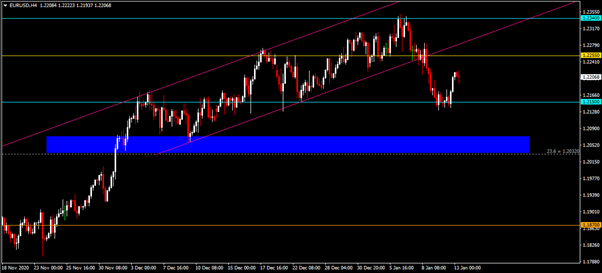

From a technical analysis point of view, the EURUSD met Resistance from a high near 1.2350 last week and fell back, closing at the wedge-shaped trend line Resistance and 1.2255 Resistance. Looking at the candlestick pattern, the weekly chart shows the shooting star pattern, while the daily chart shows the bear engulfing three crows pattern.

On the 4-hour chart, the EURUSD rebounded from the 1.2150 Support and stabilized, currently trading at the 1.22 level. If the currency continues its upward trend, the upper Resistance will focus on 1.2255, the channel trend line and the January high level (1.2340) of this year. On the other hand, if the EURUSD declines, the lower Support will focus on the 1.2150, 23.6 Fibonacci level (1.2030)/wedge-shaped trend line Support seen in the weekly chart and the 1.2030 to 1.2080 area.

Click here to access the HotForex Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.